Tennessee State Budget

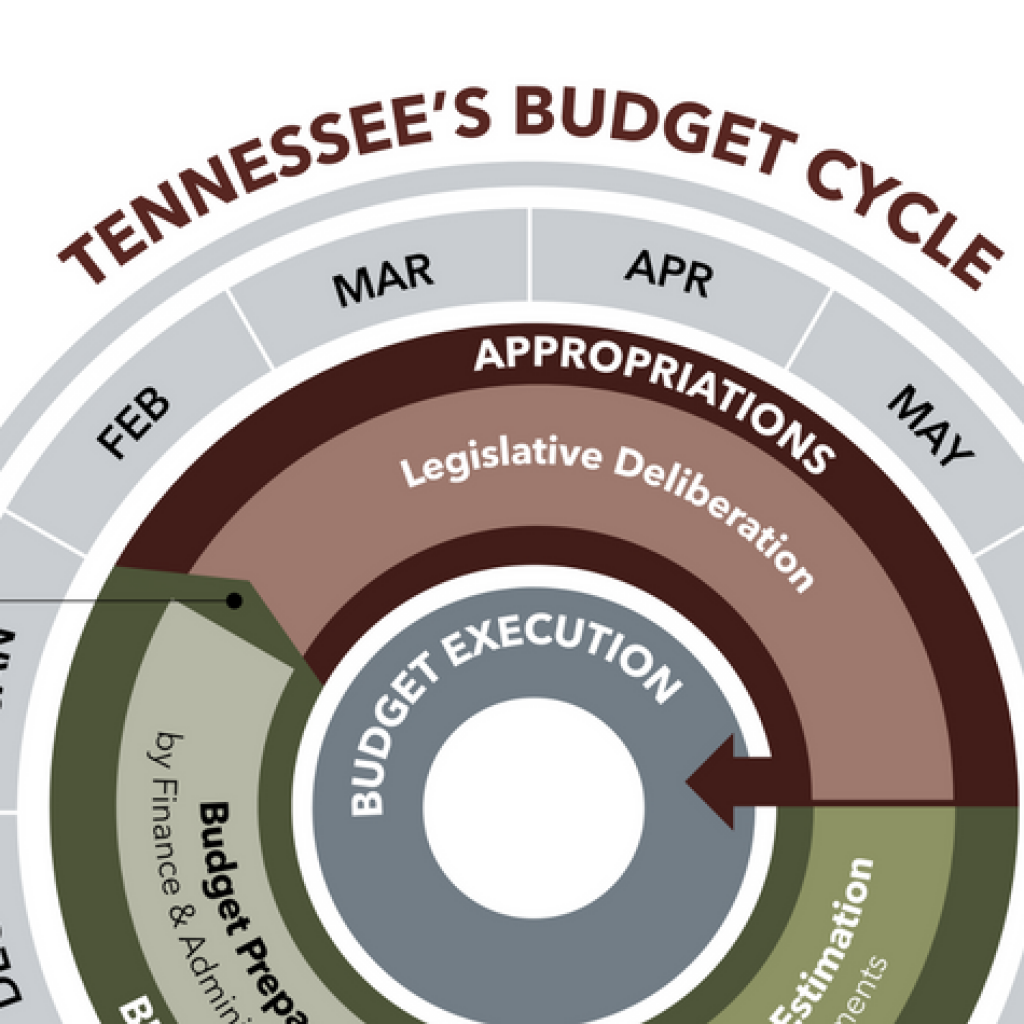

Tennessee’s budget represents the goals our state policymakers want to achieve, the public goods and services intended to help meet those goals, and detailed plans for how to finance them.

The Sycamore Institute’s work on the state budget seeks to help interested stakeholders understand where the money comes from, where it goes, and what factors influence its flow through the system.

Our Tennessee State Budget Primer unpacks the budget process, breaks down the numbers, and explores historical trends using simple language and charts. You can also use our Budget Data Explorer to see how the mix of programs and revenues in Tennessee’s budget has ebbed and flowed over time.

Tennessee Tax Revenue Tracker for FY 2024

As of May 31, 2024, Tennessee had collected about 80% of the $22.7 billion in total budgeted revenue for the current fiscal year.

Summary of Tennessee’s FY 2025 Enacted Budget

Major differences in the enacted budget vs. the governor’s recommendation include more money for franchise tax refunds, a potential FY 2024 revenue deficit, and new spending funded mainly by higher expected treasury investment earnings.

Budgeting for Incarceration in Tennessee

The Tennessee Department of Correction spent about $907 million on incarceration in FY 2023, and our counties spent an estimated $554 million in FY 2022 to operate local jails.

