On January 29, 2018, Governor Bill Haslam released his recommendation for the FY 2018-2019 Budget – along with re-estimates and recommended changes for the FY 2017-2018 Budget. (1) (2) It is now the job of the legislature to consider and act on this recommendation. Changes in the governor’s amended budget, released in March, are summarized here.

Key Takeaways

- Governor Haslam’s FY 2018-2019 recommended budget is 0.5% (or $171 million) higher than estimates for the current fiscal year. Spending from state revenues is 1.2% (or $217 million) lower.

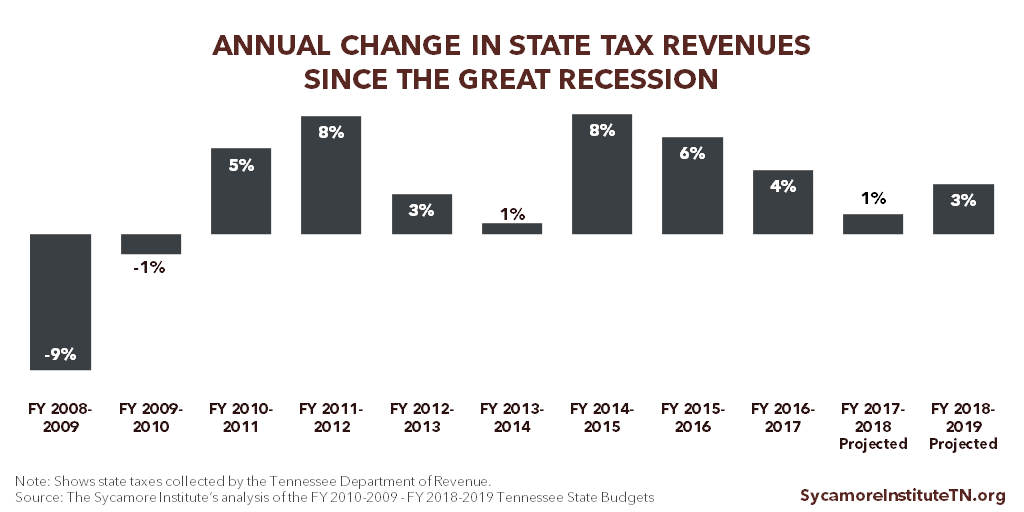

- The Budget projects state tax revenues to grow by 3.2% in FY 2018-2019 — the 9th consecutive year of revenue growth since the Great Recession.

- Areas with noteworthy spending increases include salaries and benefits, TennCare, K-12 education, efforts to address the opioid epidemic, higher education, economic development, and capital improvements.

- Noteworthy spending reductions are recommended in TennCare and the Department of Corrections.

