Governor Bill Lee will soon kick off Tennessee’s FY 2022 budget process by recommending a revenue and spending plan for state lawmakers to consider. During this process, policymakers will make changes to the current budget (FY 2021) and write a new budget for FY 2022, which starts July 1. When lawmakers last passed a budget in June 2020 in the midst of the pandemic, there was substantial uncertainty about how COVID-19 would affect state revenues. To date, collections have far exceeded expectations. As a result, the governor’s upcoming budget recommendation could include about $3.1 billion in additional funding.†

Revenue Collections Higher than Expected

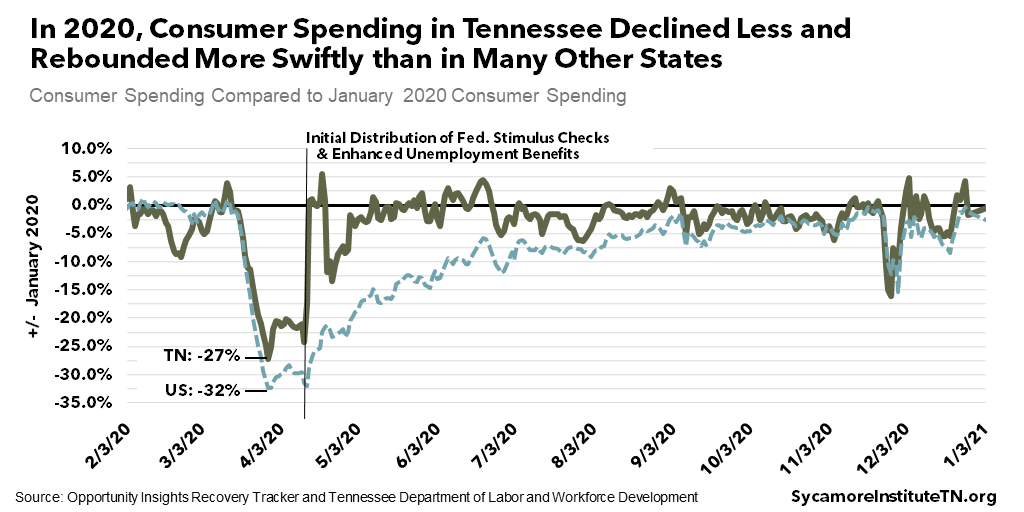

Over the last year, consumer spending in Tennessee declined less and rebounded more swiftly than in many other states (Figure 1). In late March 2020, consumer spending in Tennessee dropped 27% below January levels – compared to 32% nationally. Soon after, the state received billions in federal aid designed to provide economic relief to citizens, businesses, and health care providers. After federal stimulus payments and enhanced unemployment benefits began in mid-April, Tennessee’s consumer spending rebounded close to pre-pandemic levels, while spending nationwide remained down by about 16%. (1) (2) Meanwhile, prior changes to state law took effect in July 2020 that led the state to collect sales tax on more internet purchases. (3)

