On February 6, 2023, Tennessee Gov. Bill Lee released his $55.6 billion recommendation for the state’s FY 2024 Budget — along with recommended changes for FY 2023. (1) (2) Among his agenda items are efforts to address pressures on Tennessee’s current approach to road funding and ability to meet our growing population’s mobility needs. This brief summarizes and analyzes key pieces of that proposal. See here for a full summary of the FY 2024 budget.

Key Takeaways

- Tennessee’s Highway Fund revenues have struggled to keep up with cost increases for previously approved projects and the demand for new projects.

- As part of the FY 2024 budget process, the governor proposed the Transportation Modernization Act to address pressures on road funding revenues and needs.

- Key features include:

- A $3.3 billion one-time subsidy from the General Fund for state and local transportation needs.

- Higher fees on electric vehicles and new fees on hybrids to backfill expected losses in existing revenue streams — both of which would be shared with local governments.

- Paid choice lanes to address urban congestion using public-private partnerships.

- The authority to more frequently use contracting strategies that could reduce construction timelines and costs.

Background

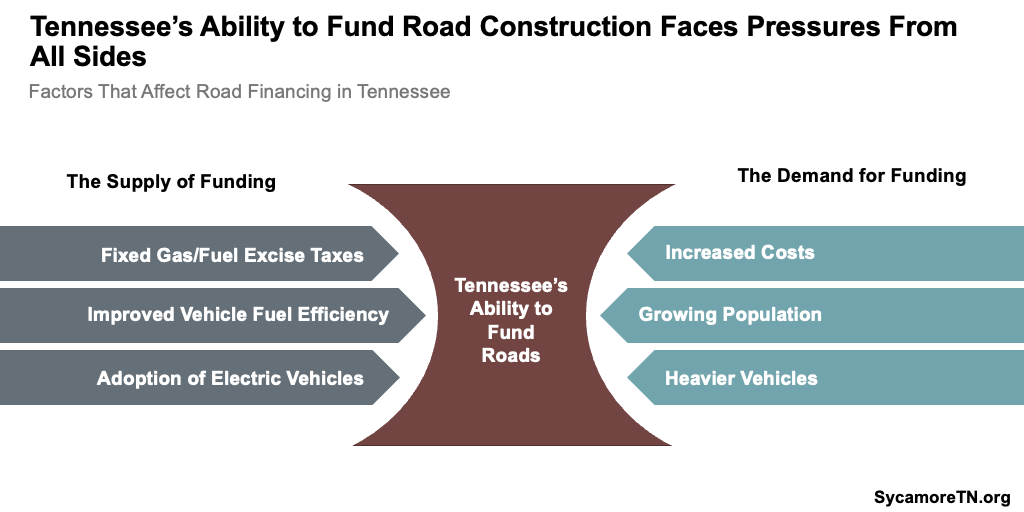

Tennessee’s ability to fund road construction and maintenance faces pressures from all sides (Figure 1). Vehicle-related excise taxes set at specific, fixed levels are the largest funding sources for transportation projects in Tennessee. These taxes are not responsive to road funding needs, and the pressures from rising fuel efficiency and electric vehicle (EV) adoption could get worse.

Tennessee’s Highway Fund revenues have struggled to keep up with both cost increases for already-approved projects and the demand for new projects. Between FYs 2005-2021, for example, the purchasing power of Tennessee’s Highway Fund collections fell by 3% after adjusting for inflationary changes in construction costs (Figure 2). (1) (3) (4) As a result, the Tennessee Department of Transportation (TDOT) anticipates the state will need an additional $16 billion to complete projects already approved in the 2016 IMPROVE Act. Even so, it will take over 50 years to finish those projects at current funding levels. The administration also estimates another $26.3 billion is needed to alleviate current or anticipated traffic congestion issues across the state. (5)

