Even if not convicted, people charged with crimes in Tennessee often face substantial fees, fines, taxes, and other financial obligations. Our state and local governments use these fees and fines both as punishment and to fund the criminal justice system itself. Many policymakers may not fully appreciate the extent of their use and the trade-offs they entail.

This executive summary briefly explains the fees and fines people can incur through the criminal justice system and how they affect everyone from the accused, convicted, and incarcerated to victims, law enforcement, and the courts. Click here to read Sycamore’s full report and see the list of over 360 distinct fees and fines authorized in Tennessee state law.

Future reports will look at how Tennessee’s state and local governments use fees and fines to raise revenue, as well as options for policymakers who want to consider alternatives or address any unintended consequences.

Key Takeaways

- People can accrue a multitude of fees, fines, taxes, and other financial charges – both punitive and procedural – as they move through Tennessee’s criminal justice system.

- State law sets broad rules for fees and fines, but many state and local entities influence when and how they apply in each situation. The result is wide variation across Tennessee.

- Fees and fines help pay for many essential functions of the criminal justice system, but the revenue is not always reliable and may create undesirable incentives.

- For people less able to pay, fees and fines can prolong their involvement in the criminal justice system and make it harder to get ahead.

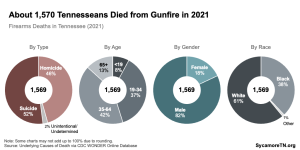

People can accrue a multitude of different fees and fines as they move through Tennessee’s criminal justice system (Figure 1). State law lays out hundreds of optional and mandatory costs that can be levied by courts, state agencies, local officials, and sometimes private entities. The actual amounts owed depend on the offense, the actors involved, and a case’s ultimate outcome, but they can add up quickly. (1) Recent testimony claims the average can end up totaling several thousand dollars from pre-trial to community supervision. (2)

Figure 1

Who Decides What Fees & Fines Apply?

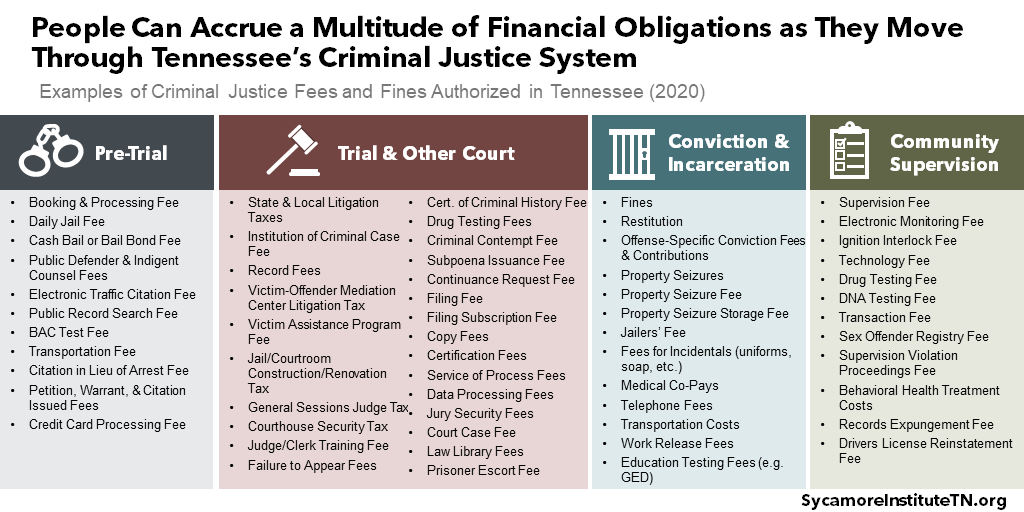

Across Tennessee, there is significant variation in when and how criminal justice fees and fines are applied. State law lays out a broad framework within which many different entities have discretion that affects the financial obligations of being accused or convicted of a crime (Figure 2). These people include law enforcement, district attorneys, judges, juries, county commissions, jail administrators, and court clerks.

Terminology

“Criminal justice fees and fines,” “criminal justice financial obligations,” “legal financial obligations,” and criminal justice debt all refer to costs a person may owe as they move through the criminal justice system. These terms do not include the costs of private legal representation.

Figure 2

How Fees & Fines Affect Different Stakeholders

Fees and fines help pay for many essential functions of the criminal justice system, but they often come with trade-offs and can have unintended consequences. In the full report, we describe in greater detail some of the ways – both good and bad – that legal financial obligations affect various stakeholders. Specifically, we discuss how fees and fines matter to taxpayers and society, crime victims, state and local government, and the people accused of committing crimes.

- Taxpayers and Society – Some fees and fines are meant to help deter crime and fund critical public safety functions. However, research suggests that the severity of a penalty – financial or otherwise – often does little to deter serious crimes.

- Victims of Crime – Restitution and compensation repay victims of crime for economic losses it has caused.

- State and Local Governments – Fees and fines help fund state and local criminal justice systems, but the revenue is not always reliable and may create undesirable incentives and new costs for governments.

- People Accused or Convicted of Crimes — For people unable to pay fees and fines, these costs can prolong their involvement in the criminal justice system and make it harder to get ahead. For example, an ex-offender reentering society with unpaid debts and a revoked driver’s license may have more trouble securing a job, housing, and financial stability – all associated with reduced recidivism. Unintended consequences like these can play out in a number of ways.

Parting Words

People can face a wide range of fees and fines at every stage within the criminal justice system. While meant to deter or punish crime and help pay for essential public safety functions, they can also make it harder for offenders to reintegrate and avoid further criminal justice involvement. This report begins a series intended to help policymakers better understand those trade-offs. Future installments will explore how fees and fines help fund Tennessee’s state and local governments and present options for policymakers who want to address unintended side-effects or take an alternative approach.

Read the full report for a more in-depth analysis and a full list of sources and citations.

References

Click to Open/Close

- Barrie, Jennifer, et al. Tennessee’s Court Fees and Taxes: Funding the Courts Fairly. Tennessee Advisory Commission on Intergovernmental Relations (TACIR). [Online] January 26, 2017. https://www.tn.gov/content/dam/tn/tacir/documents/2017_CourtFees.pdf.

- Tennessee Advisory Committee to the U.S. Commission on Civil Rights. Legal Financial Obligations in the Tennessee Criminal Justice System. U.S. Commission on Civil Rights. [Online] January 15, 2020. https://www.usccr.gov/pubs/2020/01-15-TN-LFO-Report.pdf.