The Budget in Brief: Summary of Gov. Lee’s FY 2025 Recommended Budget

Compared to current law, Gov. Lee’s budget reflects lower-than-expected tax collections and proposes new spending and tax cuts for FYs 2024-2025 — mostly funded by previously unallocated recurring revenues and a large FY 2023 surplus.

Video: Sycamore Presents Before the Joint Working Group on Federal Education Funding

Sycamore presents on topics like dependency on federal dollars, the role of the federal government in education, and requirements that influence how K-12 schools operate before the Joint Working Group on Federal Education Funding.

Federal Funding for K-12 Education in Tennessee

This report reviews the federal government’s role in K-12 education, key federal programs and requirements, recent tensions between Tennessee and federal requirements, and some trade-offs and considerations involved.

Tennessee Tax Revenue Tracker for FY 2023

FY 2023 collections were about $2.5 billion more (or 13%) than what was budgeted when the fiscal year began, but fell short of the revised estimate adopted as part of the FY 2024 approved budget.

Federal Funding for Tennessee’s School Districts

In FY 2019, Tennessee distributed $1.1 billion in federal funds to school districts across the state — or about 11% of total district revenues that year. This report includes an interactive dashboard to explore and compare federal funding for each school district.

Summary of Gov. Lee’s FY 2024 Amended Budget

The FY 2024 budget amendment adds $501 million — or 1.7% — in net new spending from state revenues.

What’s in Gov. Lee’s 2023 Transportation Modernization Act

Gov. Bill Lee released his $55.6 billion recommendation for the state’s FY 2024 Budget — along with recommended changes for FY 2023.

The Budget in Brief: Summary of Gov. Lee’s FY 2024 Recommended Budget

The FY 2024 recommended budget includes unprecedented spending levels fueled by multiple years of significantly better-than-expected state revenue collections.

Video: Sycamore Presents Before the Senate Finance, Ways & Means Committee

Sycamore presents on topics like inflation, gas taxes, and the rainy day fund before the Senate Finance, Ways & Means Committee.

6 Facts About Road Funding in Tennessee

Tennessee’s ability to fund road construction and maintenance faces pressures from all sides.

How Inflation Affects Tennessee’s State & Local Governments

Inflation raises operating costs at every level of government, but Tennessee’s reliance on sales tax means state revenues may keep up with inflation better than those of local governments.

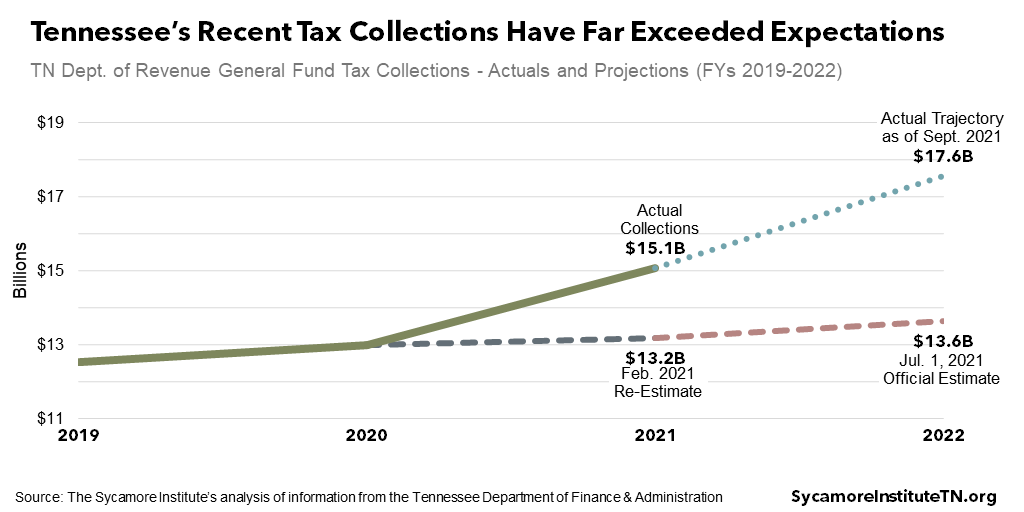

Tennessee Tax Revenue Tracker for FY 2022

Tennessee finished FY 2022 with a $1.6 billion unbudgeted surplus after collecting 28% more tax revenue than lawmakers initially budgeted.

Stadium Subsidies in Tennessee

Since 2021, state and local officials in Tennessee have committed or proposed $1.8 billion in subsidies for at least 5 pro sports venues.

Summary of Gov. Lee’s FY 2023 Amended Budget

The governor amended his FY 2023 budget proposal with $260 million in new spending and net revenue changes from surplus and tax cuts.

