Even before the COVID-19 pandemic, Tennesseans were more likely to have medical debt than most other Americans. This report explores how the health and economic challenges created by the new coronavirus could make medical debt even more common in Tennessee.

To learn more about medical debt, see our prior reports on how medical debt occurs, how it affects people’s lives, who has it in and across Tennessee, and 12 policy options to address it.

Key Takeaways

- Medical debt hurt the credit history of an estimated 22% of Tennesseans with a credit report in 2018 – the 8th highest rate in the country.

- The pandemic’s dual economic and public health crises could make medical debt even more common, which would likely hamper our economic recovery.

- Despite state, local, and private actions aimed at covering COVID-19 test and treatment costs, some Tennesseans may still face bills they cannot afford even if they have health insurance.

- The pandemic’s economic fallout may make non-COVID-19 medical costs harder to afford for Tennesseans who have lost their jobs or had their hours cut.

Acknowledgment: This research was funded by the Annie E. Casey Foundation. We thank them for their support but acknowledge that the findings and conclusions presented in this report are those of the authors alone, and do not necessarily reflect the opinions of the Foundation.

Sycamore takes a neutral and objective approach to analyze and explain public policy issues. Funders do not determine research findings. More information on our code of ethics is available here.

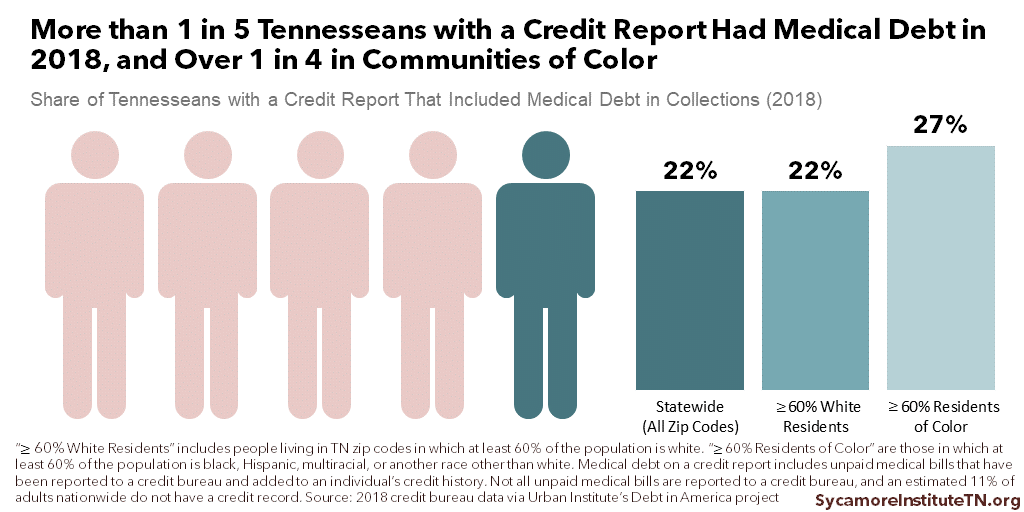

Figure 1

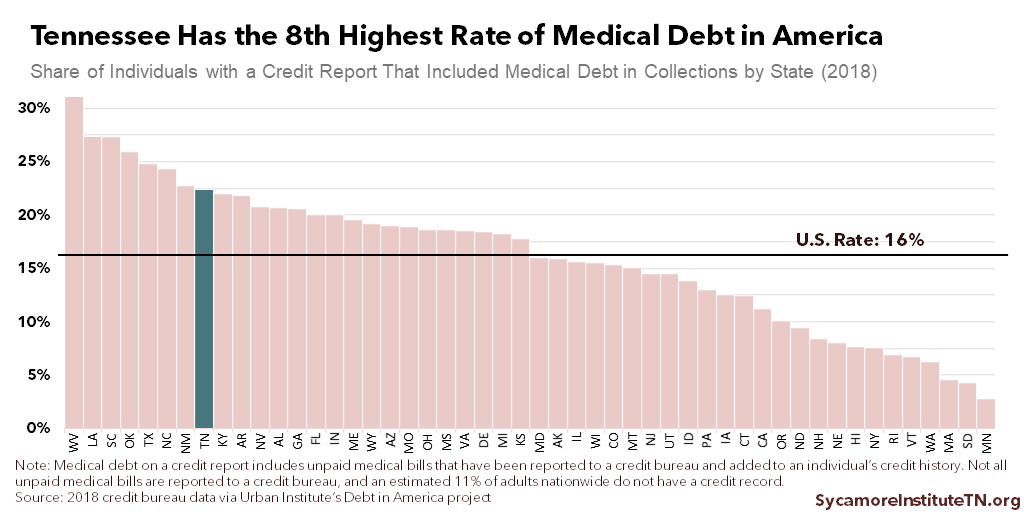

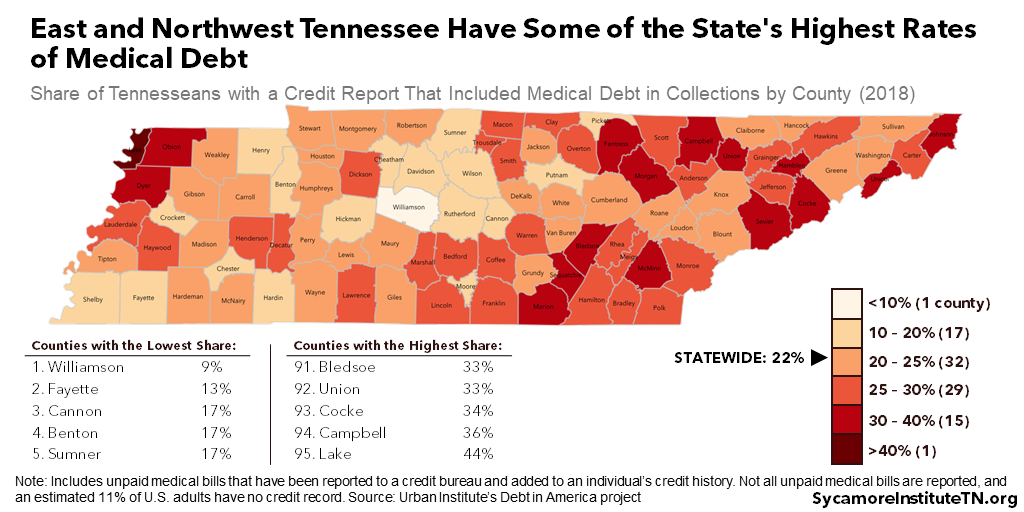

