In late June, the legislature finalized a plan to keep the state budget balanced as Tennessee weathers the COVID-19 pandemic’s economic fallout. The budget includes changes for both FY 2020 and FY 2021.

**This post, which previously summarized Governor Lee’s proposed changes to the FY 2021 preliminary budget, was updated on July 1, 2020 to reflect the final budget.**

Key Takeaways

- The enacted budget projects General Fund shortfalls totaling $1.5 billion over FY 2020 and FY 2021, compared to the preliminary budget approved in March. This amounts to a 1.4% dip in collections in FY 2020 and another 3.0% in FY 2021.

- To stay in balance, the budget taps nearly every tool available – reserves, other non-recurring revenues, tax changes, spending cuts and forgone increases, borrowing, and federal funds.

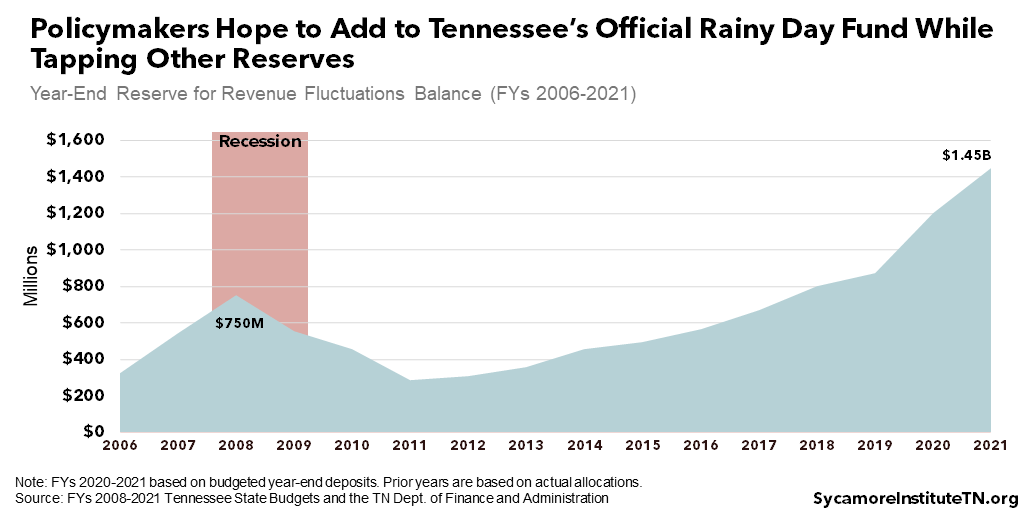

- For now, the Lee administration does not intend to dip into the Reserve for Revenue Fluctuations (the official rainy day fund).

- As time goes on, policymakers will need to fill in details around program reserves, use of federal funds, the Highway Fund, taxes shared with local governments, and additional spending cuts.

Where Lawmakers Left Off in March

In March, the General Assembly passed a preliminary FY 2021 budget and paused this year’s session until June 1 due to the COVID-19 pandemic. The March budget shelved many proposed initiatives in order to preserve or increase funding for COVID-19 response and higher costs from inflation, formulas, and client growth. Tennessee’s budget is “counter-cyclical,” meaning economic downturns create higher-than-usual demand for programs and services while reducing the revenues that fund them. In light of this, many expected that lawmakers would need to make more changes when they returned given the lack of information at that time about the pandemic’s effect on state revenues and spending needs.