Tennessee’s Budget in Brief: Summary of Gov. Lee’s FY 2023 Recommended Budget

The proposal includes unprecedented new spending levels fueled by multiple years of significantly better-than-expected state revenue collections.

Tennessee May Have an Extra $3 Billion to Budget Next Year

Even after the Ford deal, Gov. Lee and Tennessee lawmakers may still have at least $3 billion in unallocated funds to appropriate next year.

Tennessee Tax Revenue Tracker for FY 2021

Tennessee collected 21% more tax revenue in FY 2021 than lawmakers initially budgeted, giving the state a $2.1 billion unbudgeted surplus.

Summary of Gov. Lee’s FY 2022 Amended Budget

The governor amended his FY 2022 budget proposal with $73 million in net new spending and $325 million in off-budget allocations.

What and How Much Will Tennessee Get from the American Rescue Plan

The new federal law could bring $20-30 billion into Tennessee, including $6.3 billion in flexible funds for state and local governments.

The Budget in Brief: Summary of Gov. Lee’s FY 2022 Recommended Budget

The plan reflects much higher-than-expected revenues and directs the largest amounts to capital improvements/maintenance, structural balance, and economic development.

Tennessee May Have an Extra $3 Billion to Budget this Year

Tennessee collected far more tax revenue than expected over the last year, leaving Gov. Lee and state lawmakers with a lot of money to allocate.

Tennessee Tax Revenue Tracker for FY 2020

Despite the onset of a recession, Tennessee collected about $396 million (or 2%) more tax revenue in FY 2020 than originally budgeted for the fiscal year

Federal Coronavirus Funding for Tennessee

Tennessee will get over $25 billion in federal aid, including $8 billion to state government. Much of the relief has already occurred or will soon expire.

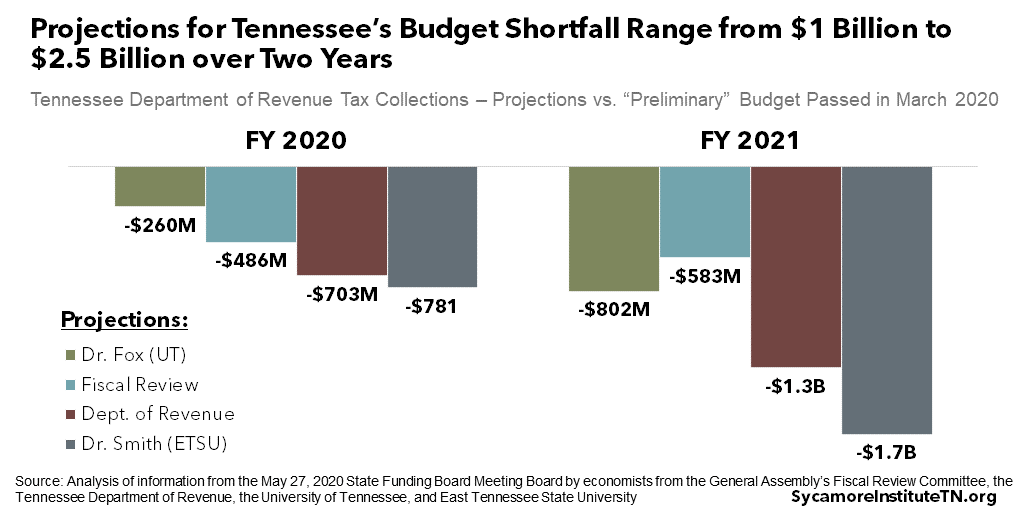

Summary of the Final FY 2021 Budget

Facing an expected $1.5 billion revenue shortfall over two years, Gov. Lee and state lawmakers turned to nearly every available tool to balance the budget.

How Big Is Tennessee’s Revenue Drop Going to Be?

Four economists gave their best estimates of how the coronavirus pandemic will affect state tax revenue in the current and next fiscal years.

Which Tennessee Counties Might See the Largest Drop in Sales Tax Revenue?

As the coronavirus’ economic toll grows, the Great Recession offers clues for how falling sales tax revenues will affect county budgets.

How State Policy Shapes Local Governance in Tennessee

Tennessee’s local governments often have the most impact on our daily lives, but state policies frequently shape their options, decisions, and priorities.

What Will the Coronavirus Recession Mean for Tennessee’s Budget?

The pandemic has serious health and economic effects, yet Tennessee still has to balance its budget. These are the challenges policymakers face and the tools they have right now.

Summary of the FY 2021 Preliminary Budget

With pandemic here and recession near, lawmakers passed a preliminary FY 2021 budget that trims $854 million from Gov. Lee’s first draft.

