This week, Governor Haslam released his amended budget proposal for the fiscal year that begins on July 1st. The revised plan makes changes and updates to the original recommended budget the Governor proposed in January. These changes reflect new information that the Administration has about revenue collections, program needs, and legislative action. The so-called “administration amendment” marks one of the final steps in the process to get next year’s budget approved by the Legislature, (which will be one of the General Assembly’s final actions before adjourning for the year).

Topline Numbers

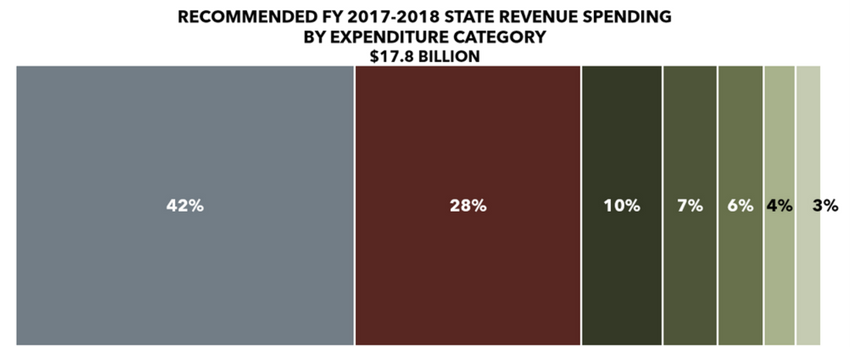

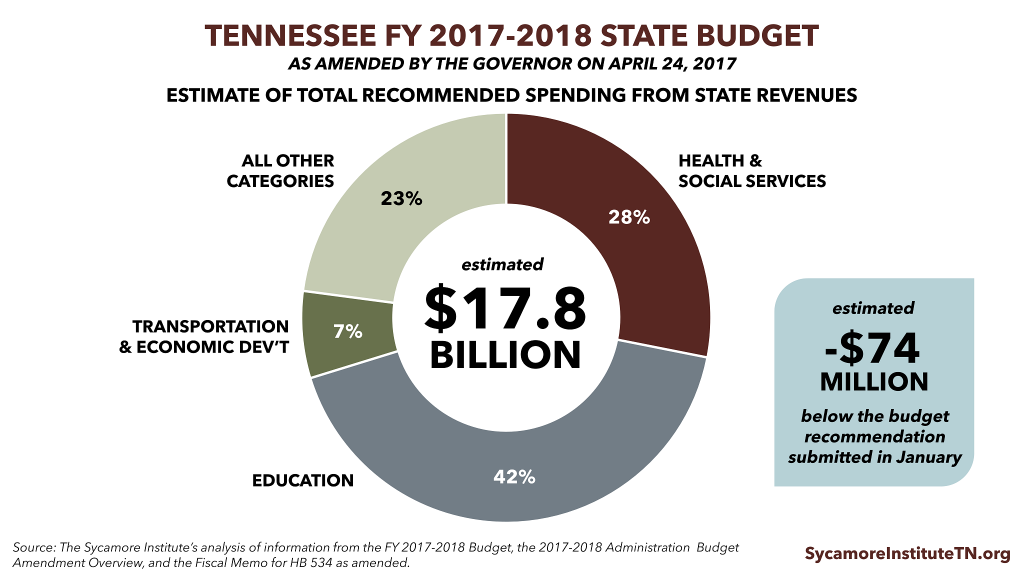

Based on the information available, we estimate the revised recommended FY 2017-2018 budget would spend about $17.8 billion from state revenues. This is approximately -$74 million less than the original recommendation. Compared to the January proposal, these estimates include a +$56 million increase for the General Fund, a -$73 million reduction for the Highway Fund, and a -$58 million reduction in the taxes shared with Cities & Counties.

