Each month, the Tennessee Department of Finance & Administration (F&A) reports how much tax revenue the state collected for the previous month. These reports help policymakers and the public understand how actual revenue collections compare to estimates from the start of the fiscal year. The Sycamore Institute’s Tennessee Tax Revenue Tracker, updated monthly, provides a quick visual snapshot of each report.

Tennessee’s FY 2021 Revenue Collections

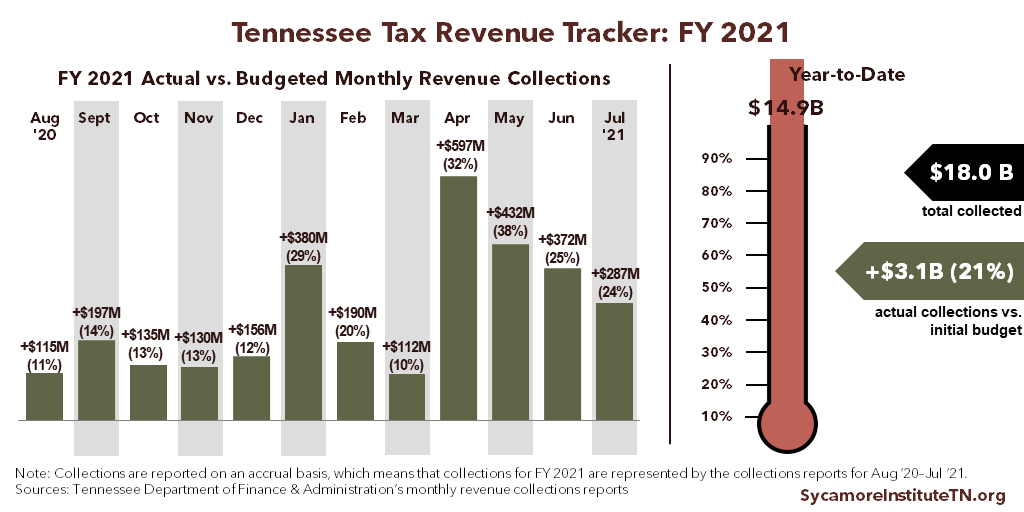

The image below shows Tennessee’s revenue collections for FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Tennessee collected just under $18.0 billion during FY 2021 – $3.1 billion higher and 21% more than the $14.9 billion in total revenue initially budgeted for the year.

- That over-collection is triple what lawmakers’ April budget revisions projected. As a result, Tennessee has an unbudgeted FY 2021 surplus of about $2.1 billion that policymakers can allocate in future fiscal years as non-recurring funds.

For additional details, read F&A’s official July 2021 report on revenue collections

![]()

Why Revenue Forecasts Are So Important

Forecasting how much tax revenue Tennessee will collect in a given year or month is a difficult but important part of maintaining a balanced budget, which the state constitution requires. F&A’s revenue forecasts have a major influence on decisions about spending. Overestimating revenues could force state policymakers to cut spending mid-year.

On the other hand, underestimating revenues creates unplanned surpluses which can be spent the following year or saved in the rainy day fund. The trade-off of a surplus is that policymakers may have preferred to either spend the money or reduce taxes in the current year.

See our Tennessee State Budget Primer for more on the implications of state revenue estimates and how accurate these estimates have been in recent years. To learn how F&A creates its revenue forecasts, read the department’s methodology here.

Tennessee’s June 2021 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for June 2021 were about 25% higher than budgeted.

- As of June 30, 2021, Tennessee had collected about 11% more than the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through June were about $2.8 billion higher (or 21%) than what was budgeted for the time period.

- With one month to go, that over-collection is almost triple what lawmakers’ April budget revisions projected for the entire fiscal year. That leaves a potential unbudgeted surplus of $1.8 billion and counting, which policymakers could allocate in future fiscal years as non-recurring funds.

For additional details, read F&A’s official June 2021 report on revenue collections.

![]()

Tennessee’s May 2021 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for May 2021 were about 38% higher than budgeted.

- As of May 31, 2021, Tennessee had collected about 99% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through May were about $2.4 billion higher (or 20%) than what was budgeted for the time period.

