As of May 31, 2024, Tennessee had collected about 80% of the $22.7 billion in total budgeted revenue for the current fiscal year.

Continue readingThe Budget in Brief: Summary of Gov. Lee’s FY 2025 Recommended Budget

Compared to current law, Gov. Lee’s budget reflects lower-than-expected tax collections and proposes new spending and tax cuts for FYs 2024-2025 — mostly funded by previously unallocated recurring revenues and a large FY 2023 surplus.

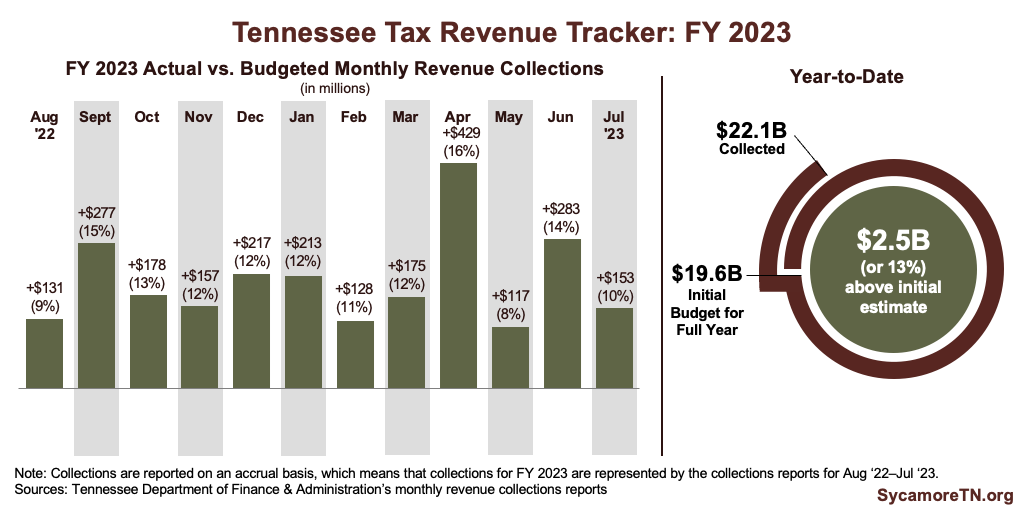

Continue readingTennessee Tax Revenue Tracker for FY 2023

FY 2023 collections were about $2.5 billion more (or 13%) than what was budgeted when the fiscal year began, but fell short of the revised estimate adopted as part of the FY 2024 approved budget.

Continue reading6 Facts About Road Funding in Tennessee

Tennessee’s ability to fund road construction and maintenance faces pressures from all sides.

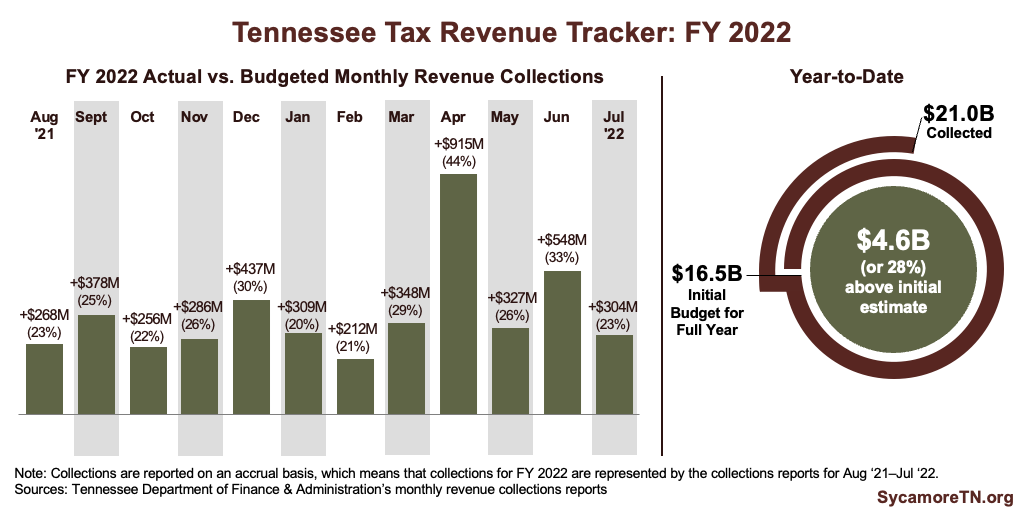

Continue readingTennessee Tax Revenue Tracker for FY 2022

Tennessee finished FY 2022 with a $1.6 billion unbudgeted surplus after collecting 28% more tax revenue than lawmakers initially budgeted.