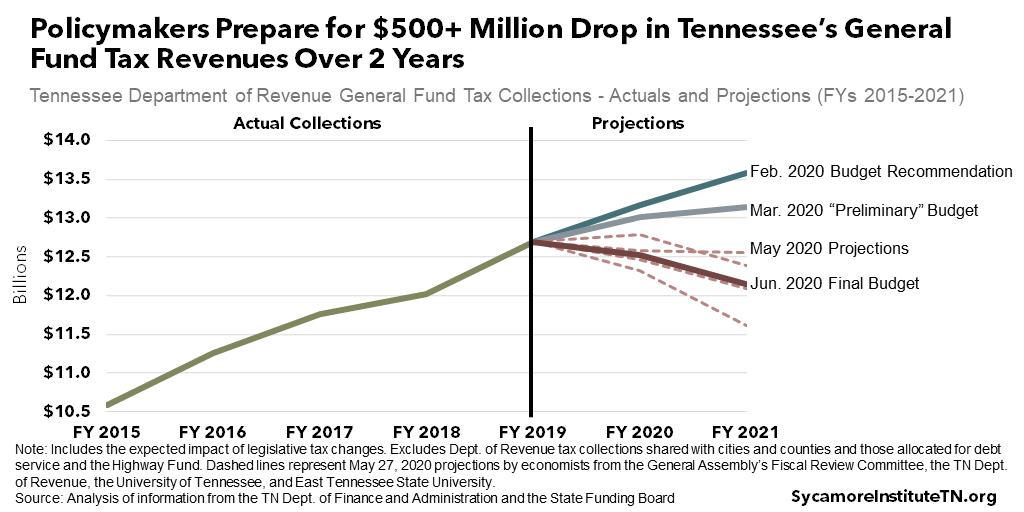

Policymakers Prepare For Lower Tax Revenues

Policymakers are now preparing for a General Fund tax revenue shortfall of $1.5 billion over FYs 2020 and 2021 compared to the preliminary budget passed in March. All told, the final budget expects General Fund tax collections to fall about $180 million (or 1.4%) in FY 2020 and another $370 million (or 3.0%) in FY 2021 (Figure 1). These projections fall near the middle of the range that four economists recently presented to state officials. Although FY 2020 ended on June 30th, policymakers won’t know final revenue collection for several months.

Figure 1

How Policymakers Balanced the Budget

To make up for expected revenue losses in FYs 2020 and 2021, policymakers have provided Governor Lee’s administration with access to nearly every tool available. The budget relies heavily on non-recurring revenues and spending reductions in FY 2020 and FY 2021 to offset recurring tax losses. The governor’s proposal laid out a three-year plan to bring recurring revenues and expenditures back into balance by FY 2023, but the House of Representatives prefers a two-year plan (see below).

Normally, the budget uses recurring revenues to cover recurring expenses. These revenues and expenses are reasonably expected to occur every year, while non-recurring funds are typically expected only one-time. Although not required under the state’s balanced budget requirement, this helps policymakers keep the budget “structurally balanced” in both the short- and long –term.

What Changed to Balance FY 2020

The $500 million recurring tax shortfall expected for FY 2020 is more than offset by a mix of non-recurring revenues and program savings. Among the non-recurring revenues are $529 million in reserves and $151 million in other non-tax revenues, mainly from interest earned on the state’s various invested dollars (e.g. fund balances). The administration also expected to spend about $250 million less than previously projected, at least in part from recent government-wide measures to freeze hiring, travel, and equipment purchases. With these changes, they expect to closeout FY 2020 with an estimated $430 million balance, which will be available for FY 2021 as non-recurring revenue.

What Stayed the Same for FY 2020

The budget keeps the large rainy day fund deposit and all of the funding added in March to respond to recent tornadoes and the COVID-19 pandemic. The administration planned to make a $325 million deposit to the state’s rainy day fund at the end of FY 2020 (see below). The budget also retained a total of $63 million for tornado disaster relief and building repair and $75 million for a health and safety emergency fund.

What Changed to Balance FY 2021

To offset the projected $1 billion FY 2021 recurring revenue shortfall, the budget taps non-recurring revenues, tax changes, spending cuts, forgone increases, borrowing, and federal funds. Changes relative to the March budget include:

- Non-Recurring Revenues — The revised budget relies on the expected $430 million FY 2020 year-end balance, another $150 million from reserves, and $40 million from other non-tax revenues.

- Tax Changes — A new law requires online sellers and marketplace facilitators (e.g. e-Bay or Etsy) with sales of $100,000 or more in Tennessee to collect and remit sales tax, which is expected to bring in an additional $23 million over estimates from March. This change is partially offset by a $15 million sales tax revenue reduction from one-time expansions to the state’s existing sales tax holiday — including a two-day holiday for restaurants and expanding the existing school supply holiday. The impact of these changes is reflected in the tax estimates above.

