To date, the federal government has passed four relief packages totaling an estimated $2.4 trillion to respond to COVID-19 and its economic fallout. (1) There remains a lot of uncertainty about the trajectory of the pandemic and how that will affect the economy in both the short- and long-term. As a result, some state and local policymakers are still considering the best ways to use the funding already allocated even as federal lawmakers debate another round of relief.

This analysis provides a comprehensive picture of the federal aid already available to Tennessee and how it has been and can be spent.

Key Takeaways

- Tennessee will get over $25 billion in federal aid, including $8 billion to state government. Most of the money is economic relief for businesses, workers, consumers, and health care providers.

- Forgivable business loans, individual stimulus payments, and extra unemployment insurance account for 71% of the money. Much of this relief has already occurred or will soon expire.

- The State of Tennessee can use less than 10% of its aid to offset lost revenue. Fortunately, data suggest that economic relief for Tennesseans may have mitigated the state’s losses to date.

- Rising COVID-19 case numbers will likely prolong the pandemic’s economic effects and undermine these efforts to shore up the economy and state finances.

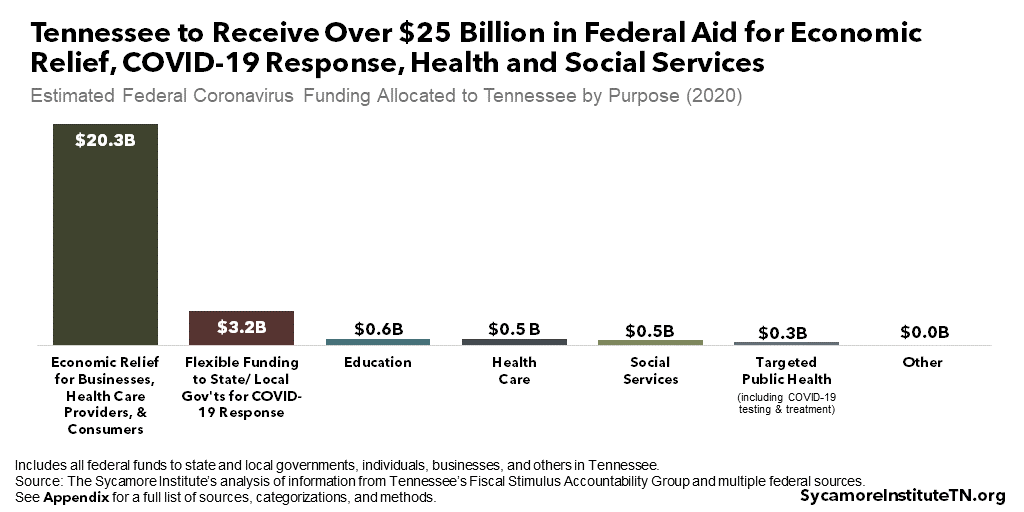

Figure 1

All Federal Relief for Tennessee

Tennessee is set to receive over $25 billion in federal coronavirus aid for economic relief, COVID-19 response, health and social services, and education (Figure 1). Federal funding across nearly 100 different programs and purposes has been allocated directly to state and local governments, individuals, businesses, health care providers, and others in Tennessee (Figure 2). (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) (14) (15) (16) (17) (18) (19) (20) (21) (22) (23) (24) (25) (26)