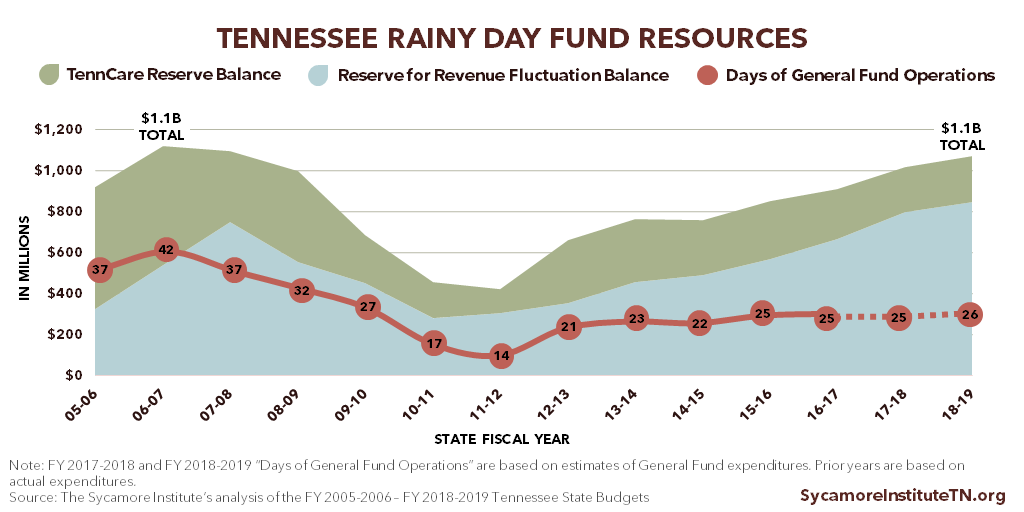

- Rainy day fund balances (including the TennCare Reserve) are projected to top $1.1 billion and cover about 26 days of General Fund operations in FY 2018-2019 — 16 fewer days than in FY 2006-2007 before the Great Recession.

Overview

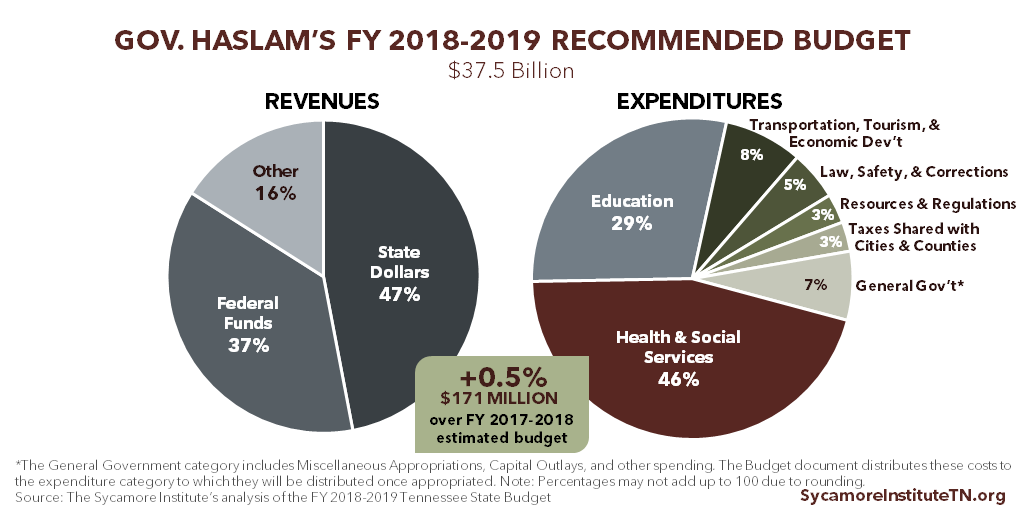

The FY 2018-2019 recommended budget totals $37.5 billion from all revenue sources, an increase of 0.5% (or $171 million) over estimates for the current fiscal year. The funding mix is 47% state dollars, 37% federal funding, and 16% from other sources. Education (29%) and Health and Social Services (46%) account for three-quarters of total expenditures. (Figure 1)