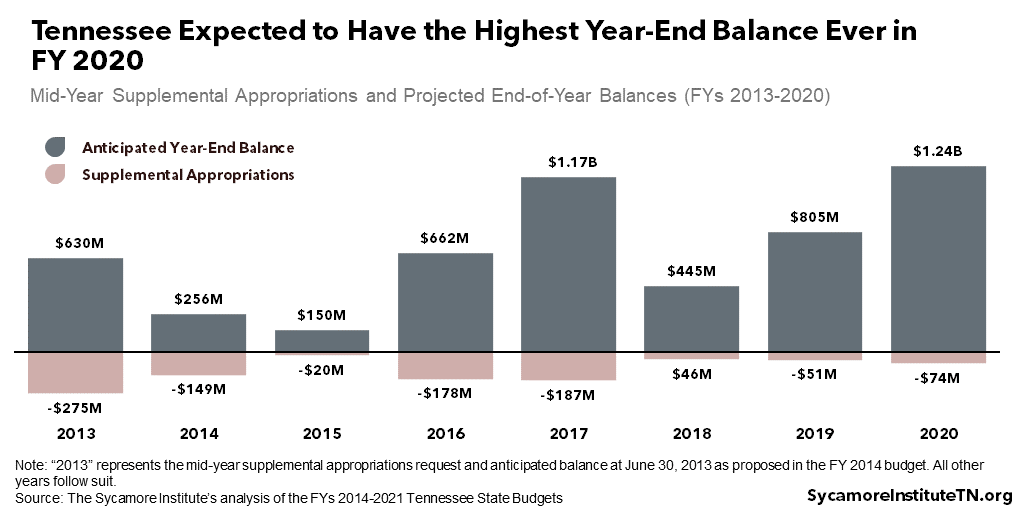

State Budget Surpluses, Deficits, and Rainy Day Funds

We explain why surpluses and deficits occur, the role of revenue projections and rainy day funds, and the trade-offs Tennessee policymakers must weigh when crafting the budget.

What You Might Have Missed in the 2019 Legislative Session

Changes to TennCare, education, criminal justice, online sales tax, sports betting, and fiscal notes had significant budget implications.

Summary of Gov. Lee’s FY 2020 Amended Budget

Governor Lee’s FY 2020 budget amendment increases state expenditures by $208.7 million relative to the recommendation submitted in March.

The Budget in Brief: Summary of Gov. Lee’s FY 2020 Recommended Budget

The governor’s recommended Budget for FY 2020 totals $38.6 billion, an increase of 1.1% over estimates for the current fiscal year.

Budgeting for Incarceration in Tennessee

Facts and trends on how Tennessee budgets for incarceration of state prisoners, which is consistently among the largest state revenue expenses.

Tennessee’s Budget May Not Be Ready for the Next Recession

Tennessee’s budget may not have enough rainy day reserves to withstand the next recession without tax hikes or spending cuts.

5 Issues for Tennessee’s Next Governor and General Assembly

No matter who wins the election, these 5 challenges could keep Tennessee’s next governor and General Assembly busy throughout 2019 and beyond.

FY 2018-2019 Tennessee Tax Revenue Tracker

Tennessee collected about $636 million (or 4%) more than was originally budgeted for the fiscal year that ended on June 30, 2019

FY 2017-2018 Tennessee Tax Revenue Tracker

Tennessee collected about $344 million (or 2%) more than was originally budgeted for the fiscal year that ended on June 30, 2018.

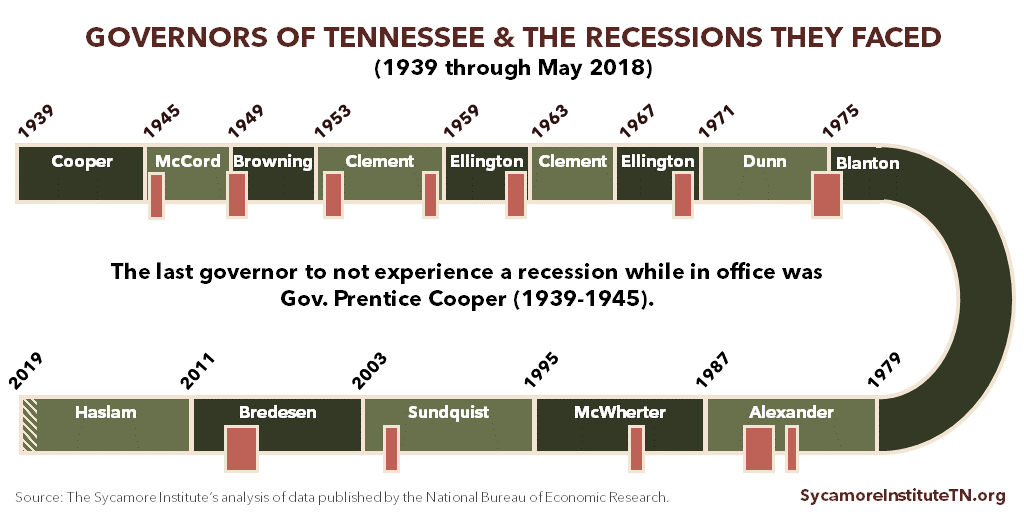

TN’s Next Governor Will Probably Face a Recession

When that recession comes, the governor’s options could prove more limited than in years past. Tough decisions lie ahead.