Figure 1

Figure 2

Overview

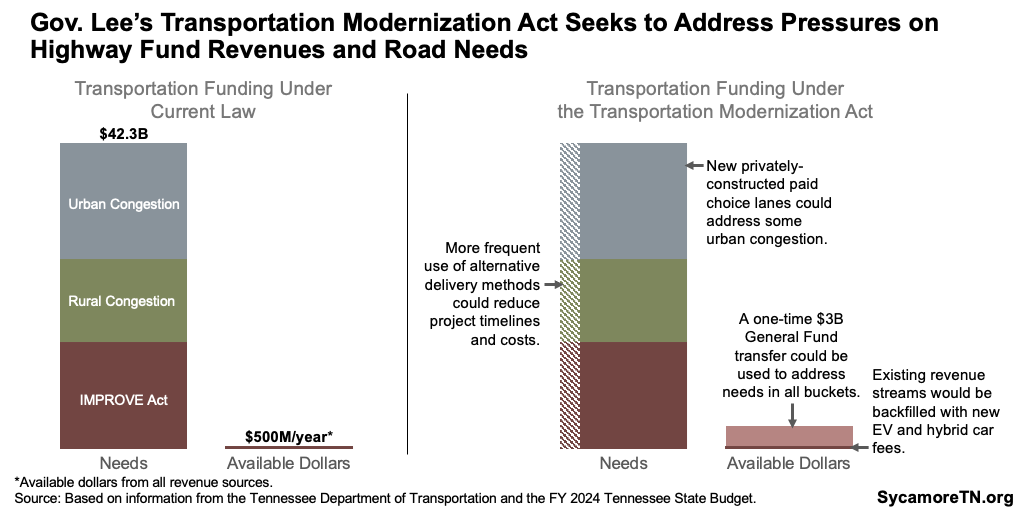

Gov. Lee’s budget and his proposed Transportation Modernization Act seek to address some of these needs and the pressures on state revenues (Figure 3). The administration has not estimated the extent to which the proposal would meet identified needs or on what timeline. However, key features of the proposal include:

- A $3.3 billion one-time transfer from the General Fund for state and local transportation needs.

- Higher fees on EVs and new fees on hybrids to backfill expected losses in existing revenue streams — both of which would be shared with local governments.

- Paid choice lanes to address urban congestion using public-private partnerships.

- The authority to more frequently use contracting strategies that could reduce construction timelines and costs.

Figure 3

General Fund Subsidies

The budget includes a $3 billion one-time General Fund subsidy to establish a new Transportation Modernization Fund. Similarly, $800 million was transferred in FYs 2022 and 2023 to supplement Highway Fund revenues and expedite IMPROVE Act projects. The new $3 billion could also be used for IMPROVE Act projects — along with congestion mitigation and other improvements. As proposed, the new dollars would be allocated equally among the state’s four TDOT planning regions. (6) (7)

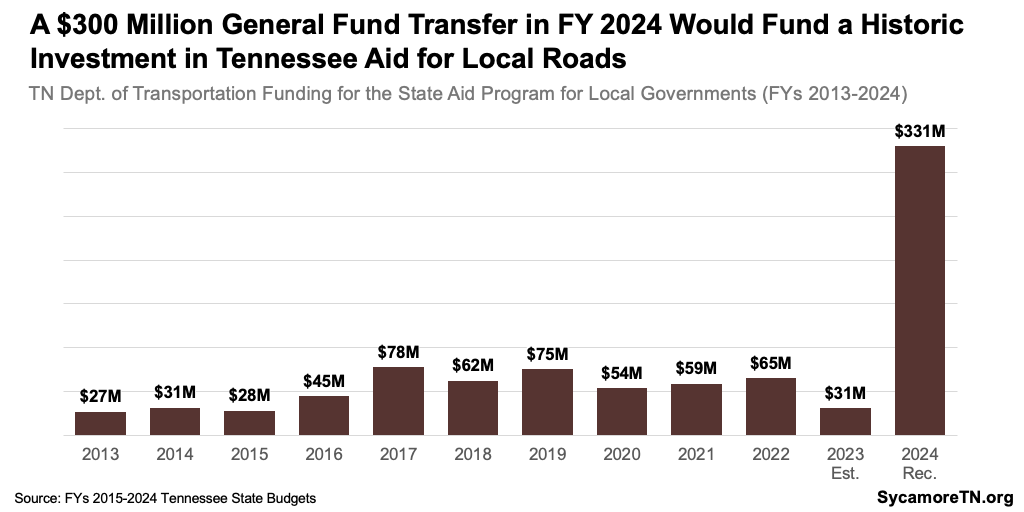

The governor also recommends a one-time $300 million General Fund contribution to TDOT’s state aid program for local roads. These funds are distributed to county governments for county roads designated as part of the state highway system. (8) Since the first IMPROVE Act tax increases took effect in FY 2017, state road aid dollars have averaged about $65 million a year. The proposed transfer would represent a historic investment in that program (Figure 4).

