Health insurers in Tennessee’s Obamacare Marketplace have until July 25 to send regulators their proposed plans for 2019, but one is already setting expectations that rate hikes will be moderate or insignificant. In recent years, average annual premium growth has been quite large. Below, we offer 2 reasons that may change next year — and 1 reason it may not.

Note: We’ll know final plans and rates by late September, and open enrollment will run from November 1 to December 15, 2018.

Key Takeaways

- In previous years, insurers offering Obamacare plans in Tennessee set their prices too low to cover the costs of enrollees. That may no longer be true.

- Two significant elements of uncertainty that contributed to previous rate hikes no longer apply.

- Federal policy changes made or proposed after 2018 rates were set have created new uncertainty that may affect premiums for 2019.

1) In previous years, insurers offering Obamacare plans in Tennessee set their prices too low to cover the costs of enrollees. That may no longer be true.

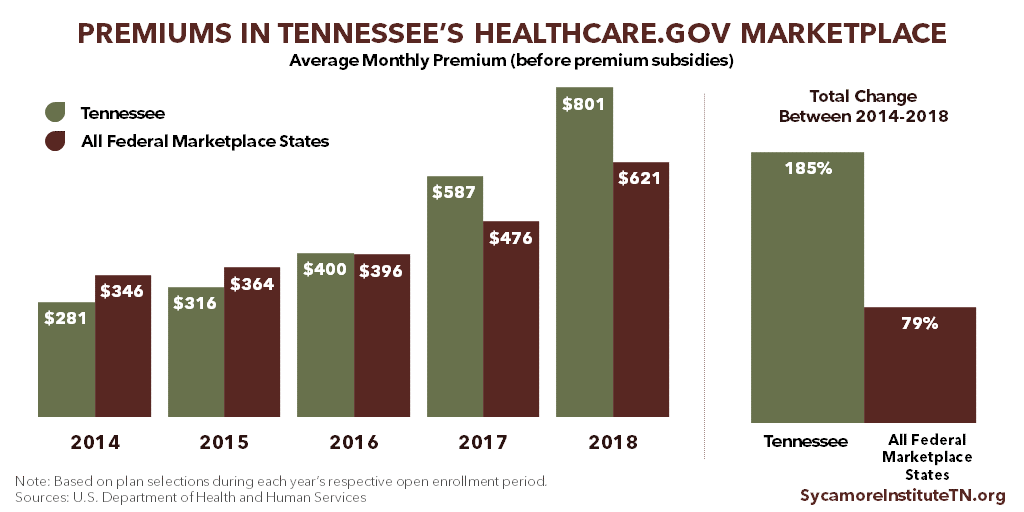

The degree to which plans were mispriced varied from insurer to insurer and from market to market, but the trend is clear. When the Affordable Care Act (ACA) took effect in 2014, Obamacare plans in Tennessee had some of the lowest premiums in the country. Meanwhile, the expected cost of covering Obamacare enrollees (largely driven by health status) was higher in Tennessee than all but 2 other states, according to a Kaiser Family Foundation analysis of 2015 data.

After taking heavy losses, insurers either dropped out of Tennessee’s Marketplace or significantly raised their prices. Between 2014 and 2018, the average premium (before subsidies) in Tennessee’s ACA Marketplace grew 185%.

Evidence suggests the new, higher premiums in Tennessee may come closer to covering enrollees’ costs. Tennessee now has the 7th highest average Obamacare premiums in the country (before subsidies). Benchmarking against other states, those premiums now fall more in line with enrollees’ health status. Insurers’ margins in the Marketplace have also improved nationally since 2014.

2) Two significant elements of uncertainty that contributed to previous rate hikes no longer apply.

