Key Takeaways

- The FY 2024 budget amendment adds $501 million — or 1.7% — in net new spending from state revenues.

- In total, the amendment proposes $559 million in new expenditures — offset by changes that increase revenues and reduce funding for items proposed in February.

- The largest new spending increases are recommended for school safety and mental health initiatives and additional General Fund transfers for transportation.

- It does not change tax collection forecasts even as FY 2023 collections have slowed in recent months.

Last week, Governor Lee proposed changes to his budget recommendation for FY 2024, which starts July 1, 2023. These revisions update the original budget plan the governor rolled out in February, reflecting new information about program needs and legislative action. With these changes, the FY 2024 budget recommendation now totals $56.2 billion — including $30.5 billion from state revenues. (1) (2) (3) (4) (5) (6)

The administration amendment marks one of the final steps in the process to get next year’s budget approved by the legislature, which will likely be one of the General Assembly’s final actions before adjourning for the year.

Overview

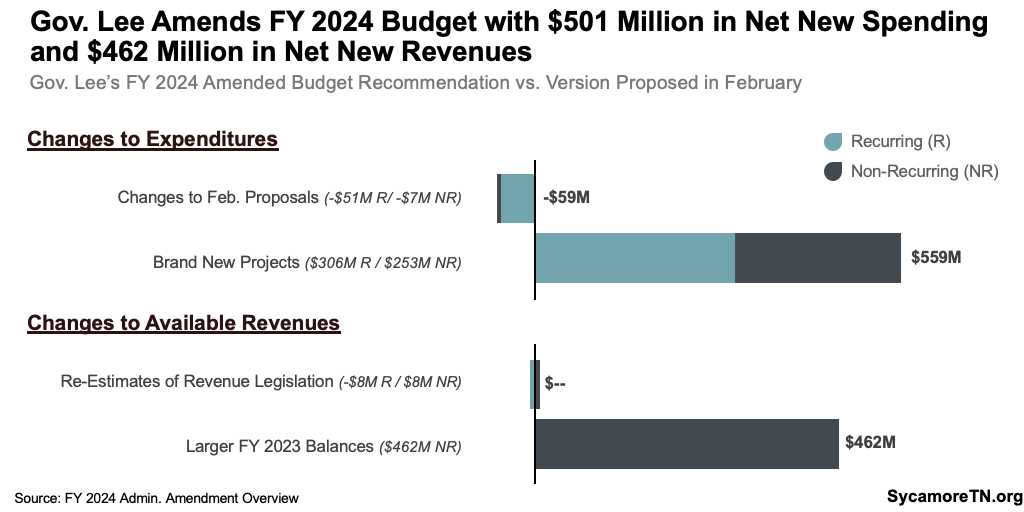

The amended FY 2024 proposed budget includes $30.5 billion from state revenues — $501 million or 1.7% more than the original budget proposal. These net increases result from dozens of changes affecting revenues and expenditures (Figure 1). Here are the topline differences with the February recommendation. The following sections highlight significant items in each area.

Figure 1

Expenditures

- Changes to February Proposals — Net reduction of $59 million in spending ($51 million recurring and $7 million non-recurring[1]) on programs and legislative initiatives proposed in February.

- Brand New Projects — Increase of $559 million in spending ($306 million recurring and $253 million non-recurring) for brand new initiatives and capital projects.

Revenues

- Re-Estimates of Revenue Legislation — Reconciling fiscal note estimates for revenue legislation nets to zero — including a reduction of $8 million in recurring revenue and an increase of $8 million in non-recurring.

- Larger FY 2023 Balances — $462 million in additional funds carried over from the current year as non-recurring revenue for use in FY 2023.