Figure 4

Electric & Hybrid Vehicle Registration Fees

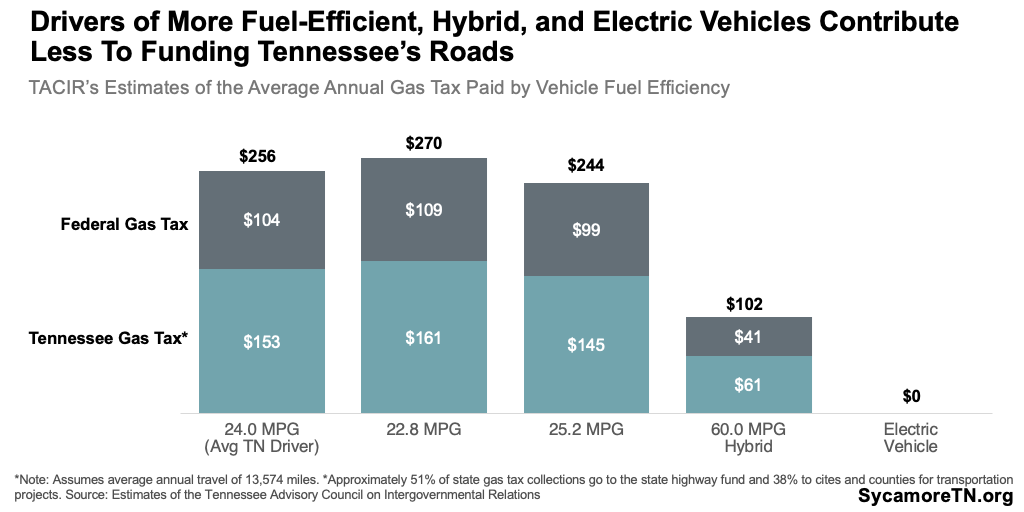

Gov. Lee proposes a phased increase to the state’s $100 annual EV fee—to $200 next year and $274 in 2026—and establishing a new $100 fee on hybrid vehicles, both indexed to inflation. (35) (6) Gas taxes have long been thought of as a user-fee-based approach to funding roads, yet hybrid and EV owners contribute less in gas tax revenue than traditional car owners (Figure 5). Researchers at the University of Tennessee and the Tennessee Advisory Commission on Intergovernmental Relations (TACIR) separately estimate that the typical Tennessee driver pays between $250-$275 a year in state and federal gas taxes. (9) (10) The fees are estimated to boost Highway Fund revenues by $8.1 million in the first full year of implementation, which — as gas tax revenues fall — would grow over time with inflation and greater hybrid and EV adoption. (7)