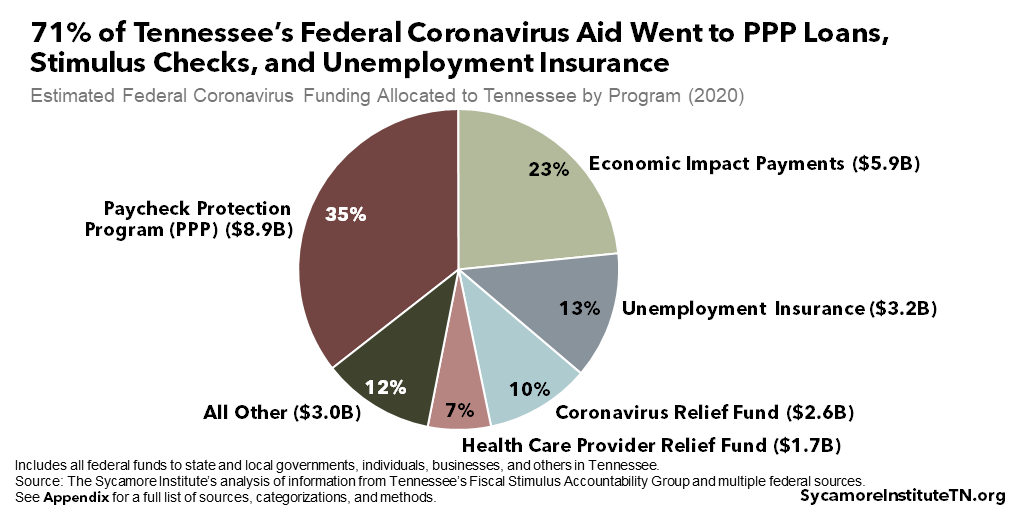

Figure 2

Figure 3

The five largest programs make up over 90% of COVID-related federal resources for Tennessee (Figure 3). These include:

- The Paycheck Protection Program (PPP) — As of July 10, $8.9 billion in federal PPP loans have been awarded to business across Tennessee. (23) The loans will be forgiven if used on eligible expenses, such as retaining and paying employees even while business is slow or shutdown entirely. (27) The current deadline to apply is August 8.

- Economic Impact Payments — As of June 26, 3.5 million stimulus payments totaling $5.9 billion had been distributed to Tennessee households. (22) Depending on income, each household may be eligible for up to $1,200 per adult and $500 per child. These types of payments have been used in recent recessions to stimulate spending in the economy and provide one-time relief to people who may have lost jobs or income. (28)

- Unemployment Insurance (UI) — As of June 30, $3.2 billion in federal funds had come to Tennessee for the UI program. (2) This money supports a $600 per week supplemental benefit that expires July 31, extended benefits and eligibility through December 31, and additional state administrative costs. See below for additional details.

- Coronavirus Relief Fund — A total of $2.6 billion has been awarded to state and local governments through the Coronavirus Relief Fund. State government was allocated $285 million. Metro Nashville-Davidson County received $121 million, Memphis $114 million, and Shelby County $50 million. (29) State and local governments have wide discretion in how they use these funds so long as they are for new or additional spending related to COVID-19. See below for additional details.

- Health Care Provider Relief Fund — As of July 20, health care providers in Tennessee had received a total of $1.7 billion from a $175 billion Provider Relief Fund.(21) (30) The payments are a flexible funding to help providers offset additional expenses and lost revenues as a result of the pandemic. (31) Payments have been made across eight separate programs targeting Medicare and Medicaid providers, hospitals with high COVID caseloads, rural hospitals and providers, skilled nursing facilities, and safety net hospitals. (32)

The remaining $3.0 billion in federal coronavirus aid for Tennessee has been allocated across numerous programs. For example, over $124 million went to airports across Tennessee to make up for lost revenues and needed coronavirus-related accommodations. (33) (6) As of July 14, Tennessee farmers have received over $80 million in economic relief payments related to lost sales. (17)

Much of this relief has already occurred or will soon expire. PPP loans, economic impact payments, and expanded UI account for 71% of all the federal coronavirus aid coming into Tennessee (Figure 3). Most economic impact payments have already been made, and the supplemental $600 per week UI benefits expire on July 31. Under a tweak passed by Congress in May, businesses have 24 weeks to spend their allotments – although many spent them in eight weeks based on the original rules for the program.

See the Appendix for a full list of programs, categorizations, and sources.

Figure 4

Figure 5

Federal Relief for Tennessee State Government

Nearly one-third of Tennessee’s federal coronavirus relief – or about $8.0 billion – has gone to our state government. The majority of this funding is to provide economic relief to Tennessee workers and to directly meet COVID-related health and economic needs (Figure 4). The five largest programs (Figure 5) include:

- Unemployment Insurance — As mentioned above, $3.2 billion in federal funds came to Tennessee for the state’s UI program through June 30. (2) While state officials administer these funds, only the administrative costs are reflected in the annual state budget. In addition to the expanded benefits discussed earlier, the Lee administration is also using some of its Coronavirus Relief Fund allocation to pay regular state UI benefits (see below). (2)

- Coronavirus Relief Fund — Tennessee state government received $2.4 billion from the Coronavirus Relief Fund. (29) State and local governments have broad flexibility to use the funds for any new or additional spending related to COVID-19. See below for more information on how the Tennessee is allocating this money.