- Forgone Increases — The budget sacrifices $383 million in increases and allocations that were retained in the March budget. The largest include $137 million for pay raises for teachers, legislators, and state and higher education employees; $94 million for new and existing capital maintenance projects; $38 million for higher education; $30 million for the Transportation Equity Fund; and $21 million for various proposals to expand TennCare services.

- New Spending Cuts — The budget includes $15 million in funding cuts for new economic development grants, $20 million from eliminating vacant state employee positions, and $6 million from reduced incarceration costs associated with reforming the state’s drug-free school zone laws. It also cuts $42 million associated with education savings accounts (ESAs) in light of recent court decisions that effectively delay implementation of the program for at least one year.(5) (6) (7)

- Borrowing — Issuing bonds for seven capital projects will free up about $197 million.

- Federal Funds — The budget does not explicitly reflect how billions in federal funding approved for the state in recent months may impact spending from the state’s own revenues.

Recent announcements and the administration’s testimony, however, begin to fill in details for how the state’s $2.4 billion federal Coronavirus Relief Fund allocation is being spent. (7) (8) (9) For example, the administration is holding back $1.2 billion in hopes that Congress will expand the scope of the program. Today, funds can only be used for expenses directly related to COVID-19. Like many states, Tennessee hopes Congress may allow states to use the funds to make up for revenue losses. Another $200 million from the Relief Fund is being distributed to as many as 28,000 small businesses who have seen a significant drop in sales.

The governor also plans to use $400 million of the Relief Fund in FY 2020 to backfill the state’s unemployment trust fund in in light of historically-high unemployment compensation claims. The administration estimates that an additional $600 million will be needed in the fund between July and December to avoid an automatic tax rate increase on businesses under current state law. (10)

The legislature also made changes to the county and city government grants approved in the March budget. The final budget adds $10.5 million to the $200 million already allocated for the grants and removes application and reporting requirements. In addition to one-time projects and COVID-19 response, city and county officials may now also use the funds to backfill or supplement local revenue. The budget also reduces the allocations for Memphis from $7.8 million to $5 million, Shelby County from $14.4 million to $10 million, and Nashville-Davidson County from $14.8 million to $10 million. All other counties’ grants will be increased. (11) (12) (13) (14) According to legislative debate, these changes were made to account for the $285 million in federal funds allocated to Memphis, Shelby County, and Nashville-Davidson County for COVID-19-related costs. (15) (16)

The final budget also includes $50 million in non-recurring funding for an employee buyout program expected to generate longer-term savings for the budget. Although no savings from the buyout are reflected in the FY 2021 budget, the House multi-year plan assumes $65 million in recurring savings in FY 2022 (see below).

What Stayed the Same for FY 2021

For now, the Lee administration does not expect to dip into the Reserve for Revenue Fluctuations — the state’s official rainy day fund — to balance the budget. State law requires that policymakers find places to reduce spending before tapping the fund. (17) The budget relies on reserves in both FYs 2020 and 2021 and allows the administration to use the rainy day fund if the state exhausts other program reserves. However, lawmakers have expressed a desire to leave the fund untouched as a last resort, and the budget still includes a $250 million deposit at the end of FY 2021 (Figure 2).

Figure 2

The revised budget also retains some increases to cover higher costs from inflation, formulas, and client growth. These include scaled-back state personnel-related costs, K-12 funding formula growth, and expected cost increases in TennCare, the Department of Children’s Services, and the Department of Correction. TennCare’s budget, however, does not reflect any state funding changes related to a several hundred million dollar boost in federal funding or any enrollment growth that may result from recent job losses.

Some cost increases in the March budget related to COVID-19 needs are also retained in full. These include $75 million for a new health and safety emergency fund and $31 million total for the state’s primary care safety net for uninsured adults.