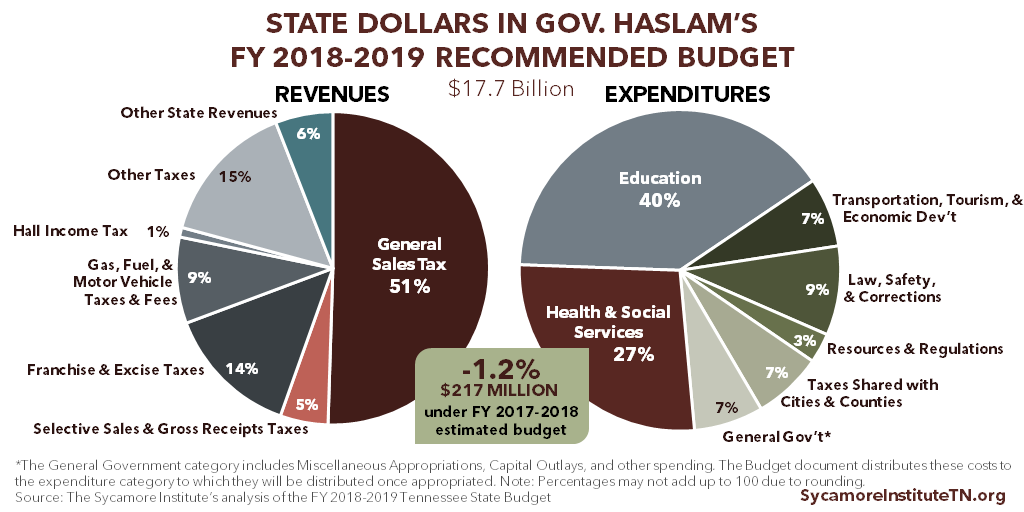

State dollars in the recommended budget total $17.7 billion, a decrease of 1.2% (or $217 million) from the current year. State revenues predominately come from sales taxes (51%) and taxes on businesses (14%). Education (40%) and Health and Social Services (27%) account for about two-thirds of expenditures from state appropriations. (Figure 2) Changes in the governor’s amended budget, released in March, are summarized here.

Figure 1

Figure 2

The General Fund in Context

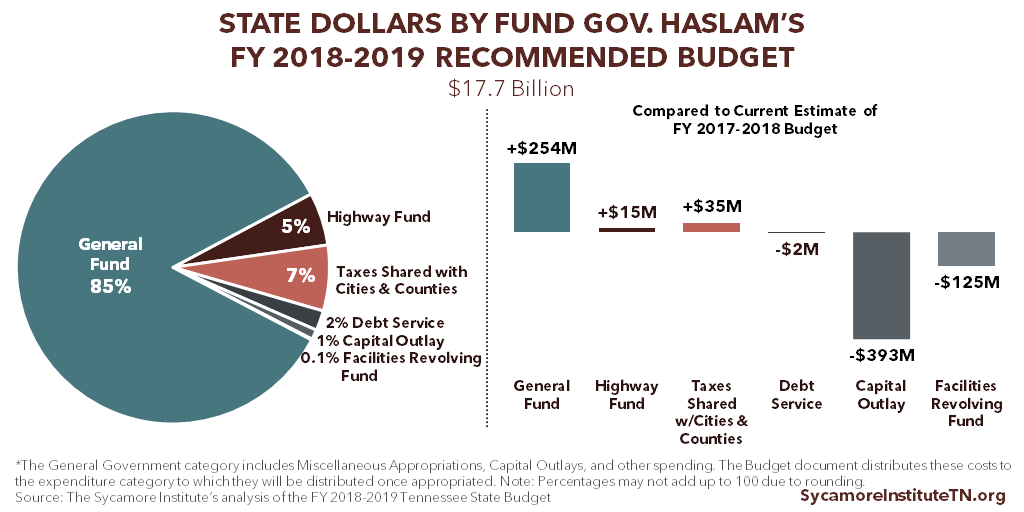

The Administration’s budget document and presentations often focus on state dollars in the General Fund, which accounts for 85% of all state dollars (Figure 3). In addition, General Fund discussions and calculations often include the Capital Outlay and the Facilities Revolving Fund totals.

Figure 3

Recommended Cost Increases and One-Time Investments

The Budget includes a number of increases to cover growing costs and new investments. Among these are a $568 million increase in recurring General Fund spending and a total of $476 million in non-recurring General Fund spending. (3)

The Budget’s Largest Recurring Increases

- +$229 million for personnel-related costs for state employees, teachers, and higher education (e.g. salary increases, retirement contributions, and health insurance cost increases). See pages xx-xxi and xxv of the Budget. (3)

- +$117 million for TennCare for items like expected increases in pharmaceutical spending and health care costs as well as IT system upgrades. See pages xxii-xxiii and B138—B140 of the Budget. (3)