Medical debt hurt the credit history of an estimated 22% of Tennesseans with a credit report in 2018 (Figure 1). Tennessee had the 8th highest rate in the U.S., compared to 16% nationally (Figure 2). Across Tennessee’s 95 counties, it varied from 9% in Williamson County to 44% in Lake County (Figure 3). Rates were generally higher among communities whose populations were at least 60% black, Hispanic, and other non-white residents. In those zip codes, 27% of Tennesseans had medical debt on their credit report. (2) (3)

The median amount of medical debt appearing on Tennesseans’ credit reports was $855. In other words, half of the affected Tennesseans had less than $855 of medical debt on their credit histories, and half had more. The median amount was slightly higher in predominantly white communities and slightly lower in communities of color — $876 and $824, respectively. (2)

Figure 2

Figure 3

The COVID-19 pandemic’s dual economic and public health crises could make medical debt even more common in Tennessee. Even with policies intended to help with the costs, insured and uninsured Tennesseans alike may still face bills they cannot afford for COVID-19 testing and treatment. To a greater extent, however, the pandemic’s economic fallout may make non-COVID medical costs harder to afford for the record number of Tennesseans who have lost jobs or had their hours cut. This report dives deeper into each of these scenarios.

An increase in medical debt would likely hamper Tennesseans’ economic recovery from COVID-19. Medical debt can hinder economic security and mobility by:

- Crowding out spending on other basic needs and investments that build long-term wealth.

- Feeding cycles of debt associated with economic stagnation and instability.

- Reducing access to and increasing the costs of credit types associated with economic mobility and long-term wealth creation.

- Creating barriers to employment and housing.

COVID-19-Testing and Treatment Costs

Insured and uninsured Tennesseans alike may still face bills they cannot afford for COVID-19 testing and treatment despite state, local, and private actions aimed at covering these costs.