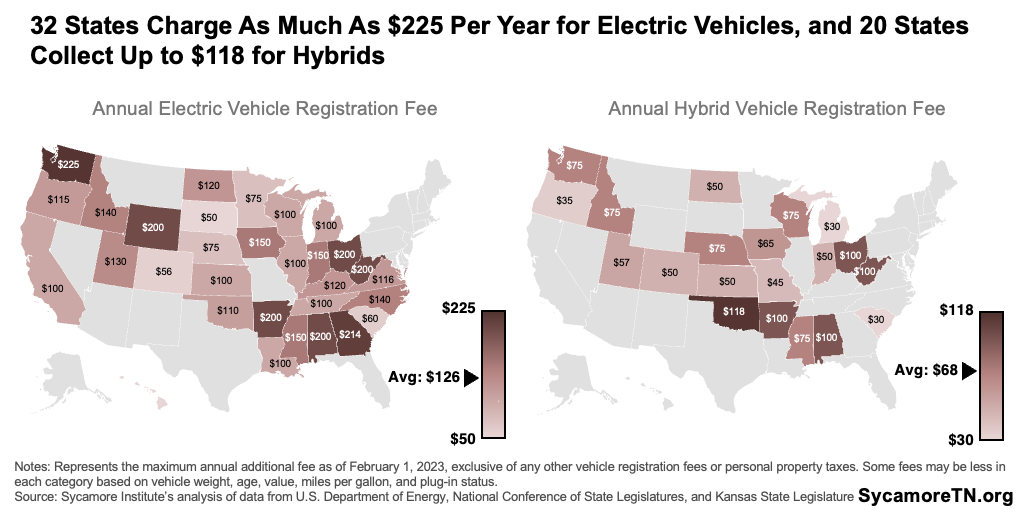

The proposed fees would be among some of the highest in the nation, but many states are considering how to require EV owners to contribute to road costs (Figure 6). At least 32 states charge between $50-$225 extra to register an EV, and 20 states charge between $30-$118 for all or certain hybrids. (11) (12) (13) (14) At least 11 state legislatures are considering proposals this year to increase, establish, or study new registration fees and/or create new fees and taxes for charging EVs. (15) (16) (17) (18) (19) (20) (21) (22) (23) (24) (25)

Figure 5

Figure 6

The governor proposes sharing these fees with cities and counties. As a share of all revenues, local governments are more dependent on state gas and fuel taxes than the state itself. (26) Tennessee’s vehicle registration fees are more immune to changes in vehicle technology than state gas and fuel taxes. However, these state fees — including the existing $100 EV fee — are not currently shared with local governments. The governor’s proposal would begin sharing fees on hybrid and EVs with cities and counties.

The state would distribute that money in a similar way as it shares existing gas tax dollars. For both, 63.4% would go to the Highway Fund, 2.8% to the General Fund, 11.8% to cities based on population, and 22% to counties. Half of the county funds would be divided equally among all 95 counties — with the rest based on population and area. (6) In their first full year of implementation, the fees are expected to increase total local revenues by about $5.7 million — a number that would grow with inflation and as more drivers switch to hybrids and EVs. (7)

Paid Choice Lanes

The Transportation Modernization Act would also let the state build and maintain new paid choice lanes to address urban congestion. In general, these lanes — also called express or toll lanes — attempt to manage congestion with a combination of pricing incentives, vehicle restrictions, and/or entry/exit controls (see below). The proposal would maintain all traditional lane capacity as of July 1, 2023 — only allowing tolls on additional lanes built after that date. All projects would be subject to public hearings, approved by a new Transportation Modernization Board and financially supported in part or whole by tolls. The state would own the new lanes but could use private companies to carry out any or all of the planning, construction, management, and maintenance. (6) (5)

Figure 7

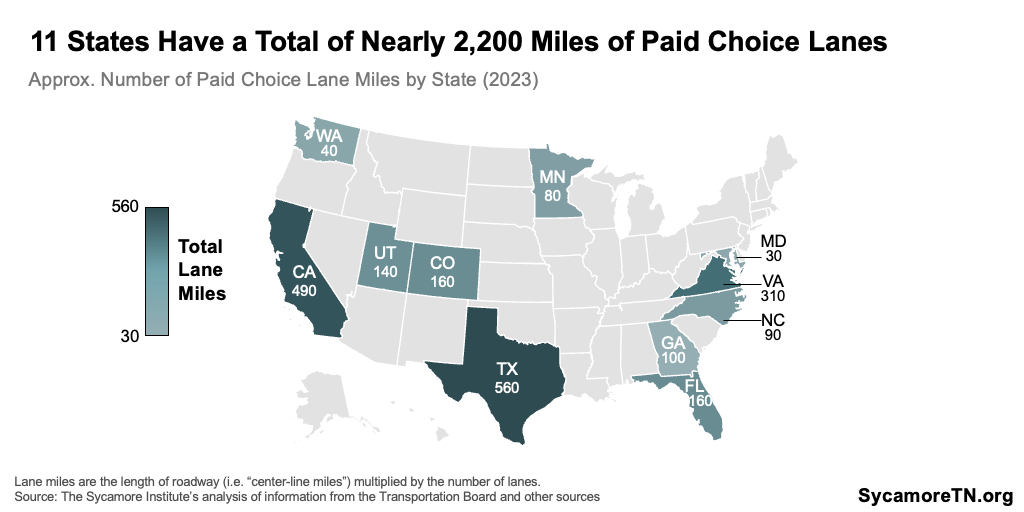

At least 2,200 miles of paid choice lanes operate in 11 states — plus around 30 more being planned or constructed — with a variety of pricing and incentive strategies (Figure 7). (27) (28) (29) (30)

