The American Health Care Act (AHCA) could give Tennessee’s governor and legislature a lot more power over and responsibility for health insurance in our state. The bill, passed by the U.S. House of Representatives last Thursday, partially repeals and replaces the Affordable Care Act (ACA) and reforms Medicaid financing. As the AHCA moves to the U.S. Senate, it’s important to understand who this legislation could impact in Tennessee, what those impacts would be, and when they might occur.

Who Would the AHCA Impact in Tennessee?

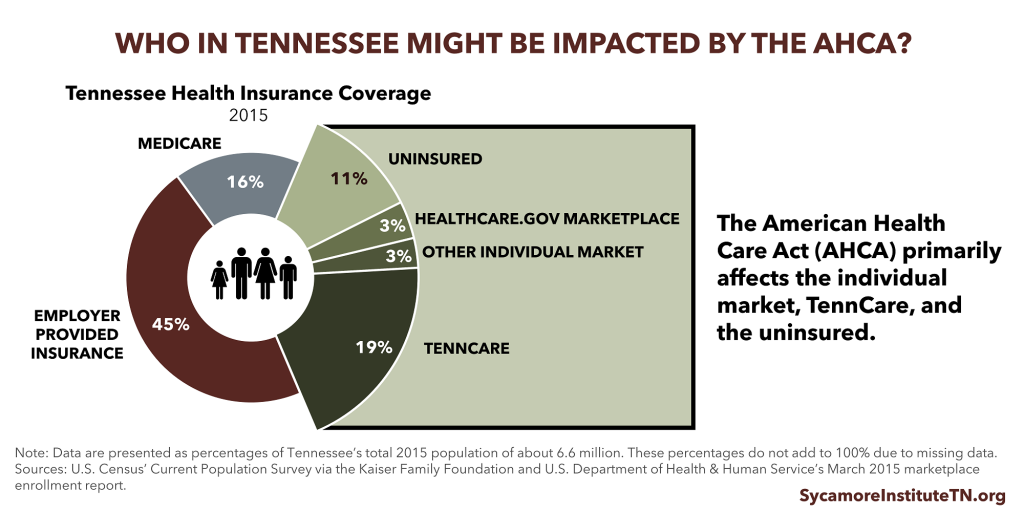

Various parts of the House-passed AHCA could affect about 36% of Tennesseans. They include: 6% of Tennesseans who get coverage in the individual market (which includes the healthcare.gov Marketplace), 19% who are covered by TennCare, and 11% who are uninsured. For context, 234,000 Tennesseans bought healthcare.gov plans for 2017, and 1.5 million Tennesseans were enrolled in TennCare in March 2017.

Key Changes to the Individual Health Insurance Market

The House-passed AHCA makes some important changes to the individual health insurance market, which covers about 6% of Tennesseans.

#1 The ACA’s premium subsidies are made more widely available and then replaced.

Premium subsidies based on income and one’s local health insurance costs are currently available for plans on the healthcare.gov Marketplace. In 2018 and 2019, subsidies would be available for any individual market plan, but the subsidies shrink for older enrollees and increase for younger ones. In 2020, premium tax credits replace ACA’s premium and cost-sharing subsidies. The tax credits’ value will depend on one’s age and income.

#2 The ACA’s requirements for what and how much plans must cover are loosened.

The AHCA repeals ACA requirements for how generous plans must be. Beginning in 2020, states can apply for a waiver from the ACA’s essential health benefits requirements. If approved, these waivers would allow states to define what benefits individual market plans must cover and whether those plans could set annual and lifetime limits on benefits.

#3 The ACA’s “rating” requirements are loosened.

The ACA limits premium costs for older individuals to no more than 3 times what younger individuals can be charged. Beginning next year, the AHCA raises that limit to no more than 5 times higher. States could also allow an even higher limit. In 2020, states can apply for a waiver from the ACA’s community rating requirements. This waiver would let insurers charges premiums based on individuals’ health status — including pre-existing conditions.

#4 The ACA’s individual mandate is replaced by a continuous coverage penalty.

New enrollees who went without coverage for more than 63 days during the prior 12 months would pay 30% higher premiums for 1 year. Health Insurance Markets 101 explains why these provisions are used to support broad and diverse health insurance risk pools.

#5 The AHCA creates a $138 billion Patient and State Stability Fund to help high-risk and/or high-cost individuals access care.

The fund includes:

- $15 billion in 2020 for maternity, newborn, and mental health and substance abuse services.

- $15 billion in 2018-2026 for high-risk pools or reinsurance programs to help insulate insurers from particularly high-cost enrollees.

- $8 billion in 2018-2023 to help high-risk individuals afford coverage in states that waive community-rating requirements.

