The IMPROVE Act – Governor Haslam’s proposal to raise revenues for the state’s transportation needs – has been making its way through the Tennessee General Assembly. Last week, the Senate Transportation Committee amended the proposal to address concerns from several legislators about the mix of tax reductions and increases.

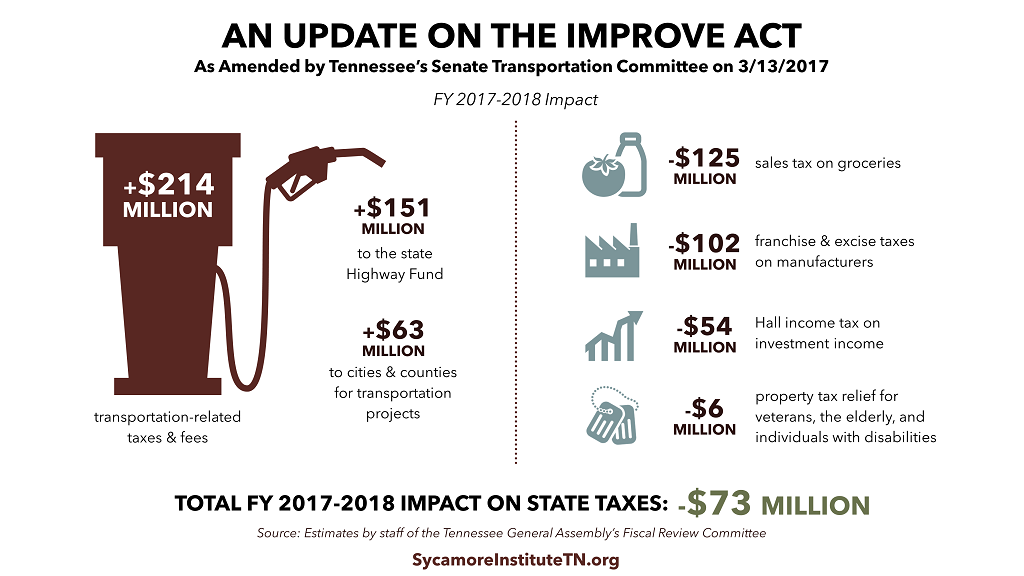

The current Senate compromise (summarized below) makes the original proposal’s Highway Fund tax increases smaller and its General Fund tax reductions larger. Late last week, the General Assembly’s Fiscal Review Committee released estimates of the revised legislation (available HERE). For FY 2017-2018, General Fund revenues would be reduced by an estimated $262 million, Highway Fund revenues would increase by $151 million, and the revenues shared with counties and cities would increase by $39 million. The overall result is an estimated $73 million tax reduction for Tennesseans in year one of the plan.

The Big Picture

The state’s General Fund has enjoyed robust revenue growth over the last several years, resulting in a projected $1.2 billion surplus by the end of the current fiscal year in June. At the same time, the Highway Fund’s primary sources of revenue have grown more slowly because inflation has eroded the purchasing power of the flat, per-gallon gas and diesel taxes while vehicles’ fuel efficiency has improved (see our State Highway Fund Fact Sheet).

The IMPROVE Act effectively shifts part of the General Fund’s revenue growth to the Highway Fund by reducing taxes for the General Fund and increasing them for the Highway Fund. These changes, however, affect not only who pays state taxes but also what incentives or disincentives those taxes might create. Alternative proposals not approved by the House and Senate committees would instead divert existing General Fund revenues directly to the Highway Fund.

The General Fund represents about 84% of the state’s own revenues. It funds nearly everything the state does, from public schools to state parks to health care for individuals with disabilities.

The decisions that Tennessee’s policymakers are now facing for funding our state’s transportation needs may have long-term significance that goes beyond the state’s infrastructure.

Critical Questions & Trade-Offs to Consider

How would different approaches to funding transportation impact the state’s ability to respond to emerging General Fund needs?

Both the IMPROVE Act and the alternative proposals would reduce General Fund revenues in future years compared to current law. Meanwhile, the President and Congress are considering major changes to Medicaid financing and the federal budget. According to the most recent available data, Tennessee relies more on federal funding than all but 2 states (Arizona and Mississippi). Because of Tennessee’s reliance on federal funding, these changes may put pressures on the state’s budget and the General Fund specifically.