- Disaster Response Reimbursement — Tennessee estimates it will spend at least $644 million on COVID-related emergency response measures eligible for federal reimbursement. During presidentially-declared national emergencies, the Federal Emergency Management Agency (FEMA) reimburses state and local governments and nonprofits for 75% of eligible expenses – in this case, an estimated $474 million. State and local governments usually split the remaining 25% of expenses evenly, however, the state plans to use its Coronavirus Relief Funds to cover these costs (see below). (2)

Purchasing personal protective equipment, testing, operating food banks and alternate care sites, and disinfecting public facilities are all examples of COVID-related expenses that FEMA could reimburse. (34)

- Reduced State Costs for TennCare — Each state gets a 6.2 percentage point increase to its federal Medicaid match rate, effective January 1, 2020 through the quarter in which the national public health emergency declaration ends. Through the end of September, this increase will offset an estimated $474 million in state spending on TennCare and another $6 million on CoverKids. (2) While these savings could help balance the budget in other areas, some of it will likely stay in the TennCare program to pay for any enrollment growth and a handful of one-time, targeted relief payments to TennCare providers.

- K-12 Emergency Relief — Tennessee has been allocated a total of $323 million for K-12 education. The state received $260 million from the Elementary and Secondary School Emergency Relief (ESSER) Fund – at least $234 million of which goes to local school districts under an existing federal funding formula. (9) These funds are relatively flexible and can cover any costs that help school districts address the impact of COVID-19. The other $64 million comes from the Governor’s Emergency Education Relief Fund for use at the governor’s discretion.

The remaining $1.2 billion in Tennessee’s federal coronavirus funding is spread across dozens of targeted programs. For example, the state has received a total of $188 million from the U.S. Centers for Disease Control and Prevention (CDC) for a number of specific public health efforts – including support for local health departments. (20) Another $170 million is going to public colleges and universities in Tennessee to provide financial aid to students, offset lost revenues, and pay for changes in instruction methods due to COVID-19. (35)

See the Appendix for a full listing of programs, categorizations, and sources.

Tennessee’s Plan for the Coronavirus Relief Fund

Tennessee’s $2.6 billion allocation from the Coronavirus Relief Fund is the most flexible source of federal aid available to state policymakers. The Fund – created by the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act – can pay for a variety of public health and economic purposes both directly and indirectly related to COVID-19. However, funding cannot support any expense the state budget already accounted for when the CARES Act passed on March 27, 2020. (4) As a result, nothing in the FY 2020 budget passed in 2019 is eligible (The FY 2021 “preliminary budget” passed by the General Assembly in March wasn’t signed into law until April.). (2)

Legally, the governor has flexibility to allocate these and other new federal health and safety emergency funds without legislative approval. Under the budget passed in March, the administration must update lawmakers quarterly on federal funding allocations for health and safety emergencies but does not need formal approval. (36) Giving this much latitude to the executive branch to allocate federal funds without advance, program-specific appropriations is unusual in Tennessee budget-making.