- Pricing – While lanes in a few states have fixed prices that may vary by day or time, most choice lanes now use technology to dynamically update prices as often as every three minutes based on traffic speed and congestion. Some choice lanes are free outside of certain hours or days, and prices are capped in most states by statute or governing boards. (16) The highest of these caps is about $28 for an 18-mile trip from Orange to Riverside County near Anaheim, CA. (31)

- Price Transparency – Price transparency appears to vary significantly across different jurisdictions’ choice lanes. Prices are typically posted on signage at choice lane entry points and can be levied based on the number of miles or zones traveled in the lane — allowing drivers to decide in real-time whether they’d like to use the lanes. Some jurisdictions also post real-time toll rates online. (32) Dynamic pricing can, however, make it challenging for drivers to plan or budget for toll expenses. Not all states provide tools for planning, but some places post pricing schedules or offer trip calculators to estimate pricing based on recent trends in toll costs. (33) (34) (31)

- Incentive Strategies – Most managed lanes are used to shape incentives for certain travel behaviors. Dynamic pricing, for example, creates incentives to travel during non-peak hours to reduce congestion. Managed lanes can also incentivize carpooling, EV adoption, or public transit use by allowing free or reduced costs for these vehicles. (27)

What’s Next?

Multiple committees in both the state House and Senate will review and consider the FY 2024 budget recommendation and the separate Transportation Modernization Act. The Finance, Ways, and Means Committees have primary jurisdiction over the budget. Meanwhile, the Transportation Modernization Act will move through the Transportation Committees before being considered by other committees and ultimately by the Finance Committees due to its impact on the budget.

Note: This report was updated on March 6, 2023 to reflect recent changes to the hybrid and electric vehicle registration fees.

References

Click to Open/Close

1. State of Tennessee. Tennessee State Budget for FY 2024. February 2023. https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fiscal-year-2023-2024-budget-publications.html

2. Tennessee Department of Finance and Administration. Budget Overview: Fiscal Year 2023-2024. February 6, 2023. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/24_FinalRecommended.pdf

3. State of Tennessee. Tennessee State Budgets for FYs 1995-2023. Available from https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html

4. U.S. Department of Transportation. National Highway Construction Cost Index (NHCCI). Federal Highway Administration. https://explore.dot.gov/views/NHIInflationDashboard/NHCCI?%3Aiid=1&%3Aembed=y&%3AisGuestRedirectFromVizportal=y&%3Adisplay_count=n&%3AshowVizHome=n&%3Aorigin=viz_share_link

5. Tennessee Department of Transportation. Build With Us: Infrastructure Priorities (ppt presentation). https://www.tn.gov/content/dam/tn/tdot/build-with-us/Tennessee-Challenges-and-Solutions-2023.pdf

6. Tennessee General Assembly. Amendment No. 003592 to HB 321. February 8, 2023. Accessed from the General Assembly Dashboard via https://wapp.capitol.tn.gov/apps/Dashboard/calendar/30121

7. Fiscal Review Committee Staff. Memorandum: SB 273-HB 321. Tennessee General Assembly. February 8, 2023. Obtained from the General Assembly Dashboard via https://wapp.capitol.tn.gov/apps/Dashboard/calendar/30121.

8. Tennessee Department of Transportation. State Aid Program. Accessed on February 16, 2023 from https://www.tn.gov/tdot/long-range-planning-home/longrange-roadway-data/state-aid-program.html.

9. Murray, Matt; Heaslip, Kevin;. Memo: Revenue Parity of Electric Vehicles. University of Tennessee Knoxville Center for Transportation Research. January 30, 2023. https://www.tn.gov/content/dam/tn/tdot/build-with-us/EV-Parity-Memo-revised-1-30-23.pdf.

10. Tennessee Advisory Commission on Intergovernmental Relations (TACIR). Electric Vehicles and Other Issues Affecting Road and Highway Funding in Tennessee. December 2022. https://www.tn.gov/content/dam/tn/tacir/2022publications/2022_ElectricVehicles.pdf

11. U.S. Department of Energy. State Laws and Incentives. Alternative Fuels Data Center. Accessed on February 13, 2023 from https://afdc.energy.gov/laws/state.

