This week, Governor Lee proposed an amendment to his budget recommendation for FY 2022, which starts July 1, 2021. These revisions update the original budget plan the governor rolled out in February, reflecting new information about program needs and legislative action. With these changes, the FY 2022 budget recommendation now totals $42.6 billion – including $21.1 billion from state revenues (1) (2) (3) (4)

The administration amendment marks one of the final steps in the process to get next year’s budget approved by the legislature (which will likely be one of the General Assembly’s final actions before adjourning for the year).

Key Takeaways

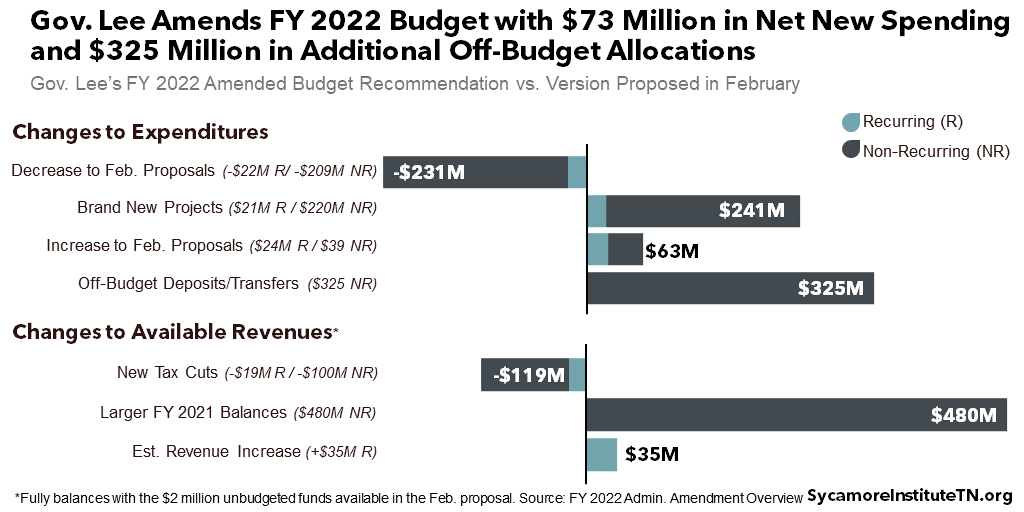

- The FY 2022 budget amendment adds $73 million in net new spending from state revenues and $325 million in new off-budget allocations.

- In total, it proposes $629 million in new expenditures and $119 million in new tax cuts – offset by changes that increase available revenues and reduce funding for items proposed in February.

- It does not fundamentally change tax collection forecasts despite a surplus that – just seven months into the current fiscal year – already exceeds recent projections by $300 million.

- More changes are inevitable due to the coming influx of federal money from the American Rescue Plan, which may overlap with state-funded initiatives.

Overview

The amended FY 2022 proposed budget includes $21.1 billion from state revenues ($73 million higher than before) plus $325 million in new off-budget deposits and transfers. These net increases are the combined result of dozens of changes that affect both revenues and expenditures (Figure 1). Relative to the February recommendation, changes to expenditures include:

- Decreases to February Proposals – $231 million ($22 million recurring and $209 non-recurring) reduction to programs proposed in February.

- Brand New Projects – $241 million ($21 million recurring and $220 million non-recurring) for brand new initiatives and capital projects.

- Increases for February Proposals – $63 million ($24 million recurring and $39 million non-recurring) added to items proposed in February.

- Off-Budget Deposits and Transfers – $325 million more in fund deposits and transfers compared to the February recommendation. These allocations typically do not count against state budget totals.

The amendment keeps the budget balanced with a $396 million increase in revenues available for FY 2022. In addition to spending $2 million that were unallocated in the initial recommendation, revenue changes include:

- Tax Cuts – $119 million ($19 million recurring and $100 million non-recurring) in reduced revenue primarily from a mix of permanent and one-time tax cuts.

- Larger FY 2021 Balances – $480 million in additional funds carried over from the current year as non-recurring revenue.

- Estimated Revenue Increases – $35 million in additional recurring revenues expected from existing taxes on insurance premiums.

The sections that follow highlight significant items in each of these areas and the role of new federal dollars from the American Rescue Plan.

Figure 1

Changes to Expenditures

Decreases to February Budget Proposals

The governor’s amended budget scales back a total of $231 million from some of the initiatives proposed in February. The largest item is the elimination of $150 million in non-recurring funding for COVID-19 response efforts due to the coming influx of additional federal funds for the same purpose. Several smaller reductions are associated with updated cost estimates for some of the governor’s legislative priorities (e.g. re-entry services for incarcerated individuals).