How Individual Market Changes May Impact Tennessee

Lower Subsidies for Many but Not All Tennesseans

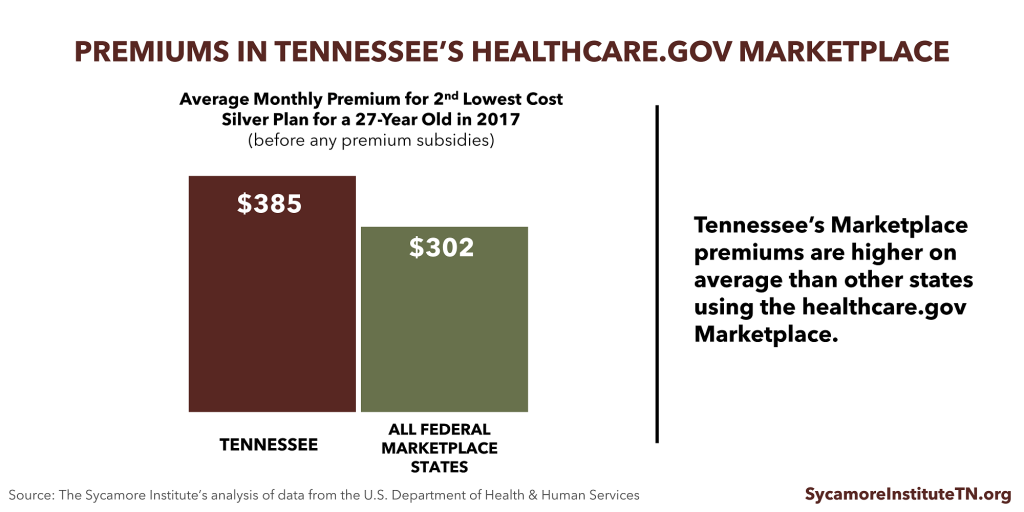

Individuals in areas with relatively higher premiums would get smaller subsidies under the AHCA. Premiums for healthcare.gov Marketplace plans are higher in Tennessee on average than other states, so subsidies for many Tennesseans would likely be less generous under the AHCA. However, subsidies alone do not determine how much a person pays for health insurance.

Potential for More Low-Cost Options with Less Comprehensive Benefits

If Tennessee policymakers implemented the flexibilities and waivers the AHCA offers states, Tennesseans would likely have more choice in what and how much plans cover. Lower cost, less generous plans — including those with higher deductibles and less comprehensive benefits — could become more widely available in Tennessee. While their premiums are lower, less generous plans can leave enrollees more exposed to out-of-pocket costs for needed services.

Bottom Line for Tennessee’s Individual Market

Combining all of these factors, young and healthy Tennesseans would likely pay less for plans that meet their needs while older and sicker Tennesseans would likely pay more. There is risk that the more generous plans that meet the needs of high-risk individuals would no longer be offered. (Health Insurance Markets 101 explains many factors that impact health insurance markets, enrollee incentives, coverage options, and plan costs.)

The AHCA’s $138 billion Patient and State Stability Fund would help to offset some of these impacts on older and less healthy individuals through mechanisms like high-risk pools and reinsurance. The extent to which this is enough money would depend on several factors, including how many states seek waivers from benefits and ratings requirements and the exact details of those waivers. The left-leaning Center for American Progress estimates that about $181 billion more would be needed for high-risk pools to cover the sickest 5% of Marketplace enrollees in every state.

High-risk pools that existed before the ACA were often expensive for enrollees and capped enrollment due to funding limitations. For more information, see Tennessee’s High-Risk Pool Experience.

Key Changes to Medicaid

The House-passed AHCA makes two significant changes to Medicaid, known in Tennessee as TennCare. TennCare covers about 19% of Tennesseans.

#1 The AHCA phases out the ACA’s Medicaid expansion.

Tennessee has not expanded Medicaid, so the only impact to our state from this change would be to prevent a future expansion of the program.

#2 The AHCA caps the growth of federal funding for TennCare.

The federal government currently pays about 65% of all TennCare costs. Starting in 2020, the growth of federal contributions to TennCare would be capped. The cap for costs associated with children and adult enrollees is linked to medical inflation. For elderly enrollees and those with disabilities, the cap is linked to medical inflation plus 1 percentage point.

