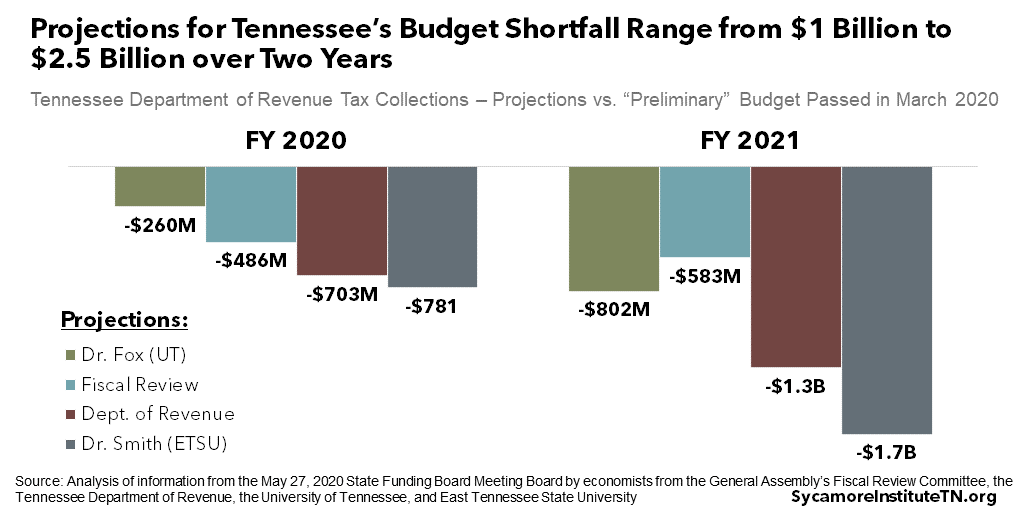

Four economists gave their best estimates of how the coronavirus pandemic will affect state tax revenue in the current and next fiscal years.

Continue readingWhat Will the Coronavirus Recession Mean for Tennessee’s Budget?

The pandemic has serious health and economic effects, yet Tennessee still has to balance its budget. These are the challenges policymakers face and the tools they have right now.

Continue readingSummary of the FY 2021 Preliminary Budget

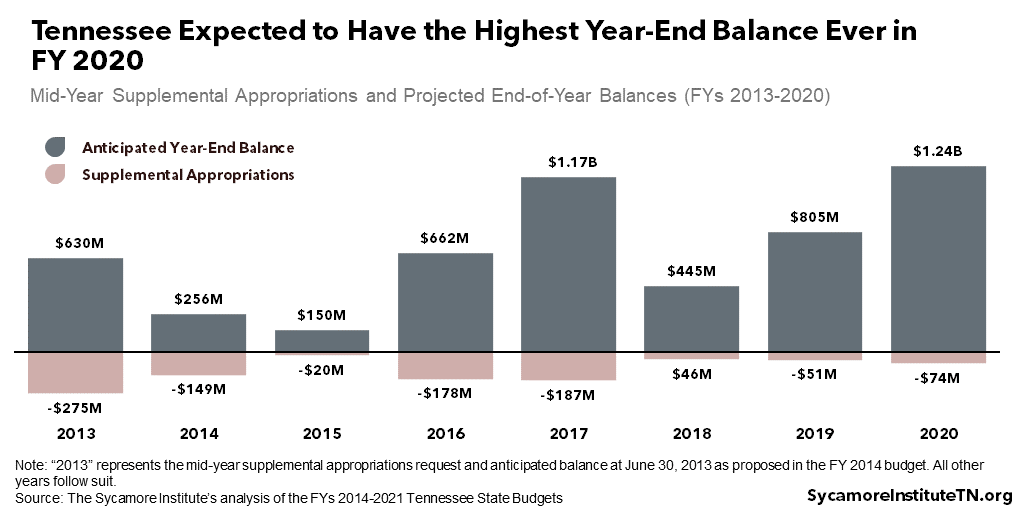

With pandemic here and recession near, lawmakers passed a preliminary FY 2021 budget that trims $854 million from Gov. Lee’s first draft.

Continue readingState Budget Surpluses, Deficits, and Rainy Day Funds

We explain why surpluses and deficits occur, the role of revenue projections and rainy day funds, and the trade-offs Tennessee policymakers must weigh when crafting the budget.

Continue readingWhat You Might Have Missed in the 2019 Legislative Session

Changes to TennCare, education, criminal justice, online sales tax, sports betting, and fiscal notes had significant budget implications.

Continue readingSummary of Gov. Lee’s FY 2020 Amended Budget

Governor Lee’s FY 2020 budget amendment increases state expenditures by $208.7 million relative to the recommendation submitted in March.

Continue readingThe Budget in Brief: Summary of Gov. Lee’s FY 2020 Recommended Budget

The governor’s recommended Budget for FY 2020 totals $38.6 billion, an increase of 1.1% over estimates for the current fiscal year.

Continue readingBudgeting for Incarceration in Tennessee

Facts and trends on how Tennessee budgets for incarceration of state prisoners, which is consistently among the largest state revenue expenses.

Continue readingTennessee’s Budget May Not Be Ready for the Next Recession

Tennessee’s budget may not have enough rainy day reserves to withstand the next recession without tax hikes or spending cuts.

Continue reading5 Issues for Tennessee’s Next Governor and General Assembly

No matter who wins the election, these 5 challenges could keep Tennessee’s next governor and General Assembly busy throughout 2019 and beyond.

Continue reading