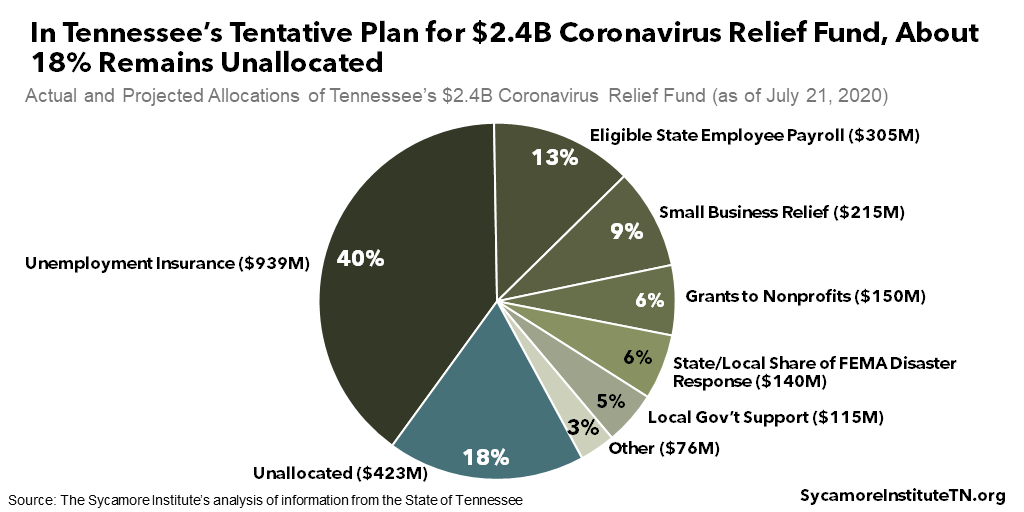

Figure 6

The state currently has a tentative plan for at least $1.9 billion – or 82% – of its Coronavirus Relief Fund allocation (Figure 6). Governor Bill Lee established the 10-member Financial Stimulus Accountability Group to oversee the state’s spending of the Relief Fund – with members from both the executive and legislative branches. (37) As of July 21, the group’s plan for the Fund included the following actual and projected allocations:

- Unemployment Insurance — Administration officials expected the historic spike in UI claims to shrink the state’s unemployment trust fund below $1 billion and trigger an increase in the employer taxes that fund it. Keeping the balance above $1 billion throughout 2020 would require an estimated $939 million while saving employers an estimated $90 million in UI payroll taxes. The Lee administration used $400 million from the Fund for UI benefits through June, and an additional $539 million is expected through December. (2) (3)

- Eligible State Employee Payroll — $305 million for the payroll expenses of state employees working on frontline health and safety or whose duties significantly shifted due to the pandemic. (2) (3) Because many of these are existing state employees whose work has been dedicated to COVID response, these dollars may help to alleviate some pressure caused by declining state revenues.

- Small Business Relief — $215 million for distribution to as many as 28,000 small businesses that saw a drop in sales after being required to close or reduce operations due to Governor Lee’s stay-at-home order. (2) (3) (38)

- Nonprofit Support — $150 million to help nonprofit organizations in Tennessee address the health and economic effects of COVID-19. (39)

- State/Local Share of FEMA Disaster Response — $140 million to pay the state and local governments’ share of spending that is eligible for FEMA reimbursement. (2) (3)

- Local Support — $115 million to help local governments cover their COVID-19 responses. (40)

- Other Purposes — $76 million for other purposes, including the state’s COVID-19 Unified Command and preparedness grants to 29 small and rural hospitals. (2) (3)

- Unallocated — $423 million has not yet been allocated. The Lee administration is reviewing a number of other potential uses for these funds, including additional relief for agricultural and forestry producers, health care providers, school districts, and state higher education institutions.(2) (3) Earlier this year, the administration hoped Congress would expand the scope of the program to allow funds to make up for revenue losses. To date, that has not happened.

Shifting federal guidance, multiple overlapping federal programs, and uncertainty have made it hard for states to finalize plans for their Coronavirus Relief Funds. Since the CARES Act passed in March, federal officials have refined and expanded the list of eligible expenses multiple times – most recently on June 30. (41) (2) At the same time, more targeted federal funding has been provided across numerous programs for the same or similar purposes that must be carefully coordinated to avoid duplication. (42) (2) Meanwhile, there is still uncertainty around the trajectory of the pandemic, its impact on state revenues, and when and if Congress may pass another relief package.