Changes to February Expenditures

The governor’s amended budget re-estimates the costs of some of the initiatives proposed in February — freeing up a total of $59 million ($51 million recurring and $7 million non-recurring) for other purposes. This includes:

- Reconciling Cost Estimates — $40 million in savings ($39 million recurring and $63,000 non-recurring) from re-estimating the costs of several budget proposals. The largest of these reductions is $34 million for a bill to make permanent K-12 summer learning camps initially held in 2021 and 2022. The camps are expected to increase state spending by $26 million instead of the $61 million estimated in the initial budget. (7)

- Administration Amendment Placeholder — $30 million reallocation ($10 million recurring and $20 million non-recurring) from a placeholder in the original budget to help fund new initiatives not included in the February request.

- Additional Increases — $20 million in additional spending ($12 million recurring and $8 million non-recurring) from boosting several increases proposed in February. Public school safety grants were originally funded at $20 million in the initial budget. The amended budget adds another $7 million non-recurring for grants to private schools. Other substantial additional increases were $3 million each recurring for operating the state’s public medical schools and for cost growth for the Governor’s Early Literacy Foundation.

- Reductions to Requested Increases — $9 million in savings ($1 million recurring and $8 million non-recurring) from scaling back some of the increases proposed in February. The largest of these comes from eliminating a $6 million General Fund subsidy for Transportation Equity Fund grants for local airport improvements. Additional funds, however, are proposed elsewhere in the amendment to support airports (see below).

- Reallocation — $13 million non-recurring replaces $13 million recurring in the initial budget to backfill a reduction in federal funding for the Victims of Crime Act.

Brand New Spending

The amended budget includes a total of $559 million in new FY 2024 spending — including $306 million recurring and $253 million non-recurring. The largest amounts go towards school safety and mental health initiatives, additional General Fund subsidies for the Department of Transportation (TDOT), earmarked grants, and 13 additional capital projects.

School Safety and Mental Health Initiative

The revisions include $166 million ($151 million recurring and $15 non-recurring) to expand school safety and mental health efforts — a response to the March 27 Covenant School shooting. This includes:

- School Safety — $140 million recurring would be directed towards funding an armed security guard for every public school. In addition to these dollars, the initial budget included $30 million ($15 million recurring and $15 million non-recurring) to fund 122 Homeland Security agents to serve schools and $20 million non-recurring in grants for public school safety upgrades. The amendment also proposes another $7 million non-recurring for private school safety upgrades (see previous section).(8)

- Mental Health — $26 million ($11 million recurring and $15 million non-recurring) for mental health initiatives. Of this, $8 million recurring would fund an expansion of school-based behavioral health liaisons, which began serving all 95 counties in FY 2021.(9) Another $18 million is proposed for TennCare — including $10 million non-recurring to help children’s hospitals develop behavioral health infrastructure, $5 million non-recurring for children’s mental health crisis stabilization units, and $3 million recurring to increase payment rates for behavioral health providers. The TennCare proposals would also use additional federal money.

Additional TDOT Subsidies

The amended budget includes $97 million ($77 million recurring and $20 million non-recurring) from the General Fund to support activities traditionally supported with dedicated TDOT revenues. The $77 million recurring subsidy would fund airport improvements, which have traditionally been supported by an aviation fuel tax. Similar one-time subsidies were funded in FYs 2022-2023 to replace declining revenue after lawmakers capped and cut the aviation fuel tax. This proposal would make the subsidy permanent. The $20 million one-time General Fund subsidy would help support a new pedestrian bridge in Knoxville. The original budget included $3.3 billion in General Fund subsidies for state and local road construction.

Earmarked Grants

The revised budget proposes about $47 million ($1 million recurring and $46 million non-recurring) for over 60 targeted grants to specific communities and organizations. The largest grants include $5 million for the Haywood County Fire Department and $4 million for improvements to the Future Farmers of America’s Camp Clements in Van Buren County. Another 20 grants are $1-3 million, and the remaining 40 range from $25,000 to $812,000 apiece.

Additional Capital Projects

The governor’s amendment includes $47 million in non-recurring spending for 13 additional capital projects. The largest of these total $18 million for HVAC improvements and replacements at one state prison. This adds to the $1.7 billion included in the initial budget for the state’s Capital Outlay program.