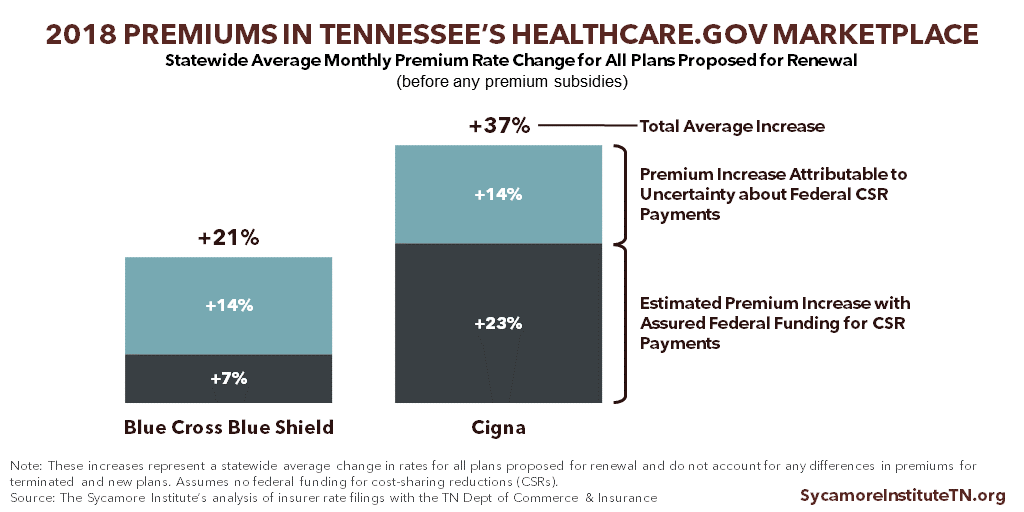

Since 2014, the federal government has rolled back implementation of 2 ACA programs important to insurers’ bottom lines. The first, a temporary risk corridors program intended to help offset the financial risk of offering Obamacare plans in the early years, was never fully funded. The second, cost-sharing reduction (CSR) payments meant to reimburse insurers for mandated limits on certain enrollees’ deductibles and co-pays, ended last year after the Trump administration determined the law had not properly funded them.

In 2018, Blue Cross Blue Shield of Tennessee and Cigna both attributed 14 percentage points of their average requested rate increases to uncertainty about the future of CSR payments. Oscar, which was new to Tennessee’s Marketplace, said CSR uncertainty accounted for 17% of its total 2018 requested rates for affected plans.

Past uncertainty about these 2 programs should not affect insurers’ pricing decisions for 2019. The temporary risk corridor program has expired, and efforts in Congress to fund CSR payments have stalled. Current Obamacare rates in Tennessee were based on the assumption that CSR payments would end. As a result, we would not expect CSRs to have a significant effect on premiums in 2019 (unless the feds change the rules for how insurers deal with the still-mandated cost-sharing limits).

3) Federal policy changes made or proposed after 2018 rates were set have created new uncertainty that may affect premiums for 2019.

Several federal policy changes implemented or floated since late 2017 could affect how insurers price their Obamacare plans for 2019. They include:

- Congress repealed the penalty for the individual mandate as part of tax reform legislation in December 2017. As a result, some (primarily young and healthy) people who would have otherwise bought Obamacare plans may choose not to do so.

- The Trump administration scaled back the 2018 open enrollment period and reduced funding for marketing. It’s not clear what effect this had or will have on enrollment, which was relatively flat in Tennessee for 2018.

- The Trump administration recently announced new rules to allow more access to plans that don’t meet ACA requirements. The effect of that change in Tennessee may be minimal, however, because such plans are already available here through the Farm Bureau.

These changes effectively provide more alternatives to the Marketplace. When planning for 2019, insurers must predict what (if any) effect these changes will have on enrollment.

Insurers predictions about how that plays out could affect their participation in the Marketplace and the prices they set for 2019. For example, insurers could reasonably expect more young and healthy people to go uninsured in 2019 or opt for lower-cost, smaller-benefit plans that don’t comply with the ACA. To the extent insurers expect that to happen, they may raise premiums for those remaining in the Marketplace, who would tend to be older and less healthy.