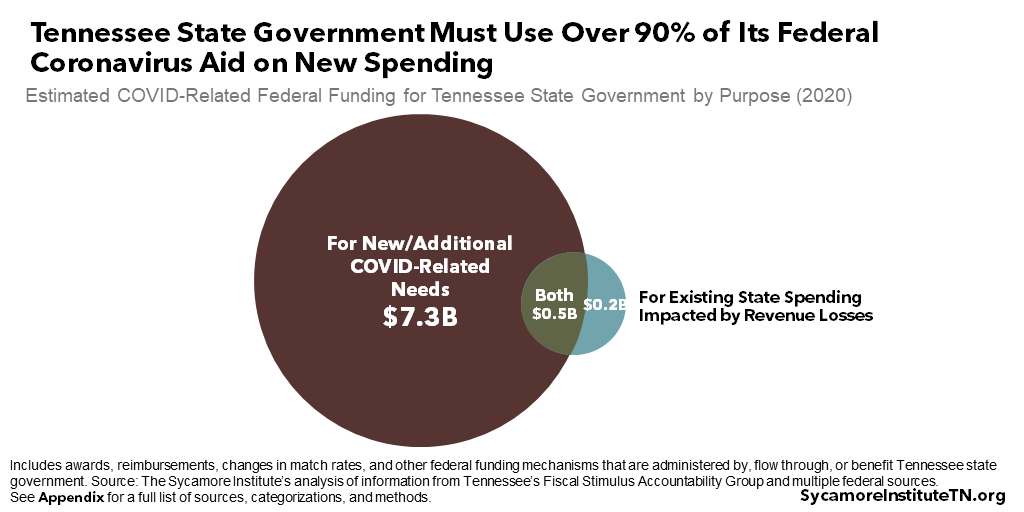

Figure 7

How Federal Funds Impact the State Budget

During the Great Recession, federal aid helped the state both respond to a surge in demand for certain programs and fill-in for at least some state revenue losses. Federal support helped with the usual recessionary uptick in demand for social services and unemployment. In addition, a boost in federal funding for programs like TennCare, transportation, and education helped keep the budget balanced without even deeper spending cuts than those that were made.

This time, state government must use almost all its federal aid for new or additional needs arising from the pandemic and its economic fallout. Only about 9% – or $685 million – can go toward existing state spending if revenues fall short (Figure 7). That includes savings from the increased federal share of TennCare spending and some funding for higher education. The budget lawmakers passed in June for FYs 2020 and 2021 did not detail how these funds will impact spending from the state’s own revenues.

Relief provided to businesses and individuals, however, could mitigate the state’s revenue loss. Supplemental UI benefits, PPP loans, and economic impact payments are all meant to help stabilize family finances and keep money flowing through the economy. Both revenue collections and recent consumer spending data suggest they may have had the intended effect. After nosediving in late March, Tennessee’s consumer spending rebounded in mid-April amid record unemployment when supplemental UI and economic impact payments began. By early July, spending was up almost 2% from January – among the strongest growth in the nation. (43) (44) As several of these programs expire in the coming weeks, however, their impact will dissipate.

Parting Words

Rising COVID-19 case numbers will likely prolong the pandemic’s economic effects and undermine these efforts to shore up household, business, and government finances. The federal government ultimately spent $2.4 trillion to buy time, and much of that time has already passed. The temporary aid described here was meant to stabilize the economy while social distancing measures helped quickly contain the virus. Most of the money has already been expended, yet many key pandemic metrics are moving in the wrong direction. The longer that continues, the more short- and long-term disruption our economy and state budget are likely to see.

Congress is currently debating yet another aid package, but the relief we need most is a large and sustained decline in the spread of COVID-19. More federal assistance is likely necessary in light of the current situation, but sooner or later, that flow of money will stop. Policymakers at all levels of government should consider how to best use any additional time bought by Congress to gain control of this pandemic.

* This report was updated on July 24, 2020 to refine the criteria for the Small Business Relief program.

References

Click to Open/Close

- Congressional Budget Office. The Budgetary Effects of Laws Enacted in Response to the 2020 Coronavirus Pandemic, March and April 2020. [Online] June 2020. https://www.cbo.gov/system/files/2020-06/56403-CBO-covid-legislation.pdf.

- Governor’s Office. Report to the Fiscal Stimulus Accountability Group on the Federal and State Reponse to COVID-19 (Updated June 30). [Online] June 30, 2020. Obtained from the Governor’s Office.

- Tennessee Department of Finance and Administration. Presentation to the Financial Stimulus Accountability Group. [Online] July 1, 2020. [Cited: July 20, 2020.] https://www.tn.gov/content/dam/tn/finance/documents/070120B.pdf.

- U.S. Department of the Treasury. Coronavirus Relief Fund: Guidance for State, Territorial, Local, and Tribal Governments. [Online] Last updated June 30, 2020. [Cited: July 20, 2020.] https://home.treasury.gov/system/files/136/Coronavirus-Relief-Fund-Guidance-for-State-Territorial-Local-and-Tribal-Governments.pdf.

- Federal Transit Administration. Fiscal Year 2020 CARES Act Supplemental Public Transportation Apportionments and Allocations. [Online] [Cited: July 10, 2020.] https://cms7.fta.dot.gov/cares-act-apportionments.

- Federal Aviation Administration . Map of CARES Funding. [Online] [Cited: July 10, 2020.] https://www.faa.gov/airports/cares_act/map/.

- U.S. Department of Labor. U.S. Department of Labor Awards Over $26 Million in Dislocated Worker Grants in Response to Coronavirus Public Health Emergency. [Online] May 15, 2020. https://www.dol.gov/newsroom/releases/eta/eta20200515.