Re-Estimates of Revenue Legislation

New cost estimates for several proposals affecting revenues create an $8 million reduction in recurring revenues and a non-recurring increase of roughly the same size. Both are largely driven by the cost estimates for the Governor’s Tennessee Works Tax Reduction and Jobs Investment Acts, which includes a three-month grocery and food sales tax holiday and changes to the state’s business, franchise, and excise taxes. (10)

Larger FY 2023 Balances

The amendment proposes additional changes to the current-year balance that would boost the estimated funds available for FY 2024 to $5.5 billion, an increase of $462 million. These funds become non-recurring revenue for FY 2024. The increase is the net result of changes that free up available dollars and increase FY 2023 state spending in several areas. Highlights include:

Increases in Available FY 2023 Dollars

- Unspent Appropriations — $180 million from normal agency underspending. Non-recurring spending reductions of this kind are known as reversions. End-of-year program reversions are common and typically total about $150-200 million per year.

- Earned Interest — $260 million comes from interest earned from investing General Fund balances. According to testimony, these balances are largely from funds reserved for approved capital projects, which will be spent over many years.

Increases in FY 2023 Supplemental Spending

- Replacing Federal Funds — $3 million to replace federal funds the state has recently rejected or lost. Of this, $1 million is for HIV monitoring and prevention, and $2 million is for family planning services. Both are continued and increased into FY 2024 — including $9 million recurring for HIV services and $8 million recurring for family planning (included in the totals discussed above).