- +$70 million for K-12 education (excluding salary and benefits increases) to fund, for example, Basic Education Program (BEP) formula growth and additional positions for the Response to Intervention program, which targets students who may need additional academic help to keep from falling behind. See pages xx and B82—B85 of the Budget. (3)

- +$46 million for Higher Education (excluding salary and benefits increases), including efforts to support the Drive to 55 initiative. See pages xxi and B86—B94 of the Budget. (3)

The Budget’s Largest Non-Recurring Expenditures

- $185 million for the Capital Outlay program, which supports the improvement and maintenance of state buildings. See page xxvi of the Budget. (3)

- $128 million for the Department of Economic and Community Development to help recruit and expand business and workforce opportunities to the state broadly and rural areas specifically. See pages xxiv-xxv and B302—B304 of the Budget. (3)

- $50 million to the state’s Reserve for Revenue Fluctuation. See pages xxvii and A41 of the Budget.(1)

The Budget reserves $5 million in recurring and $10 million in non-recurring funds for initiatives and amendments of the legislature. (3) Another $12 million in recurring funds is reserved for the Administration Amendment, including any funds needed for the Administration’s juvenile justice reform legislation. (3)

Recommended Spending Reductions

The Budget recommends ‑$79 million in recurring General Fund reductions and -$40 million in non-recurring General Fund reductions. (2)

The Budget’s Largest Recurring Reductions

- -$56 million from TennCare related primarily to an increase in the state’s federal match rate, lower-than-projected Medicare Part D premiums, and Intellectual and Development Disabilities waiver utilization. See pages 31-32 of Volume 2 of the Budget. (2)

- -$12 million from Corrections partially related to opioids-related legislation that would provide credits for reduced sentences to inmates who complete drug treatment while incarcerated. See page 36 of Volume 2 of the Budget. (2)

- -$2 million from Children’s Services due to increased child support revenue from Human Services, elimination of 12 vacant positions, and an increase in federal funds. See page 50 of Volume 2 of the Budget. (2)

The Budget’s Non-Recurring Reductions

- -$40 million from CoverKids associated with an increase in the federal match rate. See page 48 of Volume 2 of the Budget. (2)

Figure 4

Figure 5

State Tax Revenue Growth

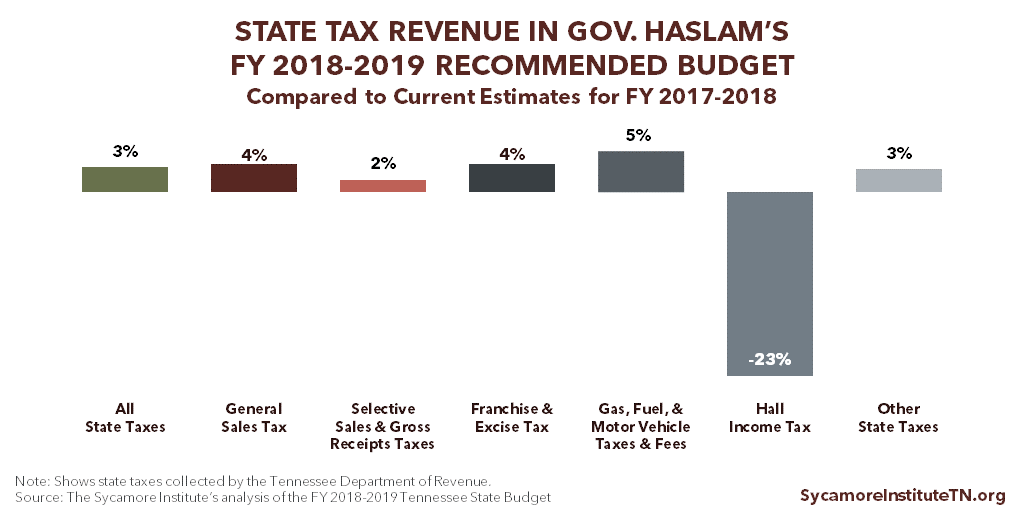

State tax collections are expected to grow by $454 million (or 3.2%) in FY 2018-2019. (Figure 4) This would be the 9th consecutive year of revenue growth since the Great Recession. (Figure 5) (1)