- —. Families First Coronavirus Response Act and Coronavirus Aid, Relief, and Economic Security (CARES) Act Funding to States Through July 11, 2020. [Online] July 11, 2020. [Cited: July 20, 2020.] https://oui.doleta.gov/unemploy/docs/cares_act_funding_state.html.

- U.S. Department of Education. Elementary and Secondary School Emergency Releif Fund State Allocations Table. [Online] 2020. [Cited: July 20, 2020.] https://oese.ed.gov/files/2020/04/ESSER-Fund-State-Allocations-Table.pdf.

- —. CARES Act: Higher Education Emergency Relief Fund. [Online] [Cited: July 14, 2020.] https://www2.ed.gov/about/offices/list/ope/caresact.html.

- —. Governor’s Emergency Education Relief Fund. [Online] [Cited: July 14, 2020.] https://oese.ed.gov/files/2020/04/GEER-Fund-State-Allocations-Table.pdf.

- U.S. Department of Housing and Urban Development. CPD Program Formula Allocations and CARES Act Supplemental Funding for FY 2020. [Online] Last updated June 9, 2020. [Cited: July 14, 2020.] https://www.hud.gov/program_offices/comm_planning/budget/fy20/.

- —. Planned Use of CARES Act Funding. [Online] June 2020. https://www.hud.gov/sites/dfiles/CFO/documents/HUD_Agency_Plan_for_Use_of_CARES_Act_Covered_Funds_FINAL.pdf.

- Federal Emergency Management Agency. FY 2020 Emergency Management Performance Grant Program COVID-19 Supplemental (EMPG-S). [Online] [Cited: July 14, 2020.] https://www.fema.gov/media-library-data/1586548278007-3bf1e643add0fa132e30e20ff2c96e0c/FY_2020_EMPG-S_NOFO_Final_508ML.pdf.

- —. Assistance to Firefighters 2020 – COVID-19 Supplemental Awards. [Online] [Cited: July 14, 2020.] https://www.fema.gov/media-library/assets/documents/188695.

- Emergency Food and Shelter National Board Program. FY 2020 CARES Allocations. [Online] 2020. [Cited: July 14, 2020.] https://www.efsp.unitedway.org/efsp/website/websiteContents/pdfs/Phase%20CARES%20Allocations.pdf.

- U.S. Department of Agriculture. Coronavirus Food Assistance Program Data. [Online] [Cited: July 14, 2020.] https://www.farmers.gov/cfap/data.

- —. TEFAP: Allocation of Coronavirus Aid, Relief, and Economic Security Act Supplemental Appropriation. [Online] April 24, 2020. [Cited: July 14, 2020.] https://www.fns.usda.gov/tefap/allocation-coronavirus-aid-relief-and-economic.

- —. Tennessee: Supplemental Nutrition Assistance Program Request for Emergeny Allotments for Current SNAP Households (Approved, June Extension, July Extension). [Online] [Cited: July 20, 2020.] https://www.fns.usda.gov/disaster/pandemic/covid-19/tennessee#snap.

- U.S. Department of Health and Human Services. HHS COVID-19 Funding. [Online] [Cited: July 22, 2020.] https://taggs.hhs.gov/coronavirus.

- Centers for Medicare and Medicaid Services. CARES Act Provider Relief Fund: Data. [Online] Updated July 20, 2020. [Cited: July 20, 2020.] https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/data/index.html.

- Internal Revenue Service. IRS Statement on Economic Impact Payments by State. [Online] Updated June 26, 2020. [Cited: July 20, 2020.] https://www.irs.gov/newsroom/irs-statement-on-economic-impact-payments-by-state.

- U.S. Small Business Administration. Paycheck Protection Program (PPP) Report: Approvals Through 07/10/2020. [Online] July 2020. [Cited: July 20, 2020.] https://home.treasury.gov/system/files/136/SBA-Paycheck-Protection-Program-Loan-Report-Round2.pdf.

- U.S. Election Assistance Commission. 2020 CARES Act Grants. [Online] [Cited: July 14, 2020.] https://www.eac.gov/payments-and-grants/2020-cares-act-grants.

- U.S. Department of Justice. Coronavirus Emergency Supplemental Funding (CESF) Program: State and Local Allocations. [Online] April 14, 2020. [Cited: July 14, 2020.] https://bja.ojp.gov/program/cesf/state-and-local-allocations.