Brand New Spending & Increases for February Proposals

The amended budget includes a total of $304 million in new spending – including $241 million on brand new projects and $63 million in increases for February proposals. The largest of these include:

- Technical Education – $79 million ($8 million recurring and $71 million non-recurring) to expand capacity at Tennessee Colleges of Applied Technology (TCATs). $8 million in recurring funds will support additional staff. The rest focuses on non-recurring grants, equipment, maintenance, and capital improvements. In the 2018-2019 academic year, 27 TCATs across the state served 29,540 students.(5) The proposed funds will help TCATs increase enrollment over the next several years to an additional 11,000 people currently on waiting lists.

- Earmarked Grants – $65 million non-recurring for 51 targeted grants to specific communities and organizations. The largest grants include $13.5 million for the sports authority of Knox County and Knoxville and $10 million to the city of Memphis for a youth sports complex. Another 13 grants are each $1-5 million, and the remaining 36 range from $20,000 to $800,000 a piece.

- Department of Safety – $37 million ($1 million recurring and $36 million non-recurring) primarily to update communications systems within the Department of Safety.

Off-Budget Transfers and Deposits

The governor’s amendment includes $325 million more in fund deposits and transfers, which typically do not count against state budget totals. The largest of these include:

- K-12 Mental Health Trust Fund – $250 million for a one-time allocation to establish a K-12 Mental Health Trust Fund. An estimated $6-10 million in annual interest earned from the fund’s investment will support mental health efforts in schools. This money is in addition to $7 million in recurring spending proposed for the same purposes in the February recommendation. Gov. Lee originally proposed this trust fund in his FY 2021 budget recommendation but shelved it when the pandemic hit.

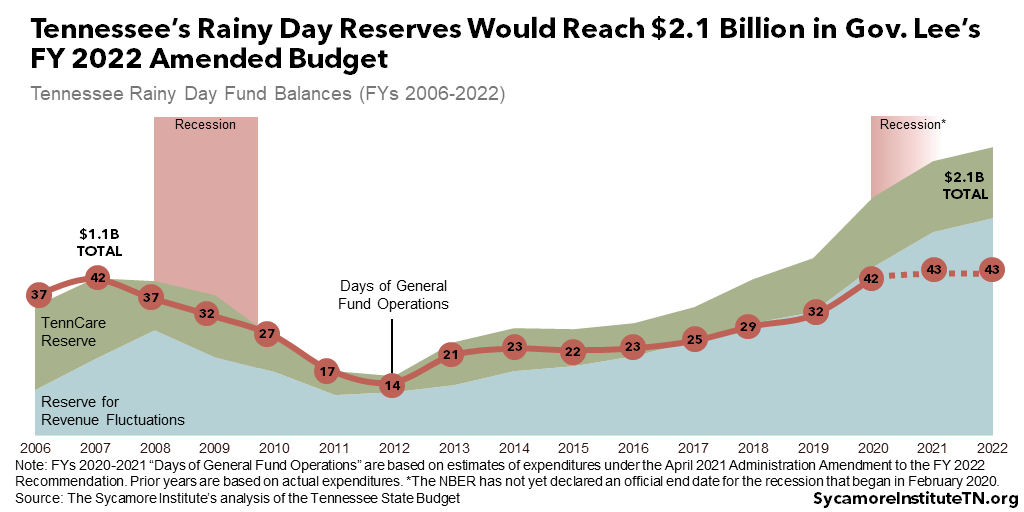

- Rainy Day Fund – An additional $50 million for the state’s Reserve for Revenue Fluctuations, bringing the total proposed FY 2022 deposit to $100 million. Together with the TennCare Reserve, this would bring the state’s rainy day resources to $2.1 billion – or about 43 days of General Fund operations (Figure 2).

Figure 2

Changes to Available Revenues

New Tax Cuts

The amendment reduces revenues by $119 million, primarily through one new permanent tax cut and two temporary tax holidays. These include:

- Professional Privilege Tax Reduction – A cut to the professional privilege tax from $400/year to $300/year would reduce revenues by an estimated $17 million per year. The tax currently applies to lobbyists, physicians, attorneys, securities agents, broker-dealers, and investment advisers. In 2019, lawmakers exempted 15 professions previously subject to the tax. Governor Lee had proposed halving the tax on the remaining professions in his FY 2021 recommendation but shelved the proposal after the pandemic hit.