How Medicaid Changes Could Impact Tennessee

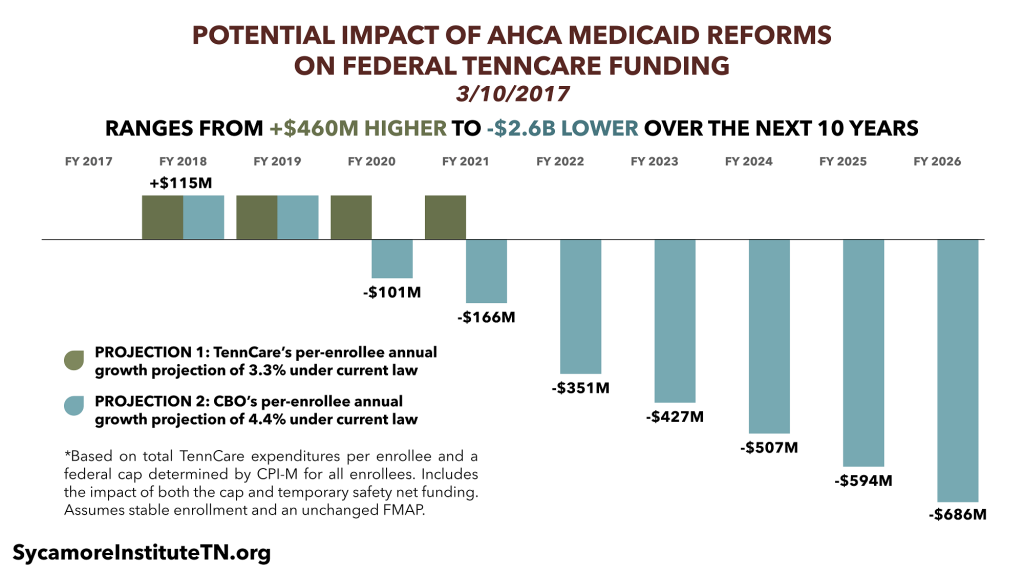

Analyzing a previous version of the AHCA, we estimated that Tennessee would have exceeded the cap in 3 of the last 10 years. Compared to funding growth under current law, we estimated that federal funding for TennCare over the next decade could range from $460 million higher to $2.6 billion lower.

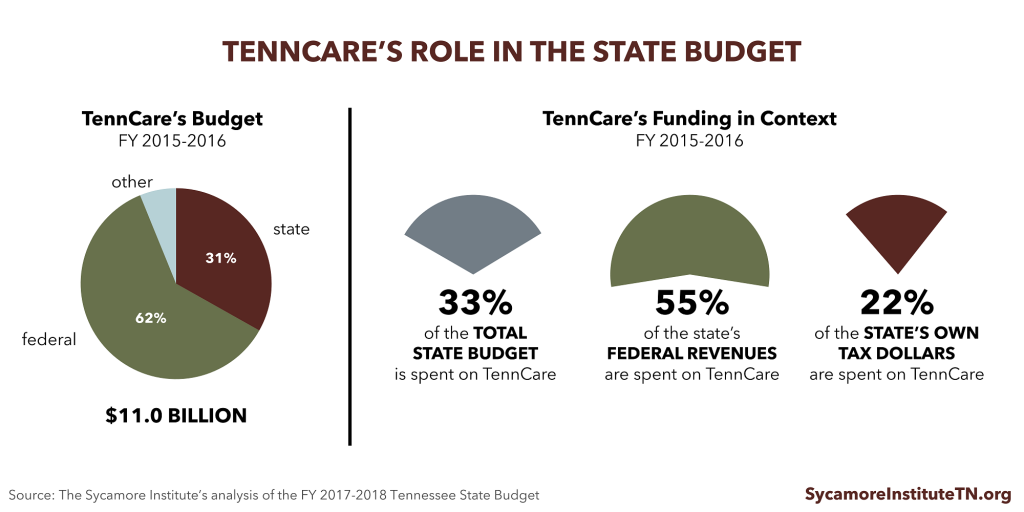

Our estimates used a cap constrained by medical inflation for all enrollees (versus medical inflation plus 1 percentage point for some enrollees). Because Tennessee has been a relatively low-cost Medicaid state, the state may not see federal funding cuts in the short-term. However, nearly all analyses agree that capping federal spending on Medicaid will slow the growth of federal funding for nearly every state over the longer-term. TennCare currently accounts for a significant part of the state budget.

Our estimates used a cap constrained by medical inflation for all enrollees (versus medical inflation plus 1 percentage point for some enrollees). Because Tennessee has been a relatively low-cost Medicaid state, the state may not see federal funding cuts in the short-term. However, nearly all analyses agree that capping federal spending on Medicaid will slow the growth of federal funding for nearly every state over the longer-term. TennCare currently accounts for a significant part of the state budget.

The AHCA does not include any new program design flexibilities, which would likely have to pass in separate legislation due to the U.S. Senate’s budget reconciliation rules. Without this flexibility, Tennessee would have to fill any funding gap with state dollars. Because the state budget must be balanced, this could require raising new revenues or shifting spending from other areas. If program design flexibilities are eventually granted, policymakers might also respond to funding gaps by changing what and who TennCare covers.

What’s Next? The Senate Plans to Write Its Own Bill

The U.S. Senate will now consider the AHCA. Any bill that passes the Senate is likely to have significant changes. After the AHCA passed the House, U.S. Senator Lamar Alexander (R-TN) said, “We’re writing a Senate bill and not passing the House bill.”

The Congressional Budget Office’s (CBO) analysis of the House-passed AHCA’s impact on federal spending and insurance coverage may also influence the Senate’s actions. CBO expects to publish its analysis during the week of May 22, 2017.

If the Senate passes a different version of the AHCA, the House will have to pass the new bill or work out a compromise with the Senate before the bill can go to the President.

Parting Words

Health insurance coverage is hardly the only driver of Tennesseans’ health, but it can help people afford and access services they need to stay healthy and productive. If the AHCA (or something similar) becomes law, Tennessee’s policymakers may face difficult decisions about if and how to use new flexibilities or respond to new pressures on the state budget. Information about our state’s past experiences, the trade-offs involved in such decisions, and how downstream effects might impact broader policy goals will all be important elements to consider.

For a comprehensive comparison between the ACA and the House-passed AHCA, we recommend this summary by the Kaiser Family Foundation.