The IMPROVE Act

The IMPROVE Act

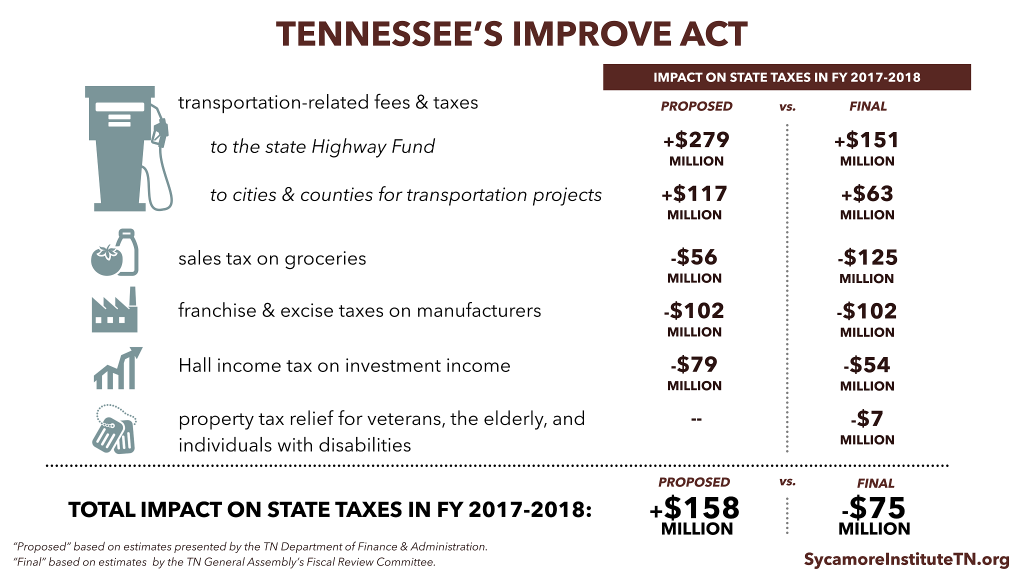

Many of the amendment’s changes to both revenues and expenditures reflect the evolution of the IMPROVE Act from the bill’s introduction in January to its passage on April 26, 2017. As the legislation made its way through the General Assembly, the House and Senate both made a number of changes to its mix of tax reductions and increases. (See An Update on the IMPROVE Act for more information).

Relative to the Governor’s original proposal, the enacted version of the IMPROVE Act had smaller increases to the gas and diesel taxes and larger cuts to other taxes. Ultimately, these changes to the IMPROVE Act mean fewer revenues for the General Fund, the Highway Fund, and Cities & Counties in FY 2017-2018 than had been initially proposed in the January budget.

Changes to FY 2017-2018 Revenues

Changes to FY 2017-2018 Revenues

The amendment reflects both lower-than-expected revenues from the IMPROVE Act and higher-than-expected revenues from this year’s projected surplus. The amendment anticipates the FY 2016-2017 surplus will be +$126 million higher than previously forecast, which can be appropriated for one-time spending in FY 2017-2018. The expected increase to the surplus is primarily the result of an anticipated one-time tax settlement and greater-than-expected agency savings.

Changes to FY 2017-2018 Expenditures

Relative to the January budget recommendation, the amendment includes reductions in anticipated spending from the Highway Fund and increases in spending from the General Fund.

The Highway Fund reductions reflect the IMPROVE Act changes outlined above and a proposed one-time transfer of +$55 million from the General Fund to the Highway Fund.

The General Fund increases are largely targeted at capital projects, economic development grants, and various one-time payments and systems enhancements.

The Big Picture

While the amended budget recommendation includes less spending than the January proposal, spending from state revenues in FY 2017-2018 would increase by an estimated +$1.3 billion (or 8%) compared to this year’s expected spending. These increases represent a mix of one-time and recurring spending increases.

One-time spending increases are primarily funded from the current year’s expected surplus. This surplus results from better-than-expected collections in both the current (FY 2016-2017) and prior (FY 2015-2016) fiscal years. These funds are largely put to use in the FY 2017-2018 recommended budget for one-time investments in capital projects, state retiree liabilities, and economic and community development.

The increase in recurring spending reflects growth in recurring revenues in FY 2017-2018. The IMPROVE Act effectively shuffles some of the anticipated growth in state tax revenues by reducing General Fund taxes and increasing Highway Fund taxes and fees. The amended recommendation uses this revenue growth for ongoing investments in transportation and capital projects and for covering cost growth for K-12 education, TennCare, and employee benefits.

What Happens Next?

The Tennessee House and Senate Finance Committees are set to consider the amended budget early next week. During this process, the Committees will make their own incremental changes to the budget based on amendments and legislation proposed by individual legislators. The Legislature is expected to pass the budget by the end of next week and adjourn the following week.

Sources

State of Tennessee, FY 2017-2018 State Budget. January 30, 2017. https://www.tn.gov/content/dam/tn/finance/budget/documents/2018BudgetDocumentVol1.pdf

TN Department of Finance & Administration, Commissioner’s Presentation on the FY 2017-2018 Budget, January 31, 2017. https://www.tn.gov/assets/entities/finance/budget/attachments/FY18RecBudget_FINAL_2.pdf

TN General Assembly Fiscal Review Committee, “Fiscal Memo on HB 534 – SB 1221,” April 20, 2017. http://www.capitol.tn.gov/Bills/110/Fiscal/FM1477.pdf

TN Department of Finance & Administration, Commissioner’s Presentation on the FY 2017-2018 Administration Amendment, April 25, 2017. https://www.tn.gov/assets/entities/finance/budget/attachments/18_Admin_Amend_Presentation.pdf