Each month, the Tennessee Department of Finance & Administration (F&A) reports how much tax revenue the state collected for the previous month. These reports help policymakers and the public understand how actual revenue collections compare to estimates from the start of the fiscal year. The Sycamore Institute’s Tennessee Tax Revenue Tracker, updated monthly, provides a quick visual snapshot of each report.

Tennessee’s FY 2022 Revenue Collections

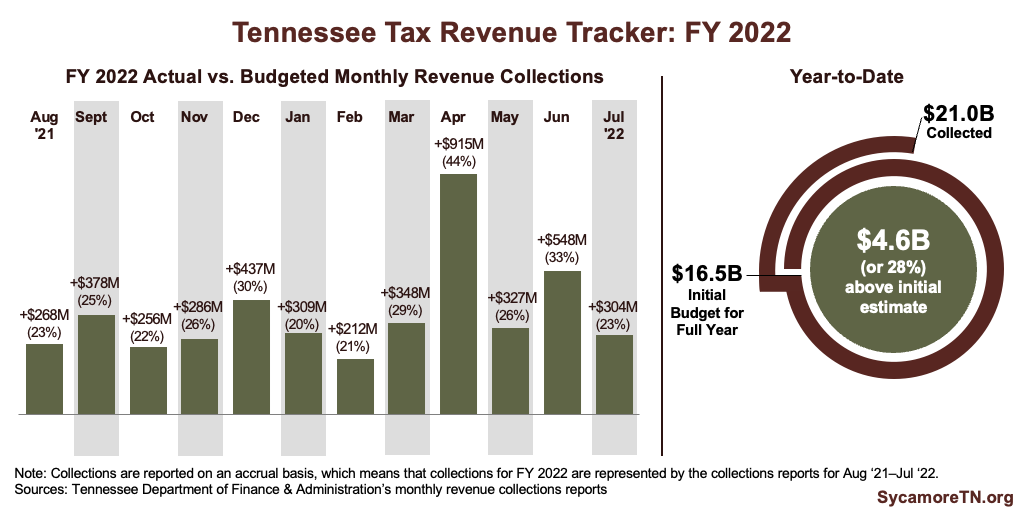

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Tennessee collected just over $21.0 billion during FY 2022 – $4.6 billion higher and 28% more than the $16.4 billion in total revenue initially budgeted for the year.

- Lawmakers amended the budget in April to allocate about $3.0 billion in expected surplus after the governor revised the state’s official FY 2022 revenue projection. As a result, Tennessee ends FY 2022 with an unbudgeted surplus of about $1.6 billion that policymakers can allocate in future fiscal years as non-recurring funds.

For additional details, read F&A’s official July 2022 report on revenue collections.

![]()

Why Revenue Forecasts Are So Important

Forecasting how much tax revenue Tennessee will collect in a given year or month is a difficult but important part of maintaining a balanced budget, which the state constitution requires. F&A’s revenue forecasts have a major influence on decisions about spending. Overestimating revenues could force state policymakers to cut spending mid-year.

On the other hand, underestimating revenues creates unplanned surpluses which can be spent the following year or saved in the rainy day fund. The trade-off of a surplus is that policymakers may have preferred to either spend the money or reduce taxes in the current year.

See our Tennessee State Budget Primer for more on the implications of state revenue estimates and how accurate these estimates have been in recent years. To learn how F&A creates its revenue forecasts, read the department’s methodology here.

Tennessee’s June 2022 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for June 2022 were about $548 million higher than lawmakers initially budgeted. Meanwhile, combined collections for the last 11 months were about $4.2 billion (or 28%) above initial estimates.

- To date, Tennessee has reported a total of $19.4 billion in tax revenue for FY 2022. That is about $3.0 billion more than lawmakers initially budgeted for the entire 12-month period.

- However, lawmakers amended the budget in April to allocate about $3.0 billion in expected surplus after the governor revised the state’s official FY 2022 revenue projection.

For additional details, read F&A’s official June 2022 report on revenue collections.