- Sales Tax Holidays – The amendment proposes two-week sales tax holidays for groceries and restaurants/prepared food in FY 2022, which would reduce revenues to the tune of $100 million. It is not yet clear if these holidays will coincide.

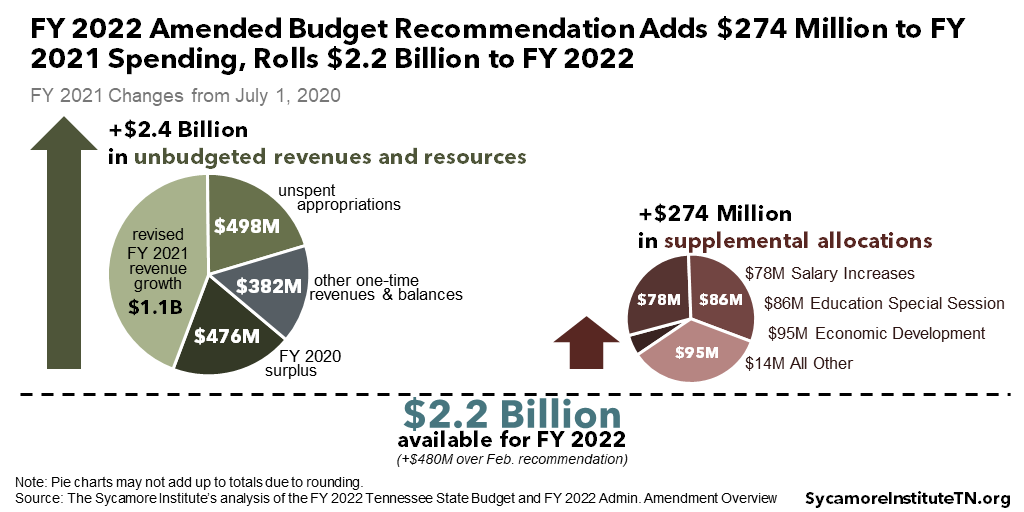

Figure 3

Larger FY 2021 Balances

The amendment proposes additional changes to the current year that would boost estimated balances available for FY 2022 by $480 million to total $2.2 billion (Figure 3). These funds will become non-recurring revenue for FY 2022. The increase is the net result of changes that free up available dollars and increase FY 2021 spending for a handful of programs. Highlights include:

Increases in FY 2021 Unbudgeted Revenues and Resources

- Unspent Appropriations – $498 million from unspent program funds that revert back to the General Fund – $100 million of which was reserved for COVID-19 response. The state was able to use federal funds for COVID-19. Non-recurring spending reductions of this kind are known as reversions. End-of-year program reversions are common but typically total about $150-200 million per year.

Increases in FY 2021 Supplemental Allocations

- Economic and Community Development – $45 million non-recurring for FastTrack projects aimed at recruiting businesses to Tennessee. This brings the total supplemental request for economic development to $95 million.

- K-12 Summer Learning Transportation – $19 million in additional non-recurring grants to local school districts to support transportation for summer learning initiatives meant to address COVID-19-related learning loss. These initiatives passed during a special session of the General Assembly earlier this year. Another $19 million is included for the same purpose in the additional spending requests for FY 2022 discussed earlier.