COVID-19 Testing Costs

Tennessee provides free testing at local health departments and state-run drive-through sites regardless of symptoms or insurance status. (4) The state has also taken the unique approach of direct, upfront payment for testing costs at state-run sites to ensure access. (5) (6)

Insurers are covering out-of-pocket costs for both in- and out-of-network testing by private providers, with a patchwork of effective dates:

- As of March 18, federal rules require insurers to waive cost-sharing for in-network, privately-administered COVID-19 testing.

- Many of Tennessee’s insurers announced their own free testing policies that preceded the federal policy. BlueCross BlueShield of Tennessee, the state’s largest insurer, began waiving costs for tests taken after March 6, 2020, the day after Tennessee’s first confirmed case. (7) (8) (9) Humana began waiving cost-sharing on March 9 and UnitedHealthcare on February 2. (10) (11) (12) Tennessee Farm Bureau is eliminating cost-sharing between February 4 and December 31, 2020. (13)

- As of March 27, federal rules also require insurers to cover out-of-network testing costs. In some cases, however, the patient — not the provider — may be responsible for getting reimbursed for anything they pay out of pocket.(14) (15)

For the uninsured, several federal funding streams are available to cover privately-administered COVID-19 testing. For example, states may use their Medicaid programs to pay private providers for testing the uninsured. (16) TennCare — our state’s Medicaid program — has not sought permission from the federal government to exercise this option. (17) Separately, $2 billion in federal funding is available to reimburse providers for testing the uninsured on or after February 4, 2020. Providers must enroll in the program and file special claims to receive new reimbursement, and patients must seek out those providers. (18) As of August 20, 2020, Tennessee health care providers had received $8.5 million for these tests. (19)

Despite these policies meant to encourage and pay for testing, some people may still face medical bills for seeking out a COVID test. The federal Medicare program pays $100 for each coronavirus test, but bills sent to private insurers and patients can vary widely. (20) Individuals could also be responsible for some or all of these costs if:

- They got a test before the various effective dates listed above.

- The test was not deemed “medically appropriate.” For example, an asymptomatic person getting tested for peace of mind, to make sure they are safe to visit an elderly relative, or to meet a workplace requirement may not have their test covered by insurance. (21)(22)

- They’re enrolled in a plan not covered by federal rules. It has not always been clear which insurance plans fall under those federal rules. (23)

- They received other diagnostic tests. Before COVID-19 tests were widely available, many providers administered other diagnostics to rule out everything else first – ordering strep, flu, and other tests. (24) (25) (26) People could be responsible for medical bills for both the testing costs and an office visit that included these other diagnostic tests but not a COVID-19 test.

COVID-19 Treatment Costs

The cost of treating COVID-19 far exceeds the cost of testing. Based on national private insurer claims data, the median treatment cost for COVID-19 is about $3,000. More severe cases with complications that require hospitalization could cost over $20,000. (27) (28)

Many – but not all – of Tennessee’s private insurers have waived cost-sharing for COVID-19 treatment, but some have set limits that could leave insured patients with bills.

- BlueCross BlueShield of Tennessee will waive cost-sharing for COVID-19 from in-network providers until the end of the COVID-19 National Emergency. (29)

- UnitedHealthcare is waiving cost sharing until October 22, 2020.(10) The expiration date could mean that those needing long hospitalizations (e.g. the most severely-ill who need several weeks or months of ventilation) may incur cost-sharing obligations. (30) (31) (32)

- Humana has eliminated COVID-19 treatment cost-sharing for most – but not all – of its plans. This policy currently has no end date. (33)

- Tennessee Farm Bureau has no plans to waive cost-sharing for COVID-19 treatment at this time. (13)