What Is Tennessee’s State-Funded Primary Care Safety Net?

It includes 4 types of health care providers focused on services that help uninsured adults avoid more costly hospitalizations.

Summary of Gov. Haslam’s FY 2018-2019 Amended Budget

The governor’s amendment makes relatively modest changes, including $30.2M for school safety and another $3.7M for the opioid epidemic.

5 for TN: Health, Budget, Opioids, the Economy & TennCare

Five 1-page infographics on issues that affect Tennesseans in 2018.

The Budget in Brief: Summary of Gov. Haslam’s FY 2018-2019 Recommended Budget

Find out where the money comes from, where it goes, and what changed from the current budget.

Healthy Debate 2018: Connections Between Tennessee’s Budget, Economy, and Health and Well-Being

Health, prosperity, public policy…all of these things are connected.

Healthy Debate 2018: Understanding Tennessee’s Budget

The budget represents our policymakers’ goals, the public goods and services intended to help meet those goals, and detailed plans to finance them.

Healthy Debate 2018: A Primer on Health & Budget Policy in Tennessee

A resource for any Tennessean who hopes to make or influence public policy in our state.

Tennessee’s State Budget — Brown Bag “Lunch & Learn” on Nov. 7

Budget decisions by Tennessee’s governor and legislature affect every Tennessean. Join us on Nov. 7 to find out how those decisions get made!

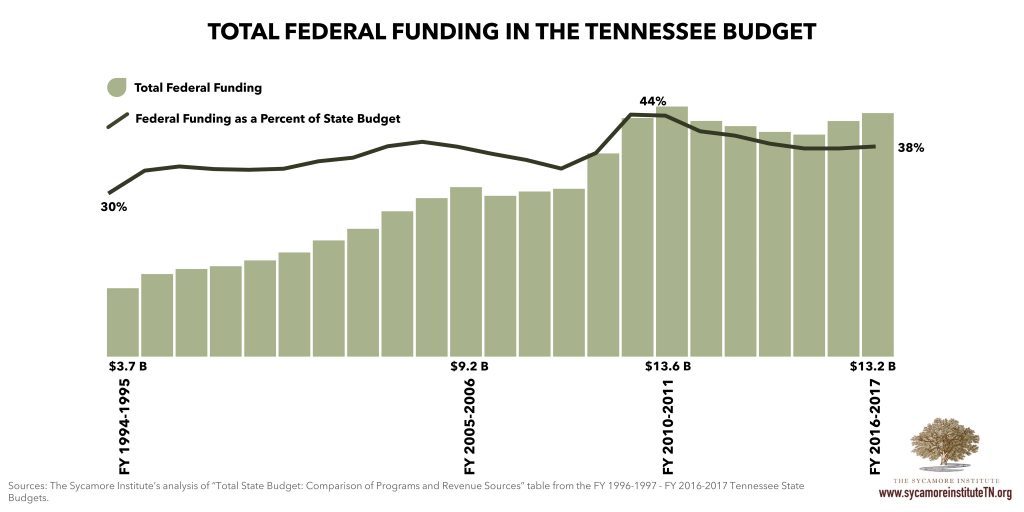

Federal Funding in Tennessee and the Strings Attached

Federal funding in Tennessee accounts for nearly 40% of the state budget. Most of that money comes with some big restrictions on how we can spend it.

Summary of Governor Haslam’s FY 2017-2018 Amended Budget

Governor Haslam’s 2017 Tennessee budget amendment makes a number of changes to the original budget recommendation he released in January.

