Health reform efforts often seek to make health insurance more affordable and accessible. This policy brief introduces some key concepts that influence access and affordability, such as risk pools, predictability, insurer and enrollee incentives, and the stability of the regulatory environment.

Risk Pooling

Insurance is a mechanism for pooling risk. The business of insurance only works if insurance companies can predict the “risk” of their enrollees accurately enough to set premiums that cover their costs. Risk is more predictable when enrollee pools are both broad and stable. (1)

Broad vs. Segmented Risk Pools

In broad risk pools, low-risk individuals subsidize high-risk individuals. This can reduce low-risk individuals’ perceived benefit from purchasing insurance. As a result, low-risk individuals may instead choose to enroll in lower-cost, lower-benefit plans that are less attractive to high-risk individuals. They may even choose not to enroll in health insurance at all.

If low-risk individuals decline to participate in the same plans as high-risk individuals, the risk pool can become segmented. To the extent that this occurs, plans that are more attractive and more beneficial to higher-risk individuals become increasingly expensive and less attractive for lower-risk individuals. A cycle can ensue in which the risk pools for these plans become so small, unstable, and concentrated with high-risk individuals that insurers decline to offer these plans altogether. This is often called a “death spiral.”

Insurers and Enrollees Have Opposing Incentives

Insurers and Enrollees Have Opposing Incentives

When comparing health insurance options, most people likely do some kind of cost-benefit analysis — even if it’s informal. Factors considered can include 1) the cost of the coverage, 2) the ability to cover those costs based on income and other household expenses, 3) how useful that coverage will be to a person based on what they know about their health needs, 4) the costs and benefits of any alternatives, and 5) tolerance for the financial risks of going without health insurance. Generally, individuals know more about their own health needs and risks than insurance companies do. The tendency for people to use this knowledge to choose plans that are more beneficial to them is known as adverse selection.

Likewise, insurers have a financial incentive to avoid high-risk individuals. Before the Affordable Care Act (ACA) restricted their use, insurers utilized a number of mechanisms to respond to adverse selection. While actuaries might refer to these practices as risk management, detractors refer to them as cherry-picking.

Such practices included declining or limiting coverage for pre-existing conditions (i.e. medical underwriting) and cancelling policies of individuals found to have pre-existing conditions that were not previously disclosed. Insurers also structured plans to be less attractive to high-risk individuals with mechanisms like high cost-sharing requirements, annual and lifetime benefit limits, limited benefit coverage, and exclusions of specific types of drugs from coverage. While these practices limited insurers’ exposure to the costs associated with high-risk individuals, they also limited enrollees’ protection from catastrophic health care costs.

How Risk Pooling Differs in the Employer-Based and Individual Markets

While there are downsides to health insurance being tied to employment, job-based coverage has generally been an effective way to create broader and more stable risk pools that allow for more affordable and accessible health premiums. For the most part, people do not chose their employer based on their health risk. This means that risk pooling in employer-provided plans happens more naturally, is less subject to adverse selection, and requires insurers to use fewer risk management practices. Most employers subsidize premium costs and give employees a limited set of plans to choose from. As a result, participation in employer-provided plans is high and employee risks are broadly pooled.

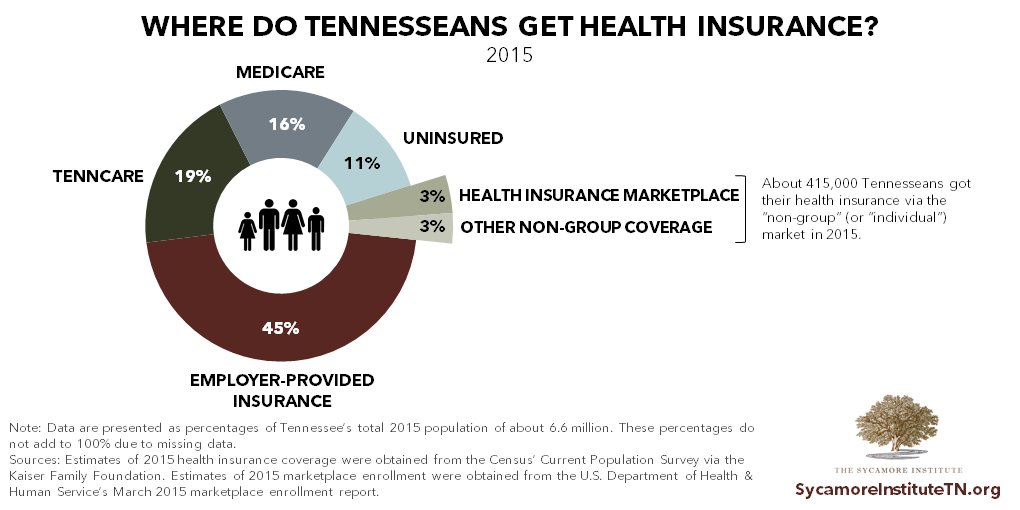

The individual health insurance market, however, faces many challenges in achieving broad, stable, and predictable risk pools. The individual/non-group market is essentially all health insurance not provided by employers or through the government. Today, that includes both the ACA’s healthcare.gov Marketplace and the “off-exchange” market. In 2015, employer-provided insurance was the single largest source of coverage for Tennesseans, and only about 6% of Tennesseans (or 415,000) got their health insurance through the individual market. For 2017, 234,000 Tennesseans enrolled in Marketplace coverage. (2) (3)

Risk Pooling and Insurance Reform

Risk Pooling and Insurance Reform

The ACA and proposed alternatives and replacements seek to regulate the individual health insurance markets by targeting various factors that affect the balance and stability of risk pools.