Figure 4

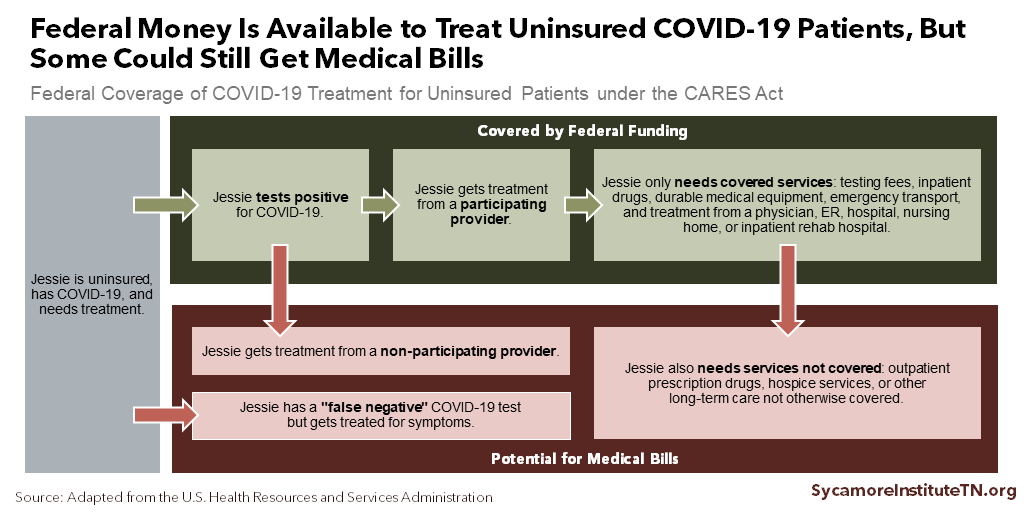

Federal funding is available for providers who treat uninsured COVID-19 patients (Figure 4). Health care providers that treat uninsured COVID-19 patients can request federal reimbursement so long as they do not bill patients for any unreimbursed charges. (34) (15) As of August 20, 2020, Tennessee health care providers had received over $10 million to treat the uninsured. (19)

There are some gaps in federal reimbursement that could leave uninsured Tennesseans with unpaid medical bills (Figure 4). Federal reimbursement does not cover any outpatient prescriptions and is only available for uninsured patients whose primary diagnosis is COVID-19. (34) False negatives could leave uninsured patients with bills they cannot afford. (35) (36) Providers must also enroll in and file special claims with the new federal program, and it is not clear how many in Tennessee are participating. (18)

Non-COVID-19 Medical Costs

The pandemic’s economic fallout may make non-COVID-19 medical costs harder to afford for the record number of Tennesseans who have lost their jobs or had their hours cut. Layoffs, furloughs, and restructurings mean that many Tennesseans may not only lose income but also job-based coverage – potentially making it harder to pay medical bills for routine and emergency medical costs unrelated to COVID-19.

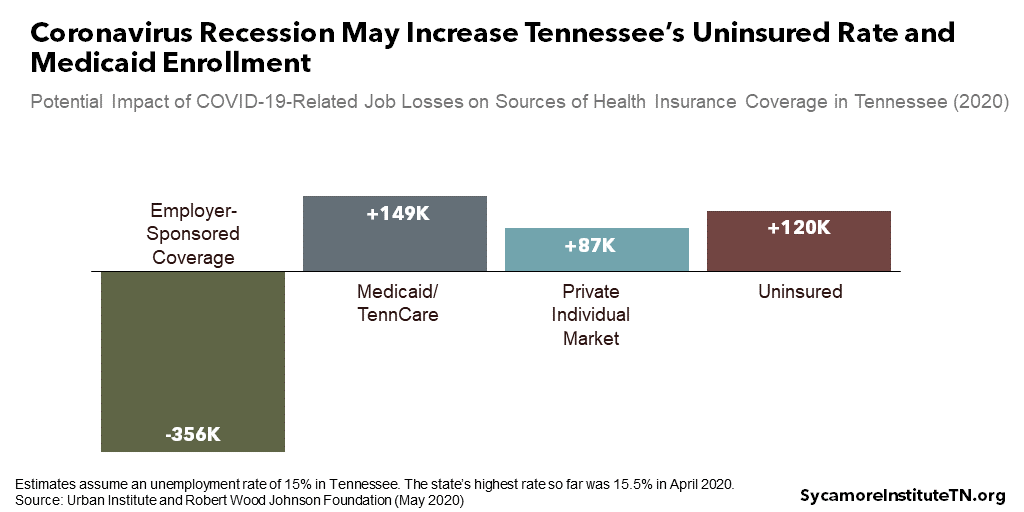

Pandemic-related job losses may threaten employer-sponsored health coverage for several hundred thousand Tennesseans, depending on the extent of the state’s joblessness (Figure 5). (37) (38) (39) In normal times, about 3.5 million Tennesseans receive their health insurance from their employer or the employer of someone in their family – the largest source of coverage in the state.