Figure 1

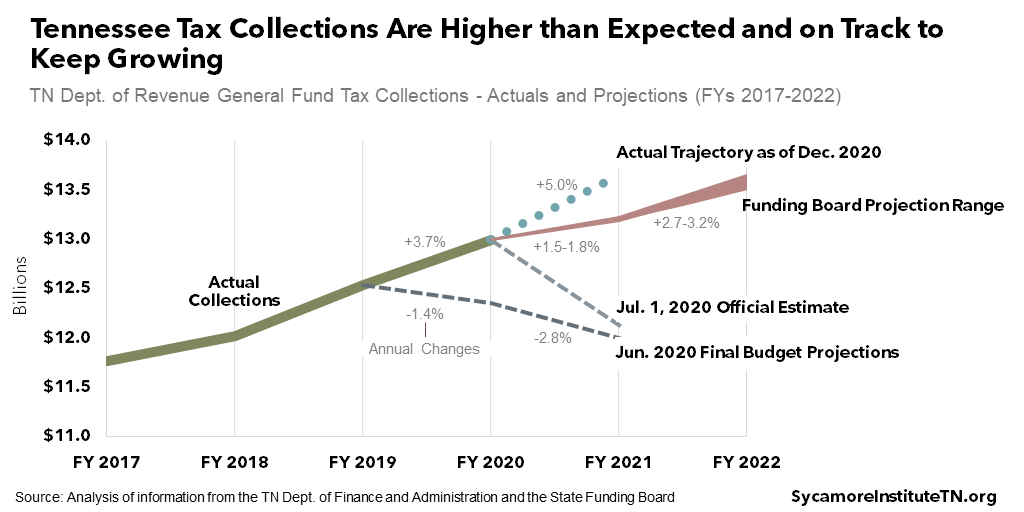

As a result, the state’s tax collections significantly beat expectations and are on track to keep growing (Figure 2). In June 2020, policymakers expected a 1.4% dip in General Fund collections† in FY 2020 and another 2.8% drop in FY 2020. Instead, the state finished FY 2020 up 3.7%. The Funding Board’s recommended range of revenue predictions for the governor’s upcoming budget proposal anticipates that collections will continue to grow in FYs 2021 and 2022. (4) (5) (6) In fact, General Fund collections for FY 2021 have already outpaced official year-to-date estimates by $716 million just five months into the fiscal year. If revenues continue to grow at that rate, they could ultimately end up 5.0% higher than FY 2020 levels. (7)

While consumer spending has been relatively strong compared to other states, Tennessee still faces significant challenges from the health and economic fallout of the COVID-19 pandemic. Unemployment among low-wage workers remains high, for example, and small business revenues have not yet recovered. (1) Meanwhile, the virus’ death toll in the state is approaching 10,000 people. (4)

Figure 2

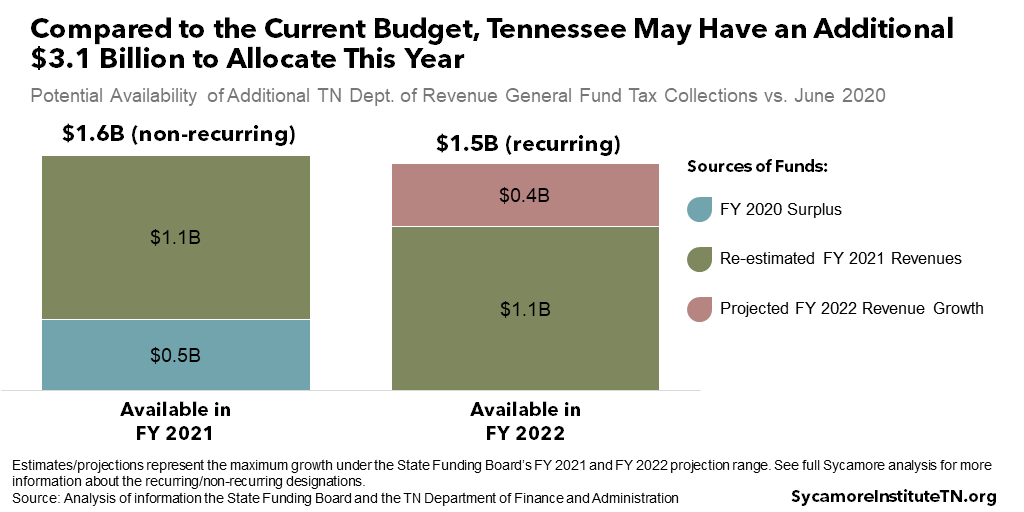

New Funds Could Reach $3.1 Billion

Compared to the current budget, the governor and state lawmakers may have about $3.1 billion in additional General Fund revenue† to allocate this session (Figure 3). Based on the upper end of the annual Funding Board ranges, this includes:

- $476 million (non-recurring) from the FY 2020 surplus (8)

- $1.1 billion (non-recurring) from projected FY 2021 collections above official budgeted estimates (4)

- $1.5 billion (recurring) from the increased FY 2021 base plus projected FY 2022 growth (4)

The FY 2021 $1.1 billion increase in available revenue will likely be treated as non-recurring revenue even though the state expects to collect those funds in subsequent years. The $1.1 billion reflects a re-estimate of what the state expects to collect in the current year from recurring revenue sources (compared to the official July 1, 2020 revenue estimate). Policymakers and official budget documents typically treat additional revenues from mid-year re-estimates like these as non-recurring. They can, however, use those revenues to begin new recurring investments in FY 2021 that they carry over into FY 2022, or they could use them on non-recurring purposes in FY 2021 and delay any new recurring commitments until FY 2022. Meanwhile, the FY 2020 surplus is only available for non-recurring purposes, and the FY 2022 revenue growth is recurring.