HIGHLIGHTS:

- The direction and degree of expected change varies by revenue type (Figure 5):

-

- +4% gain ($310 million) in general sales tax collections

-

- +2% gain ($14 million) in selective sales and gross receipts taxes collections

-

- +4% gain ($88 million) in franchise and excise tax collections from businesses

-

- +5% gain ($75 million) in gas, fuel, and motor vehicle taxes and fees collections

-

- -23% drop ($48 million) in Hall income tax collections

-

- +3% gain ($16 million) in other state tax collection

- This variation, in part, reflects last year’s IMPROVE Act, which phases in increases to various gas, fuel, and motor vehicle taxes and fees while phasing out the Hall income tax.

- The Tennessee State Funding Board recommended a 2.7—3.2% increase in total recurring state tax revenues based on estimates from a University of Tennessee economist (3.4%), the Fiscal Review Committee (3.6%), the Department of Revenue (3.4%), and an East Tennessee State University economist (2.1%).(1)

Figure 6

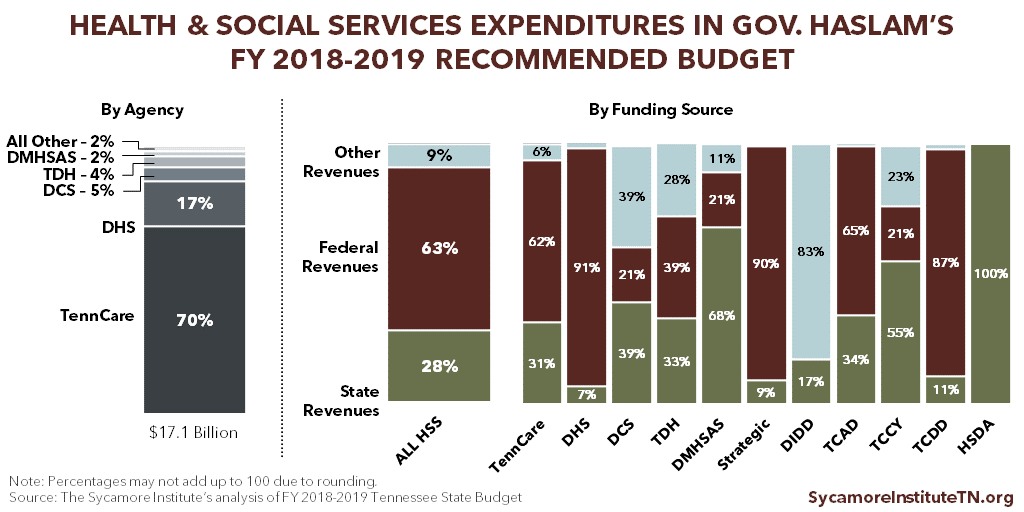

Health and Social Services

Health and social services (HSS) comprise the largest share of the total budget (46%) and the 2nd largest share of state dollars (27%). Federal funding accounts for 63% of HSS spending (Figure 6) and represents 78% of all federal dollars in the state budget. (1) Changes in the governor’s amended budget, released in March, are summarized here.

HIGHLIGHTS:

- HSS account for 25% of all recurring General Fund increases (+$144 million) and 6% of all non-recurring General Fund increases (+$31 million).(3) Notable HSS increases include:

-

- +$68 million (recurring) for TennCare medical and drug costs and utilization, which will trigger +$132 million in federal matching funds. See page B-138 of the Budget.

-

- +$15 million (recurring) and $22 million (non-recurring) for the Tennessee Eligibility Determination System (TEDS), which TennCare is developing and expects to roll out in the final quarter of FY 2017-2018. These increases will trigger +$129 million in federal matching funds. See page B-138 of the Budget.