As many as one-third of Tennesseans who lose job-based insurance could remain uninsured because they are not eligible for other types of coverage (Figure 5). The Kaiser Family Foundation and Urban Institute estimate 66-83% of those who lose employer-provided plans will find coverage elsewhere – mostly through TennCare or the private individual market, where they may be eligible for subsidies. An estimated 17-34% may remain uninsured. States like Tennessee that have narrower Medicaid eligibility are expected to have larger increases in their uninsured rates than other states. (37) (38)

Figure 5

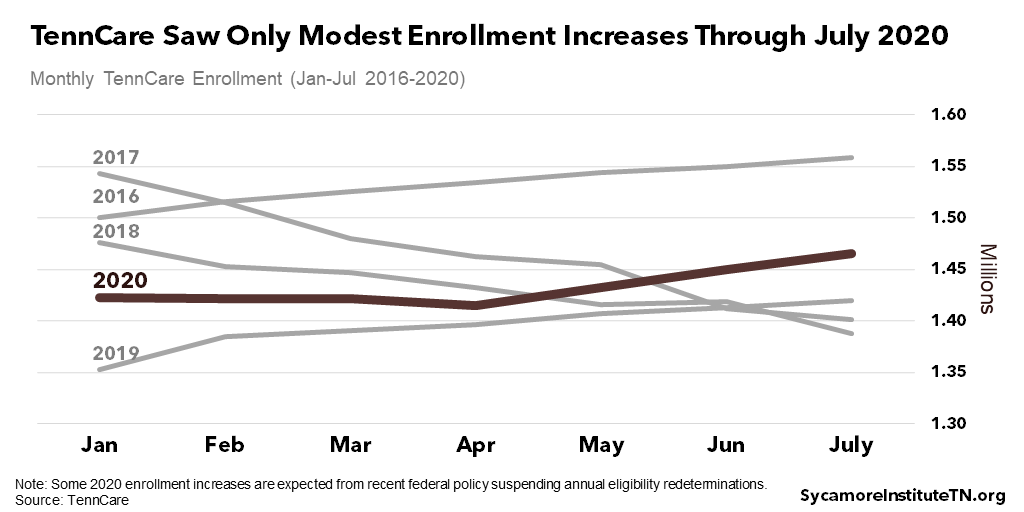

Figure 6

Tennessee may not experience significant coverage losses so long as the pandemic does not lead to another wave of layoffs. As of July, TennCare had experienced modest enrollment increases not altogether out of line with normal seasonal fluctuations (Figure 6). (40) Some growth should be expected due to the recent federal suspension of annual eligibility redeterminations. (41) The state’s unemployment rate declined to 9.5% in July after soaring to 15.5% in April, and as of August 9th, the state’s rebound in consumer spending was among the highest in the country – up 0.2% from January compared with a 4.4% decline nationally. (42) (43)

The populations most at-risk of COVID-related job losses and the uninsured are more likely to end up with medical debt. (44) (45) (46) Newly uninsured Tennesseans may incur bills they cannot afford out-of-pocket for any needed medical expenses or emergencies. Meanwhile, many of the companies most vulnerable to this pandemic are less likely to offer job-based coverage in the first place. Layoffs or reduced hours could put their employees at even higher risk for medical debt if they can no longer pay for needed medical expenses. (47)

Parting Words

Medical debt is common in Tennessee and could become even more common in the wake of the COVID-19 pandemic. New and existing debts will make it harder for Tennesseans to get ahead as they begin to recover from the pandemic’s economic fallout. However, there are many options for policymakers who want to prevent medical debt, help people manage their medical bills, and mitigate medical debt’s negative effects on financial security, economic mobility, and health.

References

Click to Open/Close

- Brevoort, Kenneth P., Grimm, Philipp and Kambara, Michelle. Data Point: Credit Invisibles. U.S. Consumer Financial Protection Bureau. [Online] May 2015. https://files.consumerfinance.gov/f/201505_cfpb_data-point-credit-invisibles.pdf.

- Braga, Breno, McKernan, Signe-Mary and Quakenbush, Caleb. Debt in America: An Interactive Map . [Online] December 17, 2019. https://apps.urban.org/features/debt-interactive-map/?type=overall&variable=pct_debt_collections.