Figure 3

Some of this money has already been appropriated, but most remains available for the governor and General Assembly to allocate. During the recent special legislative session on education, for example, lawmakers appropriated $110 million of non-recurring funds for the current fiscal year. That money will increase the state’s share of the school funding formula for teacher salaries and for other activities to mitigate pandemic-related learning loss. (9)

A portion of recurring funds will also be needed to offset decisions made in June to ensure the budget was balanced in the face of uncertain revenues. The June 2020 budget was balanced but used some non-recurring actions to offset a projected $1 billion recurring revenue shortfall. Policymakers will likely first apply re-estimated recurring revenues to bring recurring revenues and spending into balance.

† This analysis focuses exclusively on the availability of revenues collected by the Tennessee Department of Revenue and allocated to the General Fund based on actual collections, financial documents, and recent projections. It does not reflect the potential effects of other year-end transactions (e.g. transfers between funds, other General Fund revenue sources, etc.).

This brief was updated on Feb. 3, 2021 to note that policymakers may use some of these funds to get the budget back into structural balance.

References

Click to Open/Close

- Chetty, Raj, et al. Economic Tracker. Opportunity Insights. [Online] January 17, 2021. [Cited: January 29, 2021.] Consumer spending available at https://tracktherecovery.org/?ypbce. Unemployment data available at https://tracktherecovery.org/?3wqoc. Small business revenue data available at https://tracktherecovery.org/?13va6.

- Tennessee Department of Labor and Workforce Development. Tennessee Starts Sending $600 Federal Unemployment Benefit. [Online] April 14, 2020. https://www.tn.gov/workforce/general-resources/news/2020/4/14/tennessee-starts-sending–600-federal-unemployment-benefit.html#:~:text=On%20Tuesday%2C%20April%2014%2C%20the,payment%20on%20Wednesday%2C%20April%2015.

- Tennessee State Funding Board. Testimony by Dr. Bill Fox at November 18, 2020 Meeting. [Online] November 18, 2020. [Cited: January 29, 2021.] Video available from http://tnga.granicus.com/MediaPlayer.php?publish_id=cfd05d64-9f9d-48ea-8958-ae7f11eeebec.

- Tennessee Department of Health. COVID-19 Information Dashboard. [Online] February 2, 2021. [Cited: February 2, 2021.] https://covid19.tn.gov/.

- Tennessee State Funding Board. State Funding Board Growth Projections for FY 2020-21 and FY 2021-22. [Online] December 2, 2020. https://comptroller.tn.gov/content/dam/cot/slf/documents/investor-updates/2020/revenue-estimating/2020.12.02SFBRevenueEstimatingMemorandum.pdf.

- —. Meeting: November 24, 2020. [Online] November 24, 2020. [Cited: January 29, 2021.] Video available from http://tnga.granicus.com/MediaPlayer.php?publish_id=6df26e3e-92fe-43d0-b6f3-d6d1662f30d7.

- —. Meeting Minutes: November 24, 2020. [Online] [Cited: January 29, 2021.] https://comptroller.tn.gov/content/dam/cot/tsfb/documents/minutes/2020/2020.11.18-24SFBMinutes.pdf.

- Tennessee Department of Finance and Administration. December Revenues. [Online] January 11, 2021. [Cited: January 29, 2021.] https://www.tn.gov/finance/news/2021/1/11/december-revenues.html.

- State of Tennessee. Comprehensive Annual Financial Report for the Fiscal Year Ended June 30, 2020. [Online] 2020. [Cited: January 29, 2021.] https://www.tn.gov/content/dam/tn/finance/accounts/cafr/June%2030,%202020%20CAFR.pdf.

- Tennessee General Assembly. SB 7009/ HB 7020. [Online] 2021. [Cited: January 21, 2021.] http://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=SB7009.