Related Work by The Sycamore Institute

Reinsurance & High-Risk Pools – What Are They and Why Do They Matter for Tennessee?

(April 6, 2017) In addition to explaining what reinsurance and high-risk pools are in the context of Obamacare and the individual health insurance market, the paper also provides key data points on Tennessee’s healthcare.gov marketplace.

Options for Stabilizing Tennessee’s Marketplace

(July 20, 2017) Explains 3 things the state could do under current law and the trade-offs involved with each choice.

CSR Payments, Uncertainty, and Tennessee’s 2018 ACA Marketplace

(September 29, 2017) Analyzes 2018 Marketplace premiums and explains cost-sharing reduction payments and what they might mean for Tennessee.

Tennessee’s 2018 Obamacare Enrollment

(April 13, 2018) Analyzes detailed federal data on enrollment in Tennessee’s 2018 Marketplace and compares 2018 to prior years.

County-Level Data on Tennessee’s 2018 Obamacare Enrollment

(April 19, 2018) Includes maps, charts, and tables showing how key data about 2018 Marketplace enrollment vary by county.

Click here for all Affordable Care Act (ACA)-related posts by The Sycamore Institute.

Data Cited

Click to Open/Close

- Centers for Medicare and Medicaid Services. 2017 Marketplace Open Enrollment Period State-Level Public Use File. U.S. Department of Health and Human Services. [Online] May 11, 2017. [Accessed on April 4, 2018.] Accessed via https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/Plan_Selection_ZIP.html.

- —. 2018 Marketplace Open Enrollment Period State-Level Public Use File. U.S. Department of Health and Human Services. [Online] April 3, 2018. [Accessed on April 4, 2018.] Accessed via https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2018_Open_Enrollment.html.

- Pellegrin, Mandy. The Sycamore Institute’s analysis of CMS’ 2017 and 2018 Marketplace Open Enrollment Period State-Level Public Use File. 2018.

- Office of the Assistant Secretary for Planning and Evaluation. Profile of Affordable Care Act Coverage Expansion Enrollment for Medicaid/CHIP and the Health Insurance Marketplace: Tennessee. U.S. Department of Health and Human Services. [Online] May 1, 2014. https://aspe.hhs.gov/system/files/pdf/93796/tn.pdf.

- Centers for Medicare and Medicaid Services. 2015 Marketplace Open Enrollment Period County-Level Public Use File. U.S. Department of Health and Human Services. [Online] April 20, 2017. [Accessed on April 4, 2018.] Accessed via https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2015_Open_Enrollment.html.

- Office of the Assistant Secretary for Planning and Evaluation. Health Insurance Marketplaces 2016 Open Enrollment Period: Final Enrollment Report – State-Level Data Excel Tables. U.S. Department of Health and Human Services. [Online] March 11, 2016. Accessed via https://aspe.hhs.gov/health-insurance-marketplaces-2016-open-enrollment-period-final-enrollment-report.

- —. Health Insurance Marketplaces 2015 Open Enrollment Period: March Enrollment Report. U.S. Department of Health and Human Services. [Online] March 10, 2015. https://aspe.hhs.gov/system/files/pdf/83656/ib_2015mar_enrollment.pdf.

- Burke, Amy, Misra, Arpit and Sheingold, Steven. Premium Affordability, Competition, and Choice in the Health Insurance Marketplace, 2014. U.S. Department of Health and Humans Services, Office of the Assistant Secretary for Planning and Evaluation. [Online] June 18, 2014. https://aspe.hhs.gov/system/files/pdf/76896/2014MktPlacePremBrf.pdf.

- Office of the Assistant Secretary for Planning and Evaluation. Health Insurance Marketplaces 2016 Open Enrollment Period: Final Enrollment Report. U.S. Department of Health and Human Services. [Online] March 11, 2016. https://aspe.hhs.gov/system/files/pdf/187866/Finalenrollment2016.pdf.

Featured image at top by Tony Webster