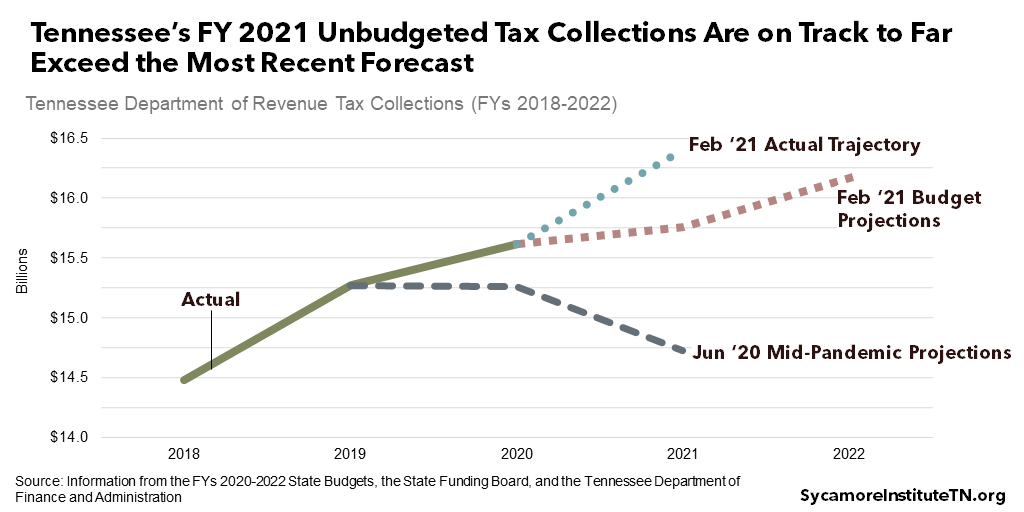

Figure 4

Figure 5

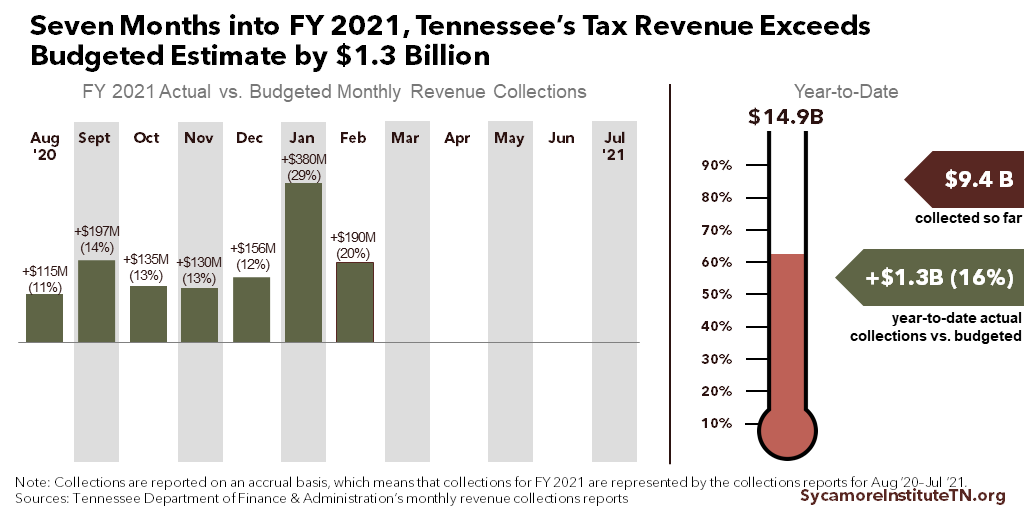

Tax Projections

Aside from the tweaks discussed here, tax collection forecasts for FY 2021 and FY 2022 remain unchanged despite a surplus that already exceeds projections updated in February. The plan Gov. Lee proposed two months ago assumes the state will collect $1.0 billion more in FY 2021 than is currently budgeted. This assumption also grew the FY 2022 base budget by the same amount (Figure 4). Seven months into the current fiscal year, actual collections already exceed the most recent forecast by $300 million (Figure 5). The amendment also continues using growth in recurring revenues to support non-recurring investments (see our February summary for more details).

The Impact of Federal Funding

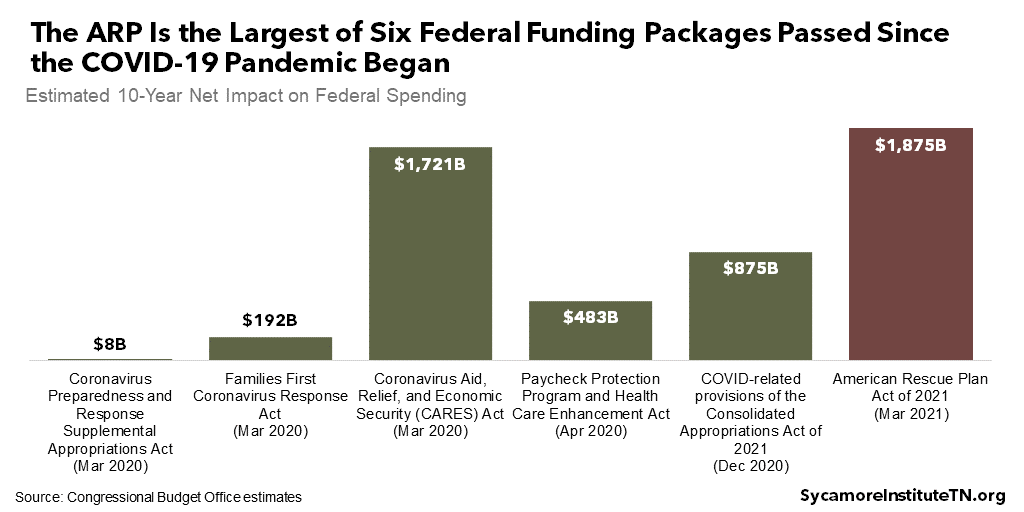

Tennessee is experiencing one of the most significant influxes of federal funding in history. Congress recently passed the American Rescue Plan (ARP) – the largest of six federal supplemental funding packages passed since the COVID-19 pandemic began last year (Figure 6). Tennessee’s state government has already received at least $9 billion, and billions more are on the way and available to spend over several years.