- —. Technical Appendix to Debt in America: An Interactive Map. [Online] December 17, 2019. https://apps.urban.org/features/debt-interactive-map/downloadable-docs/Debt_in_America_Technical_Appendix.pdf.

- State of Tennessee. Get Tested. [Online] April 2020. [Cited: June 11, 2020.] https://www.tn.gov/governor/covid-19/get-tested.html.

- Farmer, Blake. NPR. [Online] May 15, 2020. [Cited: June 11, 2020.] https://www.npr.org/sections/health-shots/2020/05/15/856458421/tennessees-secret-to-plentiful-coronavirus-testing-picking-up-the-tab.

- U.S. Department of Health and Human Services. CARES Act Provider Relief Fund: General Information. [Online] [Cited: June 11, 2020.] https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/general-information/index.html.

- Tennessee Department of Commerce and Insurance. 2018 Comprehensive Health Market Share. [Online] [Cited: June 11, 2020.] https://www.tn.gov/content/dam/tn/commerce/documents/insurance/posts/TN_Group_Comprehensive_Health_Market_Share.pdf.

- BCBS of TN News Center. BlueCross to Cover Full Testing Costs for COVID-19. [Online] March 6, 2020. [Cited: June 11, 2020.] https://bcbstnews.com/pressreleases/bluecross-to-cover-full-testing-costs-for-covid-19/.

- Mojica, Adrien. Novel Coronavirus Now in State of Tennessee. [Online] Fox17 Nashville, March 5, 2020. [Cited: June 11, 2020.] https://fox17.com/news/local/novel-coronavirus-now-in-the-state-of-tennessee.

- United HealthCare. Summary of COVID-19 Dates by Program. [Online] July 24, 2020. [Cited: July 29, 2020.] https://www.uhcprovider.com/content/provider/en/viewer.html?file=%2Fcontent%2Fdam%2Fprovider%2Fdocs%2Fpublic%2Fresources%2Fnews%2F2020%2Fcovid19%2FCOVID-19-Date-Provision-Guide.pdf.

- Humana. Humana to Waive Medical Costs Related to Coronavirus Treatment. [Online] March 30, 2020. [Cited: June 11, 2020.] https://press.humana.com/press-release/humana-waive-medical-costs-related-coronavirus-treatment.

- —. Humana Takes Steps to Care for Members in Response to Coronavirus. [Online] March 9, 2020. [Cited: June 11, 2020.] https://press.humana.com/press-release/current-releases/humana-takes-steps-care-members-response-coronavirus.

- Farm Bureau Health Plans. FBHP RESPONDS TO COVID-19. [Online] [Cited: June 11, 2020.] https://www.fbhealthplans.com/covid-19.

- Fehr, Rachel, et al. Five Things to Know about the Cost of COVID-19 Testing and Treatment. Kaiser Family Foundation. [Online] May 26, 2020. https://www.kff.org/coronavirus-covid-19/issue-brief/five-things-to-know-about-the-cost-of-covid-19-testing-and-treatment/.

- Pollitz, Karen. Free Coronavirus Testing for Privately Insured Patients? . Kaiser Family Foundation. [Online] April 20, 2020. https://www.kff.org/coronavirus-policy-watch/free-coronavirus-testing-for-privately-insured-patients/.

- Medicaid.gov. Families First Coronavirus Response Act (FFCRA), Public Law No. 116-127 Coronavirus Aid, Relief, and Economic Security (CARES) Act, Public Law No. 116-136 Frequently Asked Questions (FAQs) . [Online] April 13, 2020. [Cited: June 11, 2020.] https://www.medicaid.gov/state-resource-center/downloads/covid-19-section-6008-CARES-faqs.pdf.

- Kaiser Family Foundation. Medicaid Emergency Authority Tracker: Approved State Actions to Address COVID-19. [Online] August 21, 2020. [Cited: August 24, 2020.] https://www.kff.org/medicaid/issue-brief/medicaid-emergency-authority-tracker-approved-state-actions-to-address-covid-19/.

- U.S. Health Resources and Services Administration. FAQs for COVID-19 Claims Reimbursement to Health Care Providers and Facilities for Testing and Treatment of the Uninsured. [Online] [Cited: June 20, 2020.] https://www.hrsa.gov/coviduninsuredclaim/frequently-asked-questions.