More Details to Come

As time goes on and the revenue picture becomes clearer, policymakers will need to fill in more details for several areas of the state’s finances. Significant aspects not spelled out in Governor Lee’s plan or the enacted budget include:

- Reserves — The plan to balance the budget in FY 2020 and FY 2021 relies on a total of $679 million in reserves from across state government. The budget does not identify specifically which reserves will be tapped but lays out a priority order. The TennCare reserve and the Reserve for Revenue Fluctuations will serve as last resorts after reviewing and exhausting other available program reserves. (1) (7) (4) (12)

- Federal Funds — Under the budget passed in March, the administration appears to have the flexibility to spend new federal funds for health and safety without legislative approval for the specific purposes. It must only provide quarterly updates to the legislature. (20) As discussed above, the budget does not yet provide full details on how billions of dollars in federal aid will be spent as questions remain about what, if any, changes Congress may make to how those funds can be used. (21) Giving this much latitude to the executive branch to allocate federal funds without advance, program-specific appropriations is unusual in Tennessee budget-making.

- The Highway Fund — The budget focuses on balancing the General Fund and Education Fund. Administration officials have said that scheduled Highway Fund transportation projects may take longer to implement but have not projected precisely how Highway Fund revenues (e.g. gas tax) or project timelines are expected to change. Highway Fund taxes in May (which represents economic activity in April) were down 30% from last year. (22) In the past, the Highway Fund appropriation has been reduced to reflect lower revenue estimates.

- State Taxes Shared with Local Governments — State taxes shared with local governments are an important source of revenue for many counties and cities. Projections presented by economists in May gave a range of estimates for each of the state’s taxes, including those shared with counties and cities. Shared tax collections will certainly be lower than was estimated in the Governor’s original February budget recommendation, but those details are not yet available. They will became available when the official July 1 revenue estimates are published by the Department of Finance and Administration. In May, those taxes were down 25% from last year. (22)

The administration and the House envision different paths for bringing recurring revenues and expenses back into balance. The administration’s three-year plan calls for additional base spending cuts totaling $400 million in FYs 2022 and 2023. The House of Representative prefers a two-year approach that contemplates $570 million in new recurring savings in FY 2022. Neither plan, however, has the force of law, and the approved budget does not expressly state any legislative intent regarding the House plan.

To prepare for additional spending cuts in FY 2022, more cuts can be expected in FY 2021. In early June, the governor directed each state agency to identify 12% of their budgets for potential cuts. (23) The administration plans to withhold at least some of the funds identified by each agency in FY 2021 and then reduce recurring spending by the same amounts in the FY 2022 budget recommendation. (6) (7) (21) Before withholding any funds in FY 2021, however, the administration must notify the legislature and receive acknowledgement from the chairs of the House and Senate Finance, Ways and Means Committees. (4)

Given all the uncertainty about the next few months and years, both the Lee administration and the legislature opened the door to other options and contingencies. For example, other tax changes were discussed— including a delay in the Hall income tax phase-out and skipping the state’s sales tax holiday — but the budget does not rely on those steps at this time. (21) (6) (16)

* Thanks to Bill Bradley for his contributions to this report. Bill is the former director of the Division of Budget, Tennessee Department of Finance and Administration.

Click to Open/Close

References

- Tennessee Department of Finance and Administration. Multi-Year Approach to a Structurally Balanced Budget. [Online] Revised on June 5, 2020. Original available at https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/FY21JuneAdjusmentSchedule060420.pdf. Revised version presented at June 8, 2020 House Finance, Ways, and Means hearing.

- State of Tennessee. Tennessee State Budgets for FYs 2006-2020. [Online] Available via https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive.html.

- Tennessee State Funding Board. Meeting Presentations and Materials. [Online] May 27, 2020. https://comptroller.tn.gov/content/dam/cot/tsfb/documents/meeting-packets/2020/2020.05.27SFBPacket.pdf.

- Tennessee General Assembly. Conference Committee Report on House Bill No. 2924 / Senate Bill No. 2932. [Online] June 18, 2020. [Cited: June 25, 2020.] http://www.capitol.tn.gov/Bills/111/CCRReports/CC0022.pdf.

- Aldrich, Marta W. Tennessee Supreme Court Declines to Hear School Voucher Appeal. The Tennessean. [Online] June 4, 2020. https://www.tennessean.com/story/news/education/2020/06/04/tennessee-school-voucher-appeal-denied-supreme-court/3145037001/.