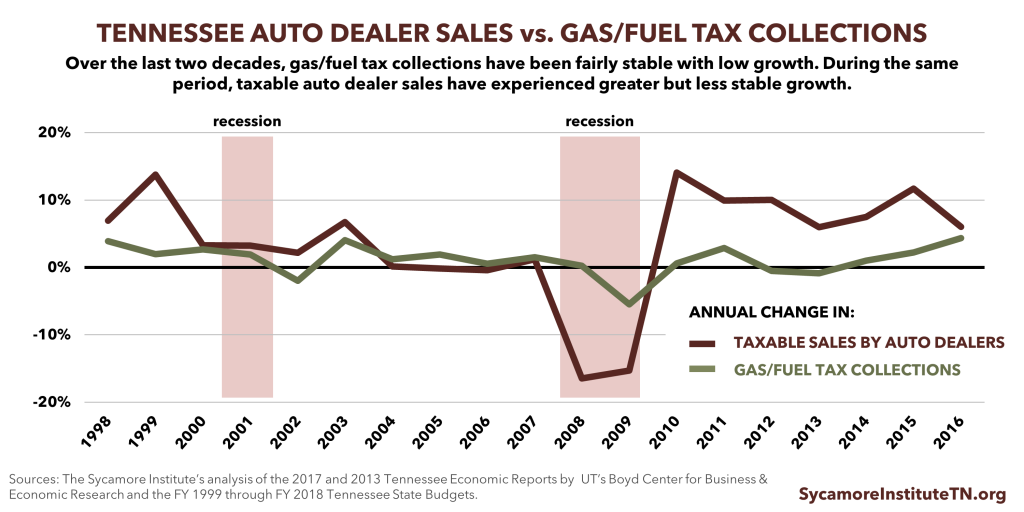

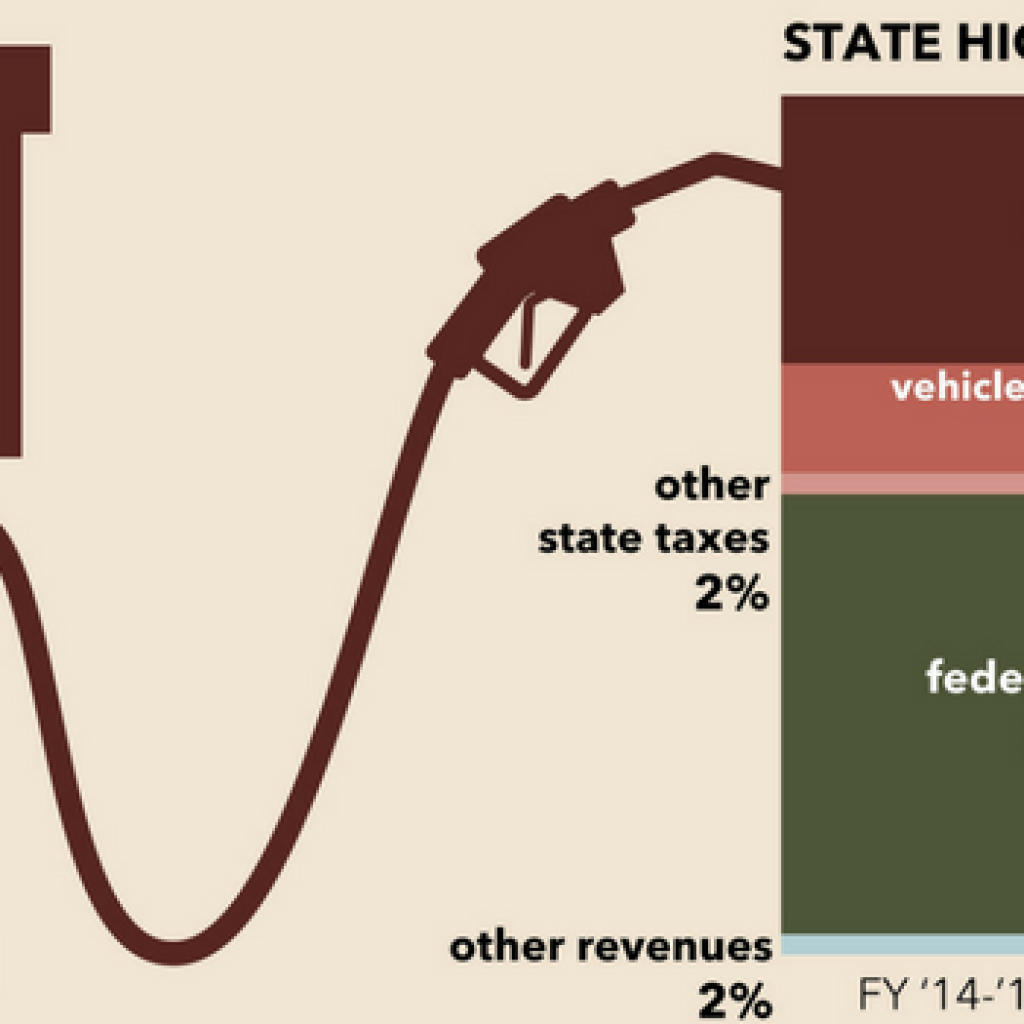

Comparing Annual Changes in Gas Tax Revenue and Car Sales

Lawmakers considering gas tax revenue and car sales taxes to fund highway projects in Tennessee should weigh the trade-offs of both options.