- U.S. Department of Health and Human Services. Claims Paid for Testing & Treatment of the Uninsured. [Online] [Cited: July 22, 2020.] https://taggs.hhs.gov/Coronavirus/Uninsured.

- U.S. Small Business Administration. Paycheck Protection Program: Loan Details and Forgiveness. https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program#section-header-5. [Online] [Cited: July 20, 2020.]

- Luhby, Tami. Flashback to Great Recession: The President Wants to Send Stimulus Checks to Americans. CNN. [Online] March 17, 2020. [Cited: July 20, 2020.] https://www.cnn.com/2020/03/17/politics/coronavirus-federal-stimulus-payments/index.html.

- Treasury, U.S. Payments to States and Eligible Units of Local Government. [Online] [Cited: July 20, 2020.] https://home.treasury.gov/system/files/136/Payments-to-States-and-Units-of-Local-Government.pdf.

- Centers for Medicare and Medicaid Services. CARES Act Provider Relief Fund. [Online] Last updated July 17, 2020. [Cited: July 20, 2020.] https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/index.html.

- U.S. Congress. Coronavirus Aid, Relief, and Economic Security (CARES) Act (P.L. 116.136). [Online] March 27, 2020. [Cited: July 20, 2020.] Full text available at https://www.congress.gov/bill/116th-congress/house-bill/748/text/enr.

- Centers for Medicare and Medicaid Services. CARES Act Provider Relief Fund: General Information. [Online] Last updated July 10, 2020. [Cited: July 20, 2020.] https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/general-information/index.html.

- Federal Aviation Administration. 2020 CARES Act Grants: Airports. [Online] May 29, 2020. [Cited: July 20, 2020.] https://www.faa.gov/airports/cares_act/.

- Federal Emergency Management Agency. Public Assistance Disaster-Specific Guidance – COVID-19 Declarations. [Online] [Cited: July 20, 2020.] https://www.fema.gov/media-library/assets/documents/187108#.

- U.S. Department of Education. Higher Education Emergency Relief Fund: Supplemental Frequently Asked Questions Under Section 18004 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. [Online] June 30, 2020. [Cited: July 20, 2020.] https://www2.ed.gov/about/offices/list/ope/caresactsupplementalfaqs63020.pdf.

- State of Tennessee. Public Chapter No. 651 (2020), Sections 56-1, 59-1.7, and 61. [Online] April 2, 2020. https://publications.tnsosfiles.com/acts/111/pub/pc0651.pdf.

- —. Gov. Lee Announced Stimulus Financial Accountability Group. [Online] April 16, 2020. https://www.tn.gov/governor/news/2020/4/16/gov–lee-announces-stimulus-financial-accountability-group.html.

- —. Gov. Lee Announces Tennessee Business Relief Program. [Online] June 2, 2020. https://www.tn.gov/governor/news/2020/6/2/gov-lee-announces-tennessee-business-relief-program.html.

- —. All News Gov. Lee Announces $150 Million in Relief Funds for Tennessee Non-Profits. [Online] July 21, 2020. https://www.tn.gov/governor/news/2020/7/21/gov–lee-announces–150-million-in-relief-funds-for-tennessee-non-profits-.html.

- —. Gov. Lee Announces Additional $115 Million for Local Governments to Support COVID-19 Response. [Online] July 20, 2020. https://www.tn.gov/governor/news/2020/7/20/-gov–lee-announces-additional–115-million-for-local-governments-to-support-covid-19-response.html.

- U.S. Department of the Treasury. The CARES Act Provides Assistance for State, Local, and Tribal Governments. [Online] [Cited: July 20, 2020.] https://home.treasury.gov/policy-issues/cares/state-and-local-governments.

- Federal Emergency Management Agency. Coronavirus Disease 2019 (COVID-19) Public Health Emergency: Coordinating Public Assistance and Other Sources of Federal Funding. FEMA Fact Sheet. [Online] June 2020. [Cited: July 20, 2020.] https://www.fema.gov/media-library-data/1593609857750-0a9c88370c27f1391b4c907818c1b3a2/FEMA-COVID-19_coordinating-public-assistance-and-other-sources-of-federal-funding_07-01-2020.pdf.

- Chetty, Raj, et al. How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data. Opportunity Insights. [Online] June 17, 2020. https://opportunityinsights.org/wp-content/uploads/2020/05/tracker_paper.pdf.

- —. Opportunity Insights Economic Tracker. [Online] [Cited: July 16, 2020.]