Continue readingStadium Subsidies in Tennessee

Since 2021, state and local officials in Tennessee have committed or proposed $1.8 billion in subsidies for at least 5 pro sports venues.

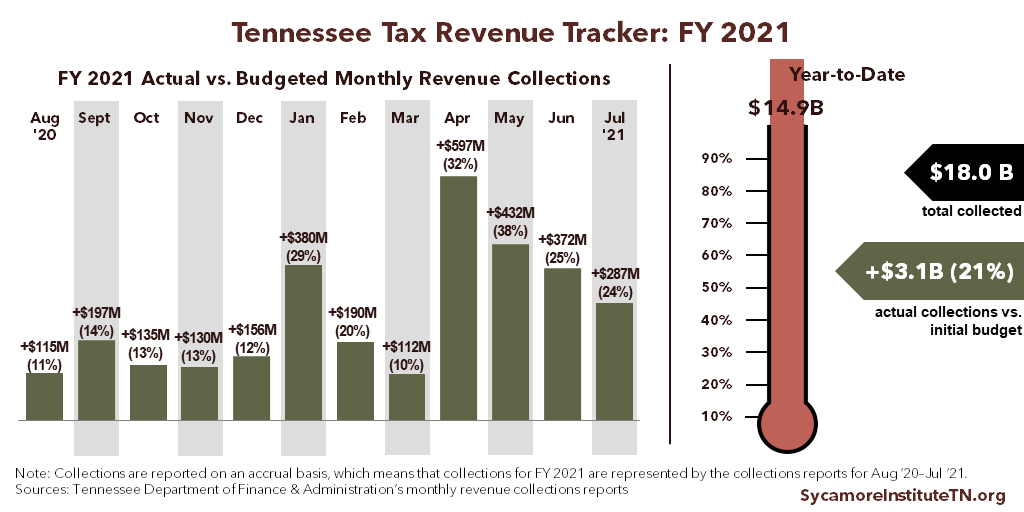

Continue readingTennessee Tax Revenue Tracker for FY 2021

Tennessee collected 21% more tax revenue in FY 2021 than lawmakers initially budgeted, giving the state a $2.1 billion unbudgeted surplus.

Continue readingTennessee May Have an Extra $3 Billion to Budget this Year

Tennessee collected far more tax revenue than expected over the last year, leaving Gov. Lee and state lawmakers with a lot of money to allocate.

Continue readingTennessee Tax Revenue Tracker for FY 2020

Despite the onset of a recession, Tennessee collected about $396 million (or 2%) more tax revenue in FY 2020 than originally budgeted for the fiscal year

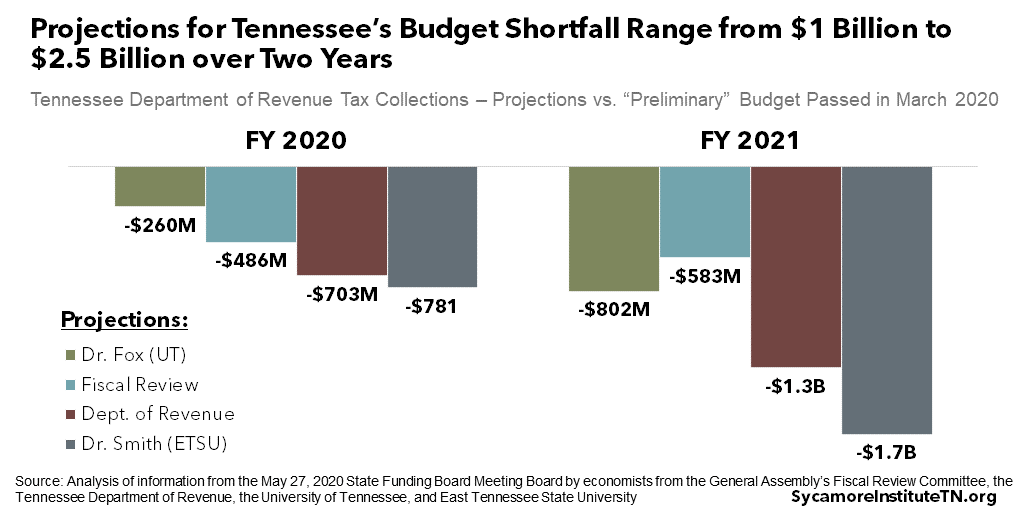

Continue readingHow Big Is Tennessee’s Revenue Drop Going to Be?

Four economists gave their best estimates of how the coronavirus pandemic will affect state tax revenue in the current and next fiscal years.

Continue reading