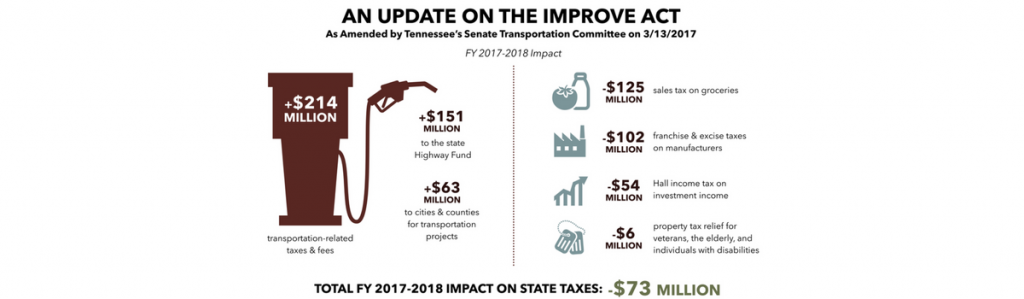

An Update on the IMPROVE Act – The Senate Transportation Committee Compromise

The Senate compromise on Gov. Haslam’s IMPROVE Act makes the original bill’s Highway Fund tax increases smaller and its General Fund tax reductions larger.

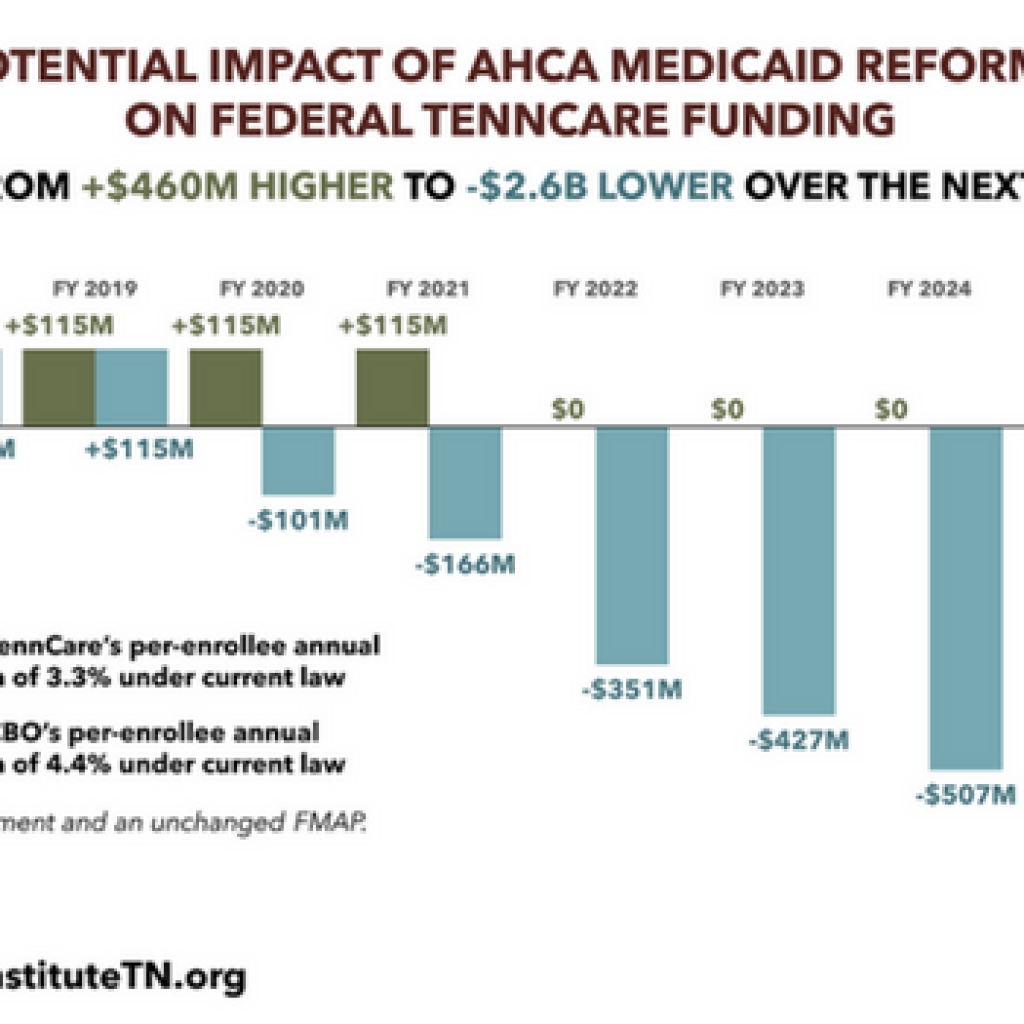

TennCare’s Federal Funding under the AHCA

Under the American Health Care Act (AHCA), federal TennCare funding could be $460 million more to $2.6 billion less than current law over the next decade.