Tax Projections

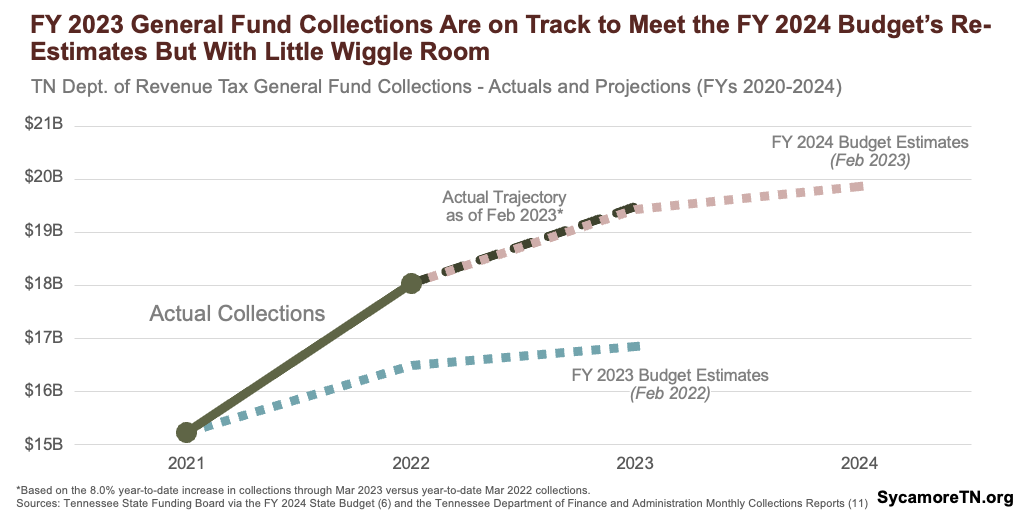

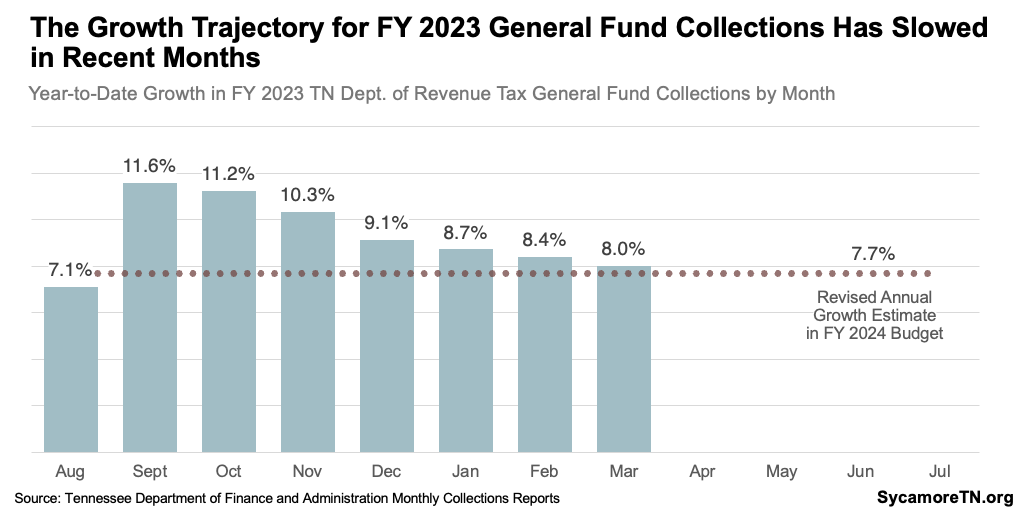

Tax collection forecasts for FY 2023 and FY 2024 remain unchanged even as FY 2023 collections have slowed in recent months. The plan Gov. Lee proposed two months ago assumes the state’s General Fund will collect $2.6 billion more in FY 2023 than is currently budgeted. Eight months into the current fiscal year, actual collections were about 8.0% higher than at the same time last year. If collections are sustained at this rate, the state would be on track to meet the revised estimate (Figure 2) — but the growth trajectory has steadily slowed since October (Figure 3). (11)

Figure 2

Figure 3

[1] Numbers do not add up to the total due to rounding.

References

Click to Open/Close

- Tennessee Department of Finance and Administration. FY 2023-2024 Administration Budget Amendment Overview. [Online] April 4, 2023. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/24%20Admin%20Amend%20Overview.pdf

- —. Commissioner’s Presentation – Fiscal Year 2024 Budget Amendment. [Online] April 4, 2023. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/FY24%20Budget%20Amend%20Presentation%20FINAL.pdf.\

- Senate Finance, Ways, and Means Committee. Hearing on FY 2024 Budget Amendment. Tennessee General Assembly. [Online] April 4, 2023. Video recording at https://tnga.granicus.com/player/clip/28238?view_id=753&redirect=true&h=92fdb4691e4103fc7c372192e90ff03c

- House Finance, Ways, and Means Committee. Hearing on FY 2024 Budget Amendment. Tennessee General Assembly. [Online] April 4, 2023. https://tnga.granicus.com/player/clip/28246?view_id=726&redirect=true&h=7f046215fc2a11a7047d4fd2e5ae41a6

- Tennessee Department of Finance and Administration. FY 2023-2024 Recommended Budget Overview. [Online] February 6, 2023. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/24_FinalRecommended.pdf

- State of Tennessee. FY 2024 Tennessee State Budget. [Online] February 2023. https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fiscal-year-2023-2024-budget-publications.html

- Fiscal Review Committee Staff. Corrected Fiscal Memorandum: HB 68 – SB 249. Tennessee General Assembly. [Online] March 5, 2023. https://www.capitol.tn.gov/Bills/113/Fiscal/FM0015.pdf

- State of Tennessee. Gov. Lee, Legislative Leadership Present Strong School Safety Actions. [Online] April 3, 2023. https://www.tn.gov/governor/news/2023/4/3/gov–lee–legislative-leadership-present-strong-school-safety-actions.html

- Tennessee Department of Mental Health and Substance Abuse Services. School-Based Behavioral Health Liaisons. [Online] [Accessed on April 6, 2023.] https://www.tn.gov/behavioral-health/children-youth-young-adults-families/sbbhl.html

- Fiscal Review Committee Staff. Fiscal Memorandum: SB 275 – HB 323. Tennessee General Assembly. [Online] March 27, 2023. https://www.capitol.tn.gov/Bills/113/Fiscal/FM1176.pdf

- Tennessee Department of Finance and Administration. Monthly Revenue Collections for FY 2023. [Online] Available frrom https://www.tn.gov/finance/news.html