- The Center for Disease Control. Claims Reimbursement to Health Care Providers and Facilities for Testing and Treatment of the Uninsured. [Online] August 20, 2020. [Cited: August 24, 2020.] https://data.cdc.gov/Administrative/Claims-Reimbursement-to-Health-Care-Providers-and-/rksx-33p3.

- Kliff, Sarah. Most Coronavirus Tests Cost About $100. Why Did One Cost $2,315? The New York Times. [Online] June 16, 2020. https://www.nytimes.com/2020/06/16/upshot/coronavirus-test-cost-varies-widely.html.

- Appleby, Julie. For COVID Tests, the Question of Who Pays Comes Down to Interpretation. Kaiser Health News. [Online] July 20, 2020. [Cited: July 29, 2020.] https://khn.org/news/for-covid-tests-the-question-of-who-pays-comes-down-to-interpretation/.

- Blue Cross Blue Shield of Tennessee. Group Administrator Notice: Return-To-Work Testing Not included in COVID-19 Testing and Treatment Coverage Expansions. July 13, 2020.

- Farmer, Blake. Congress Said COVID-19 Tests Should Be Free — But Who’s Paying? . Kaiser Health News / Nashville Public Radio. [Online] May 22, 2020. https://khn.org/news/congress-said-covid-19-tests-should-be-free-but-whos-paying/.

- Lehren, Lisa Riordan Seville and Andrew W. Got Coronavirus? You May Get a Surprise Medical Bill, Too. [Online] April 22, 2020. [Cited: June 11, 2020.] https://www.nbcnews.com/health/health-care/got-coronavirus-you-may-get-surprise-medical-bill-too-n1187966#anchor-Teststhatarentfree.

- Heredia Rodriguez, Carmen. COVID Tests Are Free, Except When They’re Not . Kaiser Health News. [Online] April 29, 2020. https://khn.org/news/bill-of-the-month-covid19-tests-are-free-except-when-theyre-not/.

- Appleby, Julie. COVID Catch-22: They Got A Big ER Bill Because Hospitals Couldn’t Test For Virus. Kaiser Health News. [Online] July 7, 2020. [Cited: July 29, 2020.] https://khn.org/news/covid-catch-22-they-got-a-big-er-bill-because-hospitals-couldnt-test-for-virus/.

- Sarah M. Bartsch, Marie C. Ferguson, James A. McKinnell, Kelly J. O’Shea, Patrick T. Wedlock, Sheryl S. Siegmund, and Bruce Y. Lee. The Potential Health Care Costs And Resource Use Associated With COVID-19 In The United States. Health Affairs. [Online] April 23, 2020. [Cited: June 11, 2020.] https://www.healthaffairs.org/doi/full/10.1377/hlthaff.2020.00426.

- Rae, Matthew, et al. Potential Costs of COVID-19 Treatment for People with Employer Coverage. Peterson-KFF Health System Tracker. [Online] March 13, 2020. https://www.healthsystemtracker.org/brief/potential-costs-of-coronavirus-treatment-for-people-with-employer-coverage/.

- BCBS of TN. We Answer Your COVID-19 Questions. [Online] June 6, 2020. [Cited: June 11, 2020.] https://bcbstupdates.com/member-faq/#_blank.

- UnitedHealthcare. We’re here to help with your concerns about Coronavirus (COVID-19) . [Online] [Cited: June 11, 2020.] https://www.uhccommunityplan.com/covid-19.

- —. COVID-19 Testing and Cost Sharing Guidance. [Online] June 8, 2020. [Cited: June 11, 2020.] https://www.uhcprovider.com/en/resource-library/news/Novel-Coronavirus-COVID-19/covid19-testing/covid19-testing-guidance.html.

- Graham, Judith. What Does Recovery From COVID-19 Look Like? It Depends. A Pulmonologist Explains. Kaiser Family Foundation. [Online] April 9, 2020. [Cited: June 11, 2020.] https://khn.org/news/what-does-recovery-from-covid-19-look-like-it-depends-a-pulmonologist-explains/.

- Humana. Frequently asked questions. [Online] May 5, 2020. [Cited: June 11, 2020.] https://www.humana.com/coronavirus/coverage-faqs.

- Health Resources and Services Administration. COVID-19 Claims Reimbursement to Health Care Providers and Facilities for Testing and Treatment of the Uninsured. [Online] May 2020. [Cited: June 11, 2020.] https://www.hrsa.gov/CovidUninsuredClaim.