For example, certain provisions of the ACA and the recently proposed American Health Care Act (AHCA) are intended to increase enrollment of lower-risk individuals by reducing barriers to coverage and making the alternatives either more costly or non-existent. (4) (5) (6)

- The ACA’s individual mandate attaches a financial penalty to forgoing coverage, while the AHCA includes incentives for continuous coverage.

- Provisions like the ACA’s essential health benefits standardize coverage options so that lower-benefit, lower-priced plans are no longer available in the individual market, which may also reduce adverse selection and cherry-picking.

- The Marketplace mechanism allows for easier plan comparison and shopping, which may help attract lower-risk individuals.

- Premium subsidies (based on income in the ACA or age in the AHCA) can help make health insurance more affordable, which may also attract lower-risk individuals.

Nearly all public policy involves trade-offs, and insurance reform is no different.

Mandating that people buy insurance and standardizing coverage options may help to reduce adverse selection and make risk pools broad. However, these actions also limit choice and may place a financial cost on exercising individual liberty. Policymakers’ priorities and values often determine how the scale tips when weighing these trade-offs.

The ACA, as well as programs like the Medicare Part D prescription drug benefit and Medicare Advantage, include what are known as risk-spreading mechanisms. By protecting insurers from unpredictably high costs these mechanisms – which include risk adjustment, risk corridors, and/or reinsurance – are intended to remove some of the incentive for using risk management practices. While the details vary, each method seeks to retroactively balance risk across insurers by redistributing funds from plans with relatively lower-risk enrollees to those with relatively higher-risk enrollees. The AHCA’s proposed State Stability Fund would similarly allow states to use risk-spreading mechanisms to help insulate insurers from the high costs of covering higher-risk individuals. (5) (7) (8) (9)

The specific details and structure of the various mechanisms for dealing with risk in the ACA, the AHCA, and alternatives are also rooted in their proponents’ views of personal responsibility, fairness, equity, and the role of the government in accomplishing certain goals. For example, policymakers who give different answers to the following questions may prefer different approaches to health insurance reform:

- To what extent should the government help individuals buy health coverage and afford needed health care services?

- How much should health insurance insulate people from the cost of their health care, and should it vary based on ability to pay? Health status? Personal choices?

- Is it fair for some to subsidize the costs of care for others (e.g. for men to subsidize the costs of prenatal care, contraception, or other women’s health services)?

Regulatory Stability

A stable and predictable regulatory environment is another key component of a well-functioning health insurance market. (10) The ACA tied every state’s individual health insurance market to federal policy. This fact and the specific approaches in the law have been politically divisive, resulting in unexpected changes to rules, requirements, and mechanisms that underpin the ACA, legal challenges, and uncertainty about the law’s future. (10) This environment may influence individuals’ decisions about enrollment, which affects insurers’ ability to predict and adequately price their products. Insurers will only accept so much uncertainty before they decline to participate, which ultimately impacts individuals’ choices and access to coverage.

References

Click to Open/Close

- American Academy of Actuaries. Critical Issues in Health Reform: Risk Pooling. [Online] July 2009. http://www.actuary.org/pdf/health/pool_july09.pdf.

- Kaiser Family Foundation. Health Insurance Coverage of the Total Population, 2015. [Online] 2017. http://kff.org/other/state-indicator/total-population.

- Centers for Medicare & Medicaid Services. 2017 Marketplace Open Enrollment Period Public Use Files. U.S. Department of Health & Human Services. [Online] March 11, 2016. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/Plan_Selection_ZIP.html.

- Bender, Karen and Nordstrom, Michael. Comment Letter on the AHCA to U.S. House Speaker Paul Ryan and U.S. House Democratic Leader Nancy Pelosi. American Academy of Actuaries. [Online] March 22, 2017. http://www.actuary.org/files/publications/AHCA_comment_letter_032217.pdf.

- Congressional Budget Office. Cost Estimate of the American Health Care Act. [Online] March 13, 2017. https://www.cbo.gov/publication/52486.

- —. How Repealing Portions of the Affordable Care Act Would Affect Health Insurance Coverage and Premiums. [Online] January 17, 2017. https://www.cbo.gov/publication/52371.

- American Academy of Actuaries. Using High-Risk Pools to Cover High-Risk Enrollees. [Online] February 2017. http://www.actuary.org/content/using-high-risk-pools-cover-high-risk-enrollees.

- U.S. Government Publishing Office. The Patient Protection and Affordable Care Act. Public Law 111-148. [Online] March 23, 2010. https://www.gpo.gov/fdsys/pkg/PLAW-111publ148/pdf/PLAW-111publ148.pdf.

- U.S. House of Representatives. H.R. 1628 – The American Health Care Act. [Online] March 20, 2017. https://www.congress.gov/bill/115th-congress/house-bill/1628.

- American Academy of Actuaries. An Evaluation of the Individual Health Insurance Market and Implications of Potential Changes. [Online] January 2017. https://www.actuary.org/files/publications/Acad_eval_indiv_mkt_011817.pdf.