-

- +$11 million (recurring) for payment rate increases for state-contracted HSS providers delivering mental health (+$3 million), substance abuse (+$3 million), children’s (+$3 million), and intellectual/developmental disability (+$2 million) services. See pages B-140 and B-144 of the Budget.

-

- +$9 million (recurring) and +$3 million (non-recurring) for HSS agencies’ contributions to the Tennessee Together opioids initiative (more info below).

-

- +$7 million (recurring) to expand enrollment in TennCare’s Employment and Community First (ECF) CHOICES program, which will trigger +$14 million in federal matching funds. See page B-139 of the Budget.

-

- $4 million (non-recurring) for local efforts to prevent tobacco use. The FY 2017-2018 budget included $5 million (non-recurring) for this purpose.(4) See page B-142 of the Budget.

-

- +$2 million (recurring) for early childhood home visiting programs. These funds have been appropriated as non-recurring since FY 2014-2015 when recurring funding for these activities was reduced from $4 million to less than $1 million.(5) (6) See page B-142 of the Budget.

-

- +$1 million (recurring) for Adverse Childhood Experiences (ACEs) Prevention Grants. These funds have been appropriated as non-recurring since FY 2016-2017.(7) (4) See page B-145 of the Budget.

- HSS account for 77% of all recurring General Fund reductions (-$60 million), and 100% of all non-recurring reductions (-$40 million).(2) Aside from those highlighted in the Overview section above, recurring reductions across HSS agencies largely entail administrative changes, eliminating vacant positions, and increased revenues from other sources. (2)

- The Budget includes the elimination of 107 full-time state employee positions within HSS agencies as part of a cross-government initiative to eliminate 281 positions, many of which have been vacant long-term. Of the 107 HSS positions, 6 within the Department of Intellectual and Developmental Disabilities are currently filled.(2)

Tennessee Together Opioid Initiative

Governor Haslam announced the Tennessee Together initiative to address the state’s opioid epidemic on January 22, 2018. The initiative includes a mix of prevention, treatment, and law enforcement activities aimed at reducing the availability of prescription and illicit opiates and increasing access to treatment. Budgetary, legislative, and administrative action would be required for implementation. (8) We will take a broader look at the initiative in a separate analysis.

For Tennessee Together, the Budget includes a total of +$10.9 million in recurring increases and $3.6 million in non-recurring spending. (3) These funds target improved access to drug treatment and recovery services (particularly for low-income Tennesseans), data efforts to identify high-risk areas, additional activities related to prescriber practices, and enhanced law enforcement activities. Changes in the governor’s amended budget, released in March, are summarized here.

- Prevention: +$0.4 million (recurring) and $1.5 million (non-recurring):

-

- +$0.1 million (recurring) and $1.5 million (non-recurring) to collect and share data to identify high-risk areas.

-

- $0.3 million (non-recurring) to study, formulate, and implement pain management best practices.

- Treatment: +$9.0 million (recurring) and $1.2 million (non-recurring):

-

- +$8.3 million (recurring) to expand the substance abuse safety net to serve an estimated 3,500 additional individuals.(9) These funds are in addition to the $6.0 million (recurring) increase appropriated for the current fiscal year. The state also received nearly $20 million in new federal funding this year to expand opioid addiction treatment, and $13.8 million is expected again in FY 2018-2019. (10) (11)

-

- +$0.8 million (recurring) to fund peer recovery specialists in targeted emergency departments.

-

- $1.1 million (non-recurring) to supply the medications needed for medication-assisted treatment (MAT) in recovery courts and county jails. $1.0 million (non-recurring) was appropriated for this purpose in FY 2017-2018.(12)

-

- $0.2 million (non-recurring) to provide transportation services for Zero to Three Court participants to access support services.

- Law Enforcement: +$1.6 million (recurring) and $0.9 million (non-recurring):

-

- +$1.3 million (recurring) and $0.9 million (non-recurring) for the Tennessee Bureau of Investigation to hire 10 new agents and increase training.