- ARUP Laboratories. How Accurate Are COVID-19 Tests? Many Factors Can Affect Sensitivity, Specificity of Test Results. [Online] April 21, 2020. [Cited: June 11, 2020.] https://www.aruplab.com/news/4-21-2020/How-Accurate-Are-COVID-19-Tests.

- Larry Levitt, Karyn Schwartz, Eric Lopez. Estimated Cost of Treating the Uninsured Hospitalized with COVID-19. Kaiser Family Foundation. [Online] April 7, 2020. [Cited: June 11, 2020.] https://www.kff.org/uninsured/issue-brief/estimated-cost-of-treating-the-uninsured-hospitalized-with-covid-19/.

- Robert Wood Johnson Foundation. How the COVID-19 Recession Could Affect Health Insurance Coverage. Robert Wood Johnson Foundation and Urban Institute. [Online] May 4, 2020. [Cited: June 11, 2020.] Study accessed from https://www.rwjf.org/en/library/research/2020/05/how-the-covid-19-recession-could-affect-health-insurance-coverage.html.

- Rachel Garfield, Gary Claxton, Anthony Damico, Larry Levitt. Eligibility for ACA Health Coverage Following Job Loss. Kaiser Family Foundation. [Online] May 13, 2020. [Cited: June 11, 2020.] https://www.kff.org/report-section/eligibility-for-aca-health-coverage-following-job-loss-appendix/.

- Zipperer, Ben and Bivens, Josh. 16.2 Million Workers Have Likely Lost Employer-Provided Health Insurance Since the Coronavirus Shock Began. Economic Policy Institute. [Online] May 14, 2020. https://www.epi.org/blog/16-2-million-workers-have-likely-lost-employer-provided-health-insurance-since-the-coronavirus-shock-began/.

- TennCare. Enrollment Data. [Online] [Cited: August 24, 2020.] https://www.tn.gov/tenncare/information-statistics/enrollment-data.html.

- U.S. Centers for Medicare and Medicaid Services. Families First Coronavirus Response Act – Increased FMAP FAQs . [Online] April 13, 2020. [Cited: June 24, 2020.] https://www.medicaid.gov/state-resource-center/downloads/covid-19-section-6008-faqs.pdf.

- U.S. Bureau of Labor Statistics. Economy at a Glance: Tennessee. [Online] August 21, 2020. [Cited: August 24, 2020.] https://www.bls.gov/eag/eag.tn.htm.

- Chetty, Raj, et al. Opportunity Insights Economic Tracker: Percent Change in All Consumer Spending. [Online] August 9, 2020. [Cited: August 2020, 24.] https://www.tracktherecovery.org/.

- Patricia M. Herman ND, PhD, Jill J. Rissi RN, PhD, and Michele E. Walsh PhD. Health Insurance Status, Medical Debt, and Their Impact on Access to Care in Arizona. The American Journal of Public Health. [Online] October 20, 2011. [Cited: June 11, 2020.] https://ajph.aphapublications.org/doi/abs/10.2105/AJPH.2010.300080.

- Michelle M. Doty, Jennifer N. Edwards, and Alyssa L. Holmgren. Seeing Red: Americans Driven into Debt by Medical Bills, Results from a National Survey. The Commonwealth Fund. [Online] 2003. [Cited: June 11, 2020.] https://www.commonwealthfund.org/sites/default/files/documents/___media_files_publications_issue_brief_2005_aug_seeing_red__americans_driven_into_debt_by_medical_bills_837_doty_seeing_red_medical_debt_pdf.pdf.

- Caswell, Michael Karpman and Kyle J. The Urban Institute. Past-Due Medical Debt among Nonelderly Adults, 2012–15. [Online] March 2017. https://article.images.consumerreports.org/prod/content/dam/consumerist/2017/03/past_due_medical_debt.pdf

- Karen Pollitz, Cynthia Cox, Kevin Lucia, Katie Keith. Medical Debt Among People With Health Insurance. The Kaiser Family Foundation. [Online] January 17, 2014. [Cited: June 11, 2020.] https://www.kff.org/private-insurance/report/medical-debt-among-people-with-health-insurance/.

Image credit: Shutterstock.com/Koldunova Anna