How U.S. House Medicaid Reforms Could Impact TennCare

The American Health Care Act (AHCA) being considered by Congress would have a significant impact on federal funding for TennCare.

Op-Ed: Let Data Drive Tennessee Transportation Debate

Good data and research are critical to any public policy discussion. In an op-ed for The Tennessean, we put current transportation issues in context.

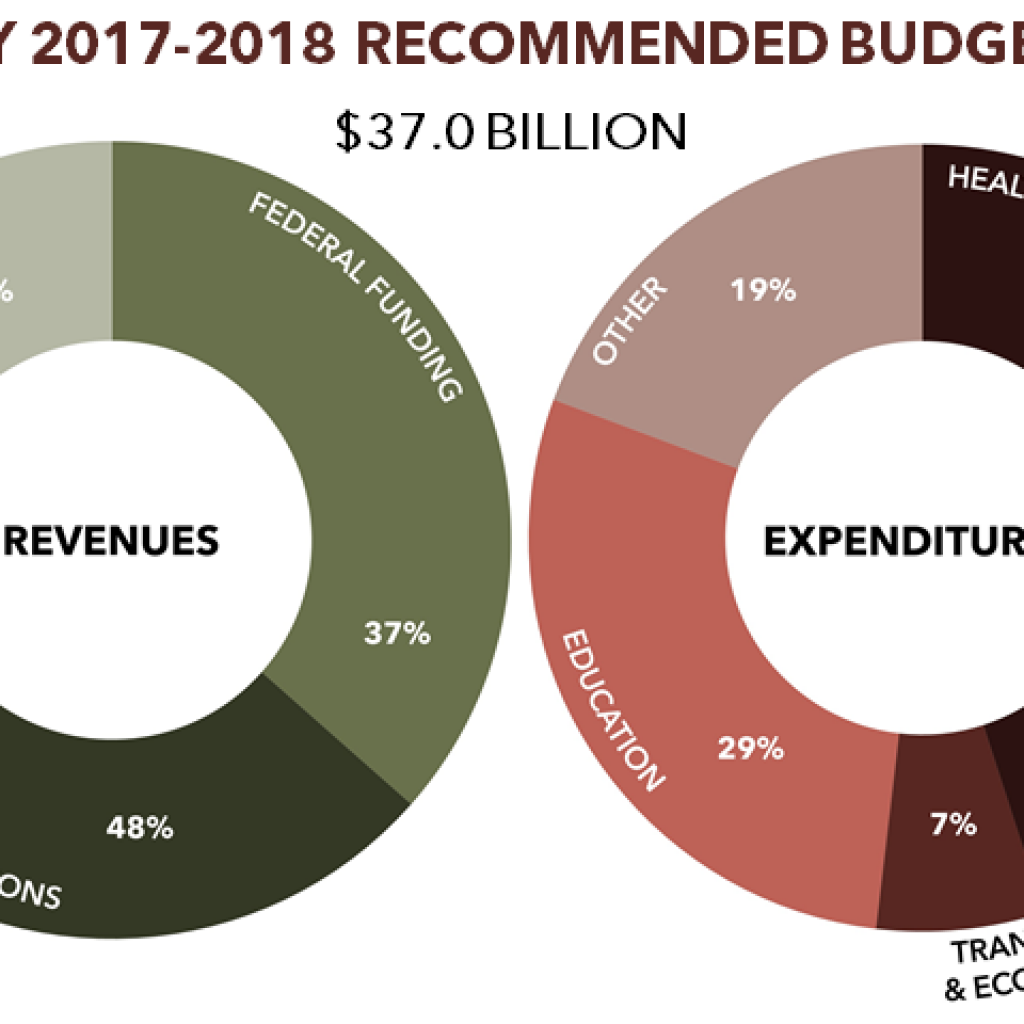

The Budget in Brief: Governor Haslam’s FY 2017-2018 Tennessee Budget Proposal

A detailed summary and analysis of Governor Bill Haslam’s 2017 Tennessee budget proposal with charts, graphs and a 1-page infographic.

Tennessee Highway Fund Fact Sheet

Charts & graphs about the Tennessee Highway Fund – where the money comes from, how funding and Tennessee’s gas tax have changed over time, and other trends.

Tennessee State Budget Primer (First Edition)

The Tennessee State Budget Primer explains what the budget does, how it’s created, where the money comes from, and where it goes.