![]()

Tennessee’s May 2022 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for May 2022 were about 26% higher than lawmakers initially budgeted.

- As of May 31, 2022, Tennessee had collected a total of $17.2 billion – about $764 million more than the $16.5 billion in total revenue initially budgeted for the entire current fiscal year.

- Collections through May were about $3.7 billion higher (or 28%) than what was initially budgeted for the time period. With two months left in the fiscal year, it is also about $785 million more than the state’s official projection for the FY 2023 surplus.

For additional details, read F&A’s official May 2022 report on revenue collections.

![]()

Tennessee’s April 2022 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for April 2022 were about 44% higher than budgeted.

- As of April 30, 2022, Tennessee had collected about 95% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through April were about $3.4 billion higher (or 28%) than what was budgeted for the time period. With three months left in the fiscal year, it is also $460 million more than the state’s official projection for the FY 2023 surplus.

For additional details, read F&A’s official April 2022 report on revenue collections.

![]()

Tennessee’s March 2022 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for March 2022 were about 29% higher than budgeted.

- As of March 31, 2022, Tennessee had collected about 77% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through March were about $2.5 billion higher (or 25%) than what was budgeted for the time period. Gov. Lee’s FY 2023 recommended budget projects this number will reach $3.0 billion by the end of the fiscal year.

For additional details, read F&A’s official March 2022 report on revenue collections.

![]()

Tennessee’s February 2022 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for February 2022 were about 21% higher than budgeted.

- As of February 28, 2022, Tennessee had collected about 67% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through February were about $2.1 billion higher (or 24%) than what was budgeted for the time period. Gov. Lee’s FY 2023 recommended budget projects this number will reach $3.0 billion by the end of the fiscal year

For additional details, read F&A’s official February 2022 report on revenue collections.

![]()

Tennessee’s January 2022 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for January 2022 were about 20% higher than budgeted.

- As of January 31, 2022, Tennessee had collected about 60% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through January were about $1.9 billion higher (or 25%) than what was budgeted for the time period. Lee’s FY 2023 recommended budget projects this number will reach $3.0 billion by the end of the fiscal year.

For additional details, read F&A’s official January 2022 report on revenue collections.

![]()

Tennessee’s December 2021 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for December 2021 were about 30% higher than budgeted.

- As of December 31, 2021, Tennessee had collected nearly half of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through December were about $1.6 billion higher (or 26%) than what was budgeted for the time period.

For additional details, read F&A’s official December 2021 report on revenue collections.

![]()

Tennessee’s November 2021 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for November 2021 were about 26% higher than budgeted.

- As of November 30, 2021, Tennessee had collected about 37% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through November were about $1.2 billion higher (or 24%) than what was budgeted for the time period.

For additional details, read F&A’s official November 2021 report on revenue collections.

![]()

Tennessee’s October 2021 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for October 2021 were about 22% higher than budgeted.

- As of October 31, 2021, Tennessee had collected about 24% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through October were about $902 million higher (or 24%) than what was budgeted for the time period.

For additional details, read F&A’s official October 2021 report on revenue collections.

![]()

Tennessee’s September 2021 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for September 2021 were about 25% higher than budgeted.

- As of September 30, 2021, Tennessee had collected about 20% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through September were about $646 million higher (or 24%) than what was budgeted for the time period.

For additional details, read F&A’s official September 2021 report on revenue collections.

![]()

Tennessee’s August 2021 Revenue Collections

The image below shows Tennessee’s revenue collections for FY 2022 relative to the estimates for which the state “budgeted” at the start of the fiscal year.

- Actual collections for August 2021 were about 23% higher than budgeted.

- As of August 31, 2021, Tennessee had collected about 9% of the $16.5 billion in total budgeted revenue for the current fiscal year.

- Collections through August were about $268 million higher (or 23%) than what was budgeted for the time period.

For additional details, read F&A’s official August 2021 report on revenue collections.

![]()

* This post was originally published on September 15, 2021 and will be updated for each month of FY 2021.