The Tennessee General Assembly is working on legislation (HB1551 & SB1728) that directs TennCare, the state’s Medicaid program, to seek federal permission to impose work requirements on certain enrollees. This effort has implications for both TennCare and the state budget.

Federal guidance says Medicaid work requirements “should be designed to promote better mental, physical, and emotional health” for enrollees and may also aim to help individuals “attain independence.”

If the proposed TennCare work requirement is to achieve these goals, our research shows there are several key issues policymakers may want to consider.

6 Insights From Our Research

To help Tennesseans weigh the trade-offs, below are 6 insights from our research. As a reminder, The Sycamore Institute does not take a position on any legislation. Our role is simply to help inform the policy debate.

1. Research shows that support services would make it more likely that TennCare enrollees seek, obtain, and keep jobs.

Child care, transportation, education/training, and work-related expenses can all make it harder to get and keep a job, according to research. The Families First (Tennessee’s TANF program) work requirement combines support services in these areas with penalties and time limits to both incentivize and aid employment among certain program recipients. Families First spent 34% of its budget on child care and 13% on work and training services in 2015. Federal guidance encourages states to provide support services in tandem with Medicaid work requirements, but they are not mandatory.

2. How Tennessee monitors and enforces a work requirement could affect the state’s administrative workload.

Tennessee would need to obtain information on TennCare enrollees that it does not currently collect. TennCare currently verifies income for eligibility purposes. Enforcement of a work requirement would likely entail tracking hours spent working, training, volunteering, or in school.

To monitor compliance and provide support services, TennCare may have to create new systems, modify existing ones, or contract with agencies that already perform similar functions such as the state’s Dept. of Human Services (DHS) or Dept. of Labor and Workforce Development (TDLWD). Each of those options would likely require some level of additional staff capacity, system modifications, and/or financial resources.

3. Any support services or new administrative capacity would likely require state funding.

States cannot use federal Medicaid match dollars to pay for many support services, although some administrative costs may be shared with the federal government. The legislature’s Fiscal Review staff estimates the state’s annual cost to implement a TennCare work requirement at $18.7 million per year, which includes projected savings from lower enrollment.

4. Programs with work requirements often account for variation in job opportunities across the state and during recessions.

The availability of jobs is a factor in the enforcement of SNAP and TANF work requirements. For example, SNAP (aka food stamps) work requirements are currently waived in 16 Tennessee counties designated as “economically distressed.” Residents of areas (often rural) that have fewer jobs or higher barriers to employment may find it harder to meet a work requirement. Recessions can compound the difficulty even as more people become eligible for TennCare.

5. Work requirements have been shown to increase employment, but the evidence is less clear on helping individuals achieve long-term independence.

Studies have found that employment increased following enactment of welfare-to-work programs, but incomes often continue to fall below the poverty level. Workers in low-wage jobs often do not get insurance benefits and may have trouble affording work-related expenses like transportation and child care.

6. A TennCare work requirement may face legal challenges.

Media reports indicate that legal challenges are likely. A lawsuit seeking to block Kentucky’s new Medicaid work requirement has already been filed.

*We updated this post on Feb. 20, 2018 to clarify that the Fiscal Review staff’s $18.7 million cost estimate is an annual figure.

Related Work by The Sycamore Institute

Medicaid Work Requirements in TN (1 of 3): What, Why, and Who?

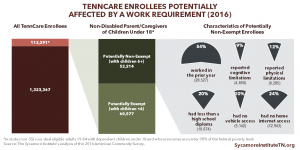

(September 14, 2017) Explains what Medicaid work requirements are, why there is interest, and who in Tennessee they could likely affect.

Medicaid Work Requirements in TN (2 of 3): Lessons from TN’s Welfare-to-Work Experience

(December 6, 2017) Explores insights in the work requirement for Families First — another state-run, federally-sanctioned program.

Medicaid Work Requirements in TN (3 of 3): Key Considerations for Policymakers

(December 8, 2017) Lays out the key points to consider in the debate over whether to add a work requirement to TennCare — from goals and details to support services and potential unintended consequences.

Digesting the Feds’ New Guidance & 1st Approval of Medicaid Work Requirements

(January 22, 2018) provides an overview and analysis of the federal government’s new guidance on Medicaid work requirements and the approval of Kentucky’s plan.

Featured Image at top by Thomas Hawk / CC BY-NC 2.0