Some of the changes discussed above reflect the impact of this federal funding. Specifically, the amendment scales back dedicated COVID-19 response funding by $100 million in FY 2021 and $150 million in FY 2022 in light of available funding.

Figure 6

The amendment preserves several state investments that may overlap with recent federal funding priorities. For example, the amended budget retains $200 million in non-recurring grants to local governments, $200 million in non-recurring grants to expand broadband access, and additional funding to address COVID-19-related learning losses. Tennessee will receive billions from the ARP for many of the same broad purposes – including $6.3 billion in flexible fiscal aid ($4.0 billion to state government and $2.3 billion to locals) and another $2.5 billion for state and local K-12 funding.

Additional changes to the budget are inevitable as the federal government begins to release the money and detailed rules for spending it. ARP funds have not yet been distributed, and in many cases recipients will want to wait for guidance from federal agencies before they use it. Most of this money will be available for several years, so the Lee administration may revisit the state’s funding priorities as these details become clearer.

It remains unclear how much flexibility the General Assembly will give Gov. Lee to spend additional federal dollars. The final FY 2021 budget gave the executive branch unusually wide latitude to allocate federal funds received mid-year without advance, program-specific appropriations. Typically, agencies that get more federal funding than the state budget anticipates will present revised spending plans to the General Assembly’s finance committees. The Lee administration has indicated it plans to return to that process going forward (4), but state lawmakers could still opt for a different approach. Since the money does not all have to be spent immediately, policymakers may not sort out every detail right away.

References

Click to Open/Close

- Tennessee Department of Finance & Administration. FY 2022 Administration Budget Amendment Overview. [Online] April 12, 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/22AdminAmendOverview2%20.pdf.

- —. FY 2022 Budget Amendment – Commissioner’s Presentation. [Online] April 13, 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/FY22BudgetAmendmentPresentation-FINAL.pdf.

- Tennessee Senate Committee on Finance, Ways, and Means. Presentation of the FY 2022 Administration Budget Amendment . [Online] April 13, 2021. Video available at https://tnga.granicus.com/MediaPlayer.php?view_id=614&clip_id=24624.

- Tennessee House Committee on Finance, Ways, and Means. Presentation of the FY 2022 Administration Budget Amendment. [Online] April 13, 2021. Video available from https://tnga.granicus.com/MediaPlayer.php?view_id=636&clip_id=24635.

- Tennessee Higher Education Commission (THEC). 2019-2020 Higher Education Fact Book. [Online] [Cited: April 13, 2021.] https://www.tn.gov/thec/research/fact-book.html.

- State of Tennessee. FY 2021-2022 Tennessee State Budget. [Online] February 8, 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/2022BudgetDocumentVol1.pdf.

- Tennessee Department of Finance and Administration. Budget Overview: FY 2021-2022. [Online] February 4, 2021. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/22AdReq15i.pdf.

- State of Tennessee. Tennessee State Budgets. [Online] Available from https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html.

- Tennessee Department of Finance & Administration. February Revenues. [Online] March 12, 2021. https://www.tn.gov/finance/news/2021/3/12/february-revenues.html.

- —. Monthly Revenue Collections Reports. [Online] Available from https://www.tn.gov/content/tn/finance/news.revenues.html.

- Congressional Budget Office. The Budgetary Effects of Laws Enacted in Response to the 2020 Coronavirus Pandemic, March and April 2020. [Online] June 2020. https://www.cbo.gov/system/files/2020-06/56403-CBO-covid-legislation.pdf.

- —. Additional Information About the Economic Outlook: 2021 to 2031 . [Online] February 2021. https://www.cbo.gov/publication/57014.

- —. Estimate for Divisions O Through FF of H.R. 133, Consolidated Appropriations Act, 2021 . [Online] January 14, 2021. https://www.cbo.gov/system/files/2021-01/PL_116-260_div%20O-FF.pdf.

- —. Summary Estimate for Divisions M Through FF of H.R. 133, Consolidated Appropriations Act, 2021. [Online] January 14, 2021. https://www.cbo.gov/system/files/2021-01/PL_116-260_Summary.pdf.

- —. Estimated Budgetary Effects of H.R. 1319, American Rescue Plan Act of 2021 . [Online] March 10, 2021. https://www.cbo.gov/publication/57056.