-

- +$0.3 million (recurring) for the Department of Corrections to reclassify certain controlled substances in order to increase criminal penalties.

- The Budget also reflects -$2.7 million (recurring) in cost reductions for the Department of Corrections, associated with separate legislation that seeks to shorten the sentences of prison inmates who agree to participate in intensive drug treatment.(2)

Figure 7

Rainy Day Fund Resources

The state’s Reserve for Revenue Fluctuations and the TennCare Reserve represent Tennessee’s ability to respond to an economic downturn. Balances in these accounts provide a revenue cushion during recessions, which often increase demand for state programs and services but decrease the revenues that fund them.

HIGHLIGHTS:

- The Budget recommends a $50 million deposit to the Reserve for Revenue Fluctuations in FY 2018-2019. This would bring the balance of that account to $850 million — the highest dollar amount ever. (Figure 7)

- The 2 reserves’ combined balance is expected to reach $1.1 billion in FY 2018-2019 and could cover state-funded General Fund operations for about 26 days at the governor’s recommended funding levels. (Figure 7)

- The combined balance would be about $49 million less and 16 fewer days of General Fund operations than in FY 2006-2007, just before the Great Recession. (Figure 7)

- State law sets a target balance for the Reserve for Revenue Fluctuations at 8% of General Fund revenues. The FY 2018-2019 recommended balance represents 6% of those revenues* — falling $304 million short of the 8% target.

* Calculated by adding Department of Revenue and Other State Revenue allocations to the General Fund, Education Fund, and Debt Service Fund minus the Gasoline Tax allocation to the Debt Service Fund (from page A-65 of the Budget).

Figure 8

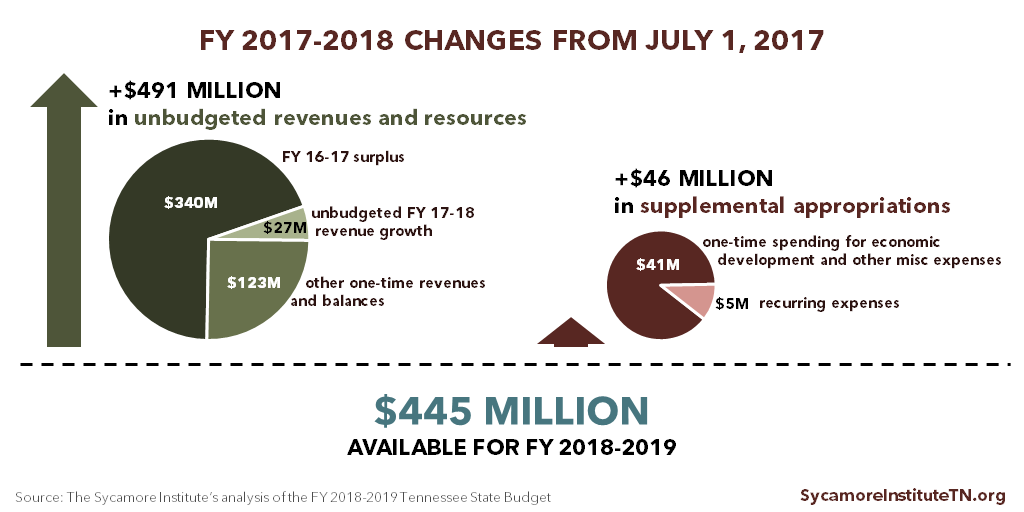

FY 2017-2018 Changes

During the course of a fiscal year, governors often find that actual revenues and spending needs are higher or lower than were originally estimated. To address new estimates for tax collections and additional spending requests, the governor’s Budget for the upcoming fiscal year typically also requests changes for the current fiscal year (Figure 8). The governor always has authority to spend less than what is appropriated.