- With two months to go, that over-collection is more than double what lawmakers’ April budget revisions projected for the entire fiscal year. That leaves a potential unbudgeted surplus of $1.4 billion and counting, which policymakers could allocate in future fiscal years as non-recurring funds.

For additional details, read F&A’s official May 2021 report on revenue collections.

![]()

Tennessee’s April 2021 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for April 2021 were about 32% higher than budgeted.

- As of April 30, 2021, Tennessee had collected about 88% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through April were about $2.0 billion higher (or 18%) than what was budgeted for the time period.

- With three months left in the fiscal year, this over-collection is 95% larger than – or nearly twice the size of – the $1.0 billion that Governor Lee’s latest budget proposal projects for the full year.

For additional details, read F&A’s official April 2021 report on revenue collections.

![]()

Tennessee’s March 2021 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for March 2021 were about 10% higher than budgeted.

- As of March 31, 2021, Tennessee had collected about 71% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through March were about $1.4 billion higher (or 15%) than what was budgeted for the time period.

- Eight months into the fiscal year, this over-collection is already 37% larger than the $1.0 billion that Governor Lee’s latest budget proposal projects for the full year.

For additional details, read F&A’s official March 2021 report on revenue collections.

![]()

Tennessee’s February 2021 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for February 2021 were about 20% higher than budgeted.

- As of February 28, 2021, Tennessee had collected about 63% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through February were about $1.3 billion higher (or 16%) than what was budgeted for the time period.

- Seven months into the fiscal year, this over-collection is already 26% larger than the $1.0 billion that Governor Lee’s latest budget proposal projects for the full year.

For additional details, read F&A’s official February 2021 report on revenue collections.

![]()

Tennessee’s January 2021 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for January 2021 were about 29% higher than budgeted.

- As of January 31, 2021, Tennessee had collected about 55% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through January were about $1.1 billion higher (or 16%) than what was budgeted for the time period.

- Just six months into the fiscal year, this over-collection is already higher than the $1.0 billion that Governor Lee’s latest budget proposal projects for the full year.

For additional details, read F&A’s official January 2021 report on revenue collections.

![]()

Tennessee’s December 2020 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for December 2020 were about 12% higher than budgeted.

- As of December 31, 2020, Tennessee had collected about 44% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through December were about $733 million higher (or 13%) than what was budgeted for the time period.

For additional details, read F&A’s official December 2020 report on revenue collections.

![]()

Tennessee’s November 2020 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Collections through November were about $576 million higher (or 13%) than what was budgeted for the time period.

- Actual collections for November 2020 were about 13% higher than budgeted.

- As of November 30, 2020, Tennessee had collected about 34% of the $14.9 billion in total budgeted revenue for the current fiscal year.

For additional details, read F&A’s official November 2020 report on revenue collections.

![]()

Tennessee’s October 2020 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for October 2020 were about 13% higher than budgeted.

- As of October 31, 2020, Tennessee had collected about 26% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through October were about $447 million higher (or 13%) than what was budgeted for the time period.

For additional details, read F&A’s official October 2020 report on revenue collections.

![]()

Tennessee’s September 2020 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for September 2020 were about 14% higher than budgeted.

- As of September 30, 2020, Tennessee had collected about 18% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through September were about $313 million higher (or 13%) than what was budgeted for the time period.

For additional details, read F&A’s official September 2020 report on revenue collections.

![]()

Tennessee’s August 2020 Revenue Collections

The image below shows Tennessee’s revenue collections so far in FY 2021 relative to the estimates for which the state “budgeted” at the start of the fiscal year. For a summary of the approved FY 2021 budget, read our summary here.

- Actual collections for August 2020 were about 11% higher than budgeted.

- As of August 31, 2020, Tennessee had collected about 8% of the $14.9 billion in total budgeted revenue for the current fiscal year.

- Collections through August were about $115 million higher (or 11%) than what was budgeted for the time period.

For additional details, read F&A’s official August 2020 report on revenue collections.

![]()

* This post was originally published on September 15, 2020 and will be updated for each month of FY 2021.