12. —. Recent State Updates. Alternative Fuels Data Center. Accessed on February 13, 2023 from https://afdc.energy.gov/laws/recent.

13. Igleheart, Austin. Special Fees on Plug-In Hybrid and Electric Vehicles. National Conference of State Legislatures. July 26, 2022. https://www.ncsl.org/energy/special-fees-on-plug-in-hybrid-and-electric-vehicles#:~:text=%24110%20additional%20annual%20fee%20for,are%20effective%20January%201%2C%202023

14. Kansas State Legislature. States’ Fees for Electric and Hybrid Vehicles. Kansas Legislative Research Department. January 25, 2022. https://www.kslegresearch.org/KLRD-web/Publications/Transportation/States-Fees-for-Electric-and-Hybrid-Vehicles.pdf

15. Oklahoma State Legislature. HB 2315. 2023. https://openstates.org/ok/bills/2023/HB2315/

16. Montana State Legislature. HB 55. 2022. https://openstates.org/mt/bills/2023/HB55/

17. The General Court of New Hampshire. HB 456. 2023. https://openstates.org/nh/bills/2023/HB456/

18. Kansas State Legislature. HB 2148. 2023. https://openstates.org/ks/bills/2023-2024/HB2148/

19. State of Wyoming Legislature. HB 275. 2023. https://openstates.org/wy/bills/2023/HB275/

20. Oregan State Legislature. HB 3131. 2023. https://openstates.org/or/bills/2023R1/HB3131/

21. Utah Legislature. HB 301. 2023. https://openstates.org/ut/bills/2023/HB301/

22. MIssissippi Legislature. SB 2926. 2023. https://openstates.org/ms/bills/2023/SB2926/

23. Montana State Legislature. HB 60. 2022. https://openstates.org/mt/bills/2023/HB60/

24. Nebraska Legislature. LB 505. 2023. https://openstates.org/ne/bills/108/LB505/

25. Texas Legislature. HB 960. 2023. https://openstates.org/tx/bills/88/HB960/

26. Federal Highway Administration. 2006-2020 Highway Statisitics Series Data. U.S. Department of Transportation. Each year accessed via https://www.fhwa.dot.gov/policyinformation/statistics.cfm.

27. Transportation Research Board Standing Committee on Managed Lanes. National Managed Lane Database. National Academy of Sciences. Accessed on February 15, 2023 from https://docs.google.com/spreadsheets/d/e/2PACX-1vRQWgWNL8lvhjPMg5sNd119nZQER0aYekuEKPC4fjQwUtdm-XnJx5CBhUrcJ4y7gOlifnFGgLLN-UrO/pubhtml#.

28. Texas Department of Transportation. Drive 288: FAQs. Accessed on Febuary 15, 2023 from https://drive288.com/faqs/.

29. Federal Highway Administration. SR 167 HOT Lanes Pilot Project. U.S. Department of Transportation. August 23, 2010. https://ops.fhwa.dot.gov/freewaymgmt/publications/documents/nrpc0610/workshop_materials/case_studies/seattle.pdf.

30. Kent Reporter. New Southbound SR 167 HOT Lane Extension Opens Dec. 17. December 7, 2016. https://www.kentreporter.com/news/new-southbound-sr-167-hot-lane-extension-opens-dec-17/.

31. Orange County Transportation Authority. 91 Express Lanes: Toll Schedules effective July 1, 2022. 2022. https://www.octa.net/91-Express-Lanes/Toll-Schedules/.

32. Peach Pass. Toll Pricing. Accessed on February 15, 2023 from https://peachpass.com/how-do-i-use-peach-pass/pricings/.

33. Virginia Department of Transportation. The Toll Calculator for 66 Express Lanes. Accessed on February 15, 2023 from https://vai66tolls.com/.

34. Mobility Partners. I-77 Express Average Pricing Calculator. Accessed on February 15, 2023 from https://www.i77express.com/pricing/average-pricing-calculator/.

35. Tennessee General Assembly. SB 273 / HB 321. March 2023. https://www.capitol.tn.gov/Bills/113/Amend/SA0078.pdf