HIGHLIGHTS:

- The Budget accounts for $491 million in revenue and resources that were not budgeted when the current fiscal year began on July 1, 2017. The revised numbers reflect last year’s budget surplus, updated revenue forecasts based on actual collections, and other one-time revenues and balances. (3)

- The Budget recommends $46 million of supplemental appropriations from those funds in the current fiscal year. Of these recommendations, the largest is $38 million (non-recurring) for Economic and Community Development grants related to DENSO and Tyson Foods. (3)

- The $445 million expected year-end balance would become available as non-recurring revenue for FY 2018-2019.

Key FY 2018-2019 Budget Documents

- FY 2018-2019 Budget Document

- FY 2018-2019 Budget: Volume 2 – Base Budget Reductions

- Budget Overview: FY 2018-2019

- The Commissioner of Finance and Administration’s FY 2018-2019 Budget Presentation

*This document was updated on Feb. 15, 2018 to correct the amount associated with HSS provider rate increases.

References

Click to Open/Close

- State of Tennessee. FY 2018-2019 Tennessee State Budget. [Online] January 29, 2018. https://www.tn.gov/content/dam/tn/finance/budget/documents/2019BudgetDocumentVol1.pdf

- —. FY 2018-2019 Tennessee State Budget: Volume 2 – Base Budget Reductions. [Online] January 29, 2018. https://www.tn.gov/content/dam/tn/finance/budget/documents/2019BudgetDocumentVol2.pdf

- Tennessee Department of Finance and Administration. Budget Overview: FY 2018-2019. [Online] January 26, 2018. https://www.tn.gov/content/dam/tn/finance/budget/documents/19AdReq16.pdf

- State of Tennessee. FY 2017-2018 State Budget. [Online] January 2017. https://www.tn.gov/content/dam/tn/finance/budget/documents/2018BudgetDocumentVol1.pdf

- Tennessee Department of Health. Tennessee Home Visiting Programs Annual Report – FY 2013-2014. [Online] January 2015. https://www.tn.gov/content/dam/tn/health/documents/HomeVisiting_AnnualReport_2014.pdf

- —. Tennessee Home Visiting Programs Annual Report – FY 2014-2015. [Online] https://www.tn.gov/content/dam/tn/health/documents/Tennessee_Home_Visiting_Programs_Annual_Report_2015.pdf

- State of Tennessee. Public Chapter No. 758. [Online] April 21, 2016. http://publications.tnsosfiles.com/acts/109/pub/pc0758.pdf

- Governor Bill Haslam. TN Together: A Comprehensive Plan to End the Opioid Crisis in Tennessee. [Online] January 22, 2018. https://www.tn.gov/content/dam/tn/opioids/documents/OpioidOnePager.pdf

- Tennessee Department of Mental Health and Substance Abuse Services. Presentation to House Health Committee. [Online] February 6, 2018. Via http://tnga.granicus.com/MediaPlayer.php?view_id=379&clip_id=14290

- —. Tennessee to Receive $13.8 Million Aimed at Prescription Opioid Crisis. [Online] April 25, 2017. https://www.tn.gov/behavioral-health/news/2017/4/25/tennessee-to-receive-13.8-million-aimed-at-prescription-opioid-crisis.html

- —. TDMHSAS to Receive New Opioid Addiction Treatment Funding. [Online] September 26, 2017. https://www.tn.gov/behavioral-health/news/2017/6/30/tdmhsas-to-receive-new-opioid-addiction-treatment-funding.html

- State of Tennessee. Public Chapter No. 460 (2017). [Online] May 25, 2017. http://publications.tnsosfiles.com/acts/110/pub/pc0460.pdf

- Tennessee Department of Finance and Administration. Commissioner’s Presentation: FY 2019 Recommended Budget. [Online] January 30, 2018. https://www.tn.gov/content/dam/tn/finance/budget/documents/FY19RecBudget%20FINAL.pdf

Featured Image at top by Nashville Area Chamber of Commerce / CC BY-NC 2.0