- House Finance, Ways, and Means Committee. Testimony from Butch Eley, TN Commissioner of Finance and Adminstration. [Online] June 4, 2020. Recorded video available from http://tnga.granicus.com/MediaPlayer.php?view_id=460&clip_id=23089.

- —. Testimony from Buth Eley, TN Commissioner of Finance and Administration. [Online] June 8, 2020. Recorded video available from http://tnga.granicus.com/MediaPlayer.php?view_id=460&clip_id=23134.

- Senate Finance, Ways, and Means Committee. Testimony from Butch Eley, TN Commissioner of Finance and Adminstration. [Online] May 28, 2020. Recorded video available at http://tnga.granicus.com/MediaPlayer.php?view_id=431&clip_id=23017.

- State of Tennessee. Gov. Lee Announces Tennessee Business Relief Program. [Online] June 2, 2020. https://www.tn.gov/governor/news/2020/6/2/gov-lee-announces-tennessee-business-relief-program.html.

- —. TN Code § 50-7-403. [Online] https://law.justia.com/codes/tennessee/2018/title-50/chapter-7/part-4/section-50-7-403/.

- —. Governor’s Local Government Support Grants. [Online] June 24, 2020. [Cited: June 25, 2020.] https://www.tn.gov/finance/governor-s-local-government-support-grants.html.

- Tennessee General Assembly. Conference Committee Report on House Bill No. 2922 / Senate Bill No. 2931. [Online] June 18, 2020. [Cited: June 24, 2020.] http://www.capitol.tn.gov/Bills/111/CCRReports/CC0023.pdf.

- State of Tennessee. Allocations Among Counties. [Online] May 14, 2020. Available via https://web.archive.org/web/20200610203143/https://www.tn.gov/content/dam/tn/finance/documents/localgovgrants/21Counties2.pdf.

- —. Allocations Among Cities. [Online] May 14, 2020. Available from https://web.archive.org/web/20200610210125/https://www.tn.gov/content/dam/tn/finance/documents/localgovgrants/21Cities.pdf.

- U.S. Treasury. Payments to State and Eligible Units of Local Government. [Online] May 11, 2020. [Cited: June 25, 2020.] https://home.treasury.gov/system/files/136/Payments-to-States-and-Units-of-Local-Government.pdf.

- Tennessee General Assembly. Committee and Floor Discussion of SB 2931 / HB 2922. [Online] June 2020. Video available from http://wapp.capitol.tn.gov/apps/BillInfo/Default.aspx?BillNumber=SB2931&GA=111.

- State of Tennessee. TN Code § 9-4-211. [Online] https://law.justia.com/codes/tennessee/2018/title-9/chapter-4/part-2/section-9-4-211/.

- —. Tennessee State for Budget for FY 2021. [Online] Available from https://www.tn.gov/finance/fa/fa-budget-information/fa-budget-archive/fa-budget-publication-2020-2021.html.

- Tennessee Department of Finance and Administration. FY 2021 Administration Budget Amendment Overview. [Online] March 17, 2020. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/21AdminAmendOverviewRevisedEstimates.pdf.

- State of Tennessee. Public Acts of 2020, Chapter 0651, Sections 56-1, 59-1.7, and 61. [Online] April 2, 2020. https://publications.tnsosfiles.com/acts/111/pub/pc0651.pdf.

- Senate Finance, Ways, and Means Committee. Testimony from Butch Eley, TN Commissioner of Finance and Adminstration. [Online] May 28, 2020. Recorded video available from http://tnga.granicus.com/MediaPlayer.php?view_id=431&clip_id=23017.

- Tennessee Department of Finance and Administration. May Revenues: Tables. [Online] June 8, 2020. [Cited: ]

- —. FY21 Base Budget Reductions for Consideration. [Online] June 5, 2020. [Cited: July 1, 2020.] Available from https://www.tn.gov/finance/fa/fa-budget-information/budget-instructions-and-forms.html.

- —. FY 2020-2021 Recommended Budget Overview. [Online] January 30, 2020. https://www.tn.gov/content/dam/tn/finance/budget/documents/overviewspresentations/21AdReq17.pdf.

Photo at top by the State of Tennessee