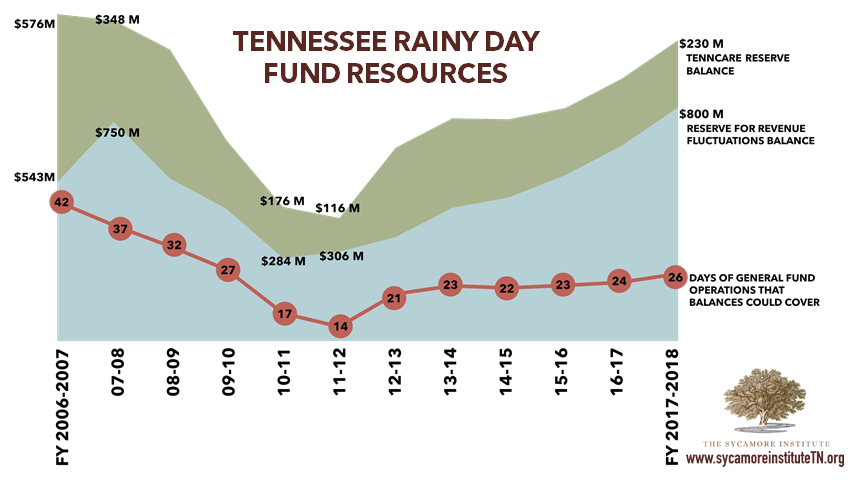

Additionally, many economists believe that another recession may be around the corner. Recessions can create greater than usual demand for General Fund programs and services while reducing the revenues that fund them. While our state’s rainy day fund balance is expected to reach a nominal all-time high by the end of this fiscal year, the spending power of our rainy day fund lags behind where we were before the most recent recession. Tennessee has also enacted a total of $1.9 billion in recurring budget reductions since that time.

How would different approaches to funding transportation affect the state’s economic growth?

A number of factors can influence businesses’ decisions to invest in Tennessee. Among these factors are the costs and ease of doing business in the state, including their state tax liability, access to an adequately trained and healthy workforce, the quality of the state’s infrastructure, and desirable cost and quality of living for employees.

The IMPROVE Act’s proposal to change the taxes paid by manufacturers, for example, is aimed at encouraging businesses to invest in Tennessee. If business investment translates to job and income growth for Tennesseans, the state could, for example, experience revenue growth from increased consumer spending. On the other hand, if state budget decisions impacting the General Fund compromise the state’s ability to offer any of these other conditions (e.g. a healthy, well-trained workforce), the effect could be the opposite.

These are the kinds of long-term considerations and trade-offs that our state policymakers are weighing as they approach this important topic.

The IMPROVE Act’s Current Status

Senate: On March 21st, the Senate State & Local Government Committee passed the amended version of the bill – adopting a handful of changes to the “local option” provisions of the bill, which are outside the purview of our analysis. The next step in the Senate is the Finance, Ways & Means Committee.

House: On February 28th, the House Transportation Subcommittee recommended for approval an amended version of the IMPROVE Act. The amendment replaced the Governor’s proposed Highway Fund tax increases with a proposal from Representative David Hawk to divert about 3.6% of the state’s sales tax collections to the Highway Fund.

Since then, the full House Transportation Committee has deferred action on the bill several times. On March 20th, the full committee held a hearing to discuss the Senate compromise. On March 21st, the Committee passed a version of the proposal that closely mirrors the Senate version with additional property tax relief for veterans and a provision that would automatically cut the state gas tax in the event of a federal gas tax increase. The next step in the House is the Local Government Committee.

A Summary of the Senate Transportation Committee’s Compromise Revenue Provisions

We summarized the original proposal HERE and in our budget summary HERE. The current Senate compromise:

- Phases in over 3 years a $0.06/gallon increase on gasoline taxes and a $0.10/gallon increase on diesel

- Retains increases to motor vehicle registrations, including a new electric car fee

- Reduces the sales tax on groceries from 5% to 4%

- Includes an option for an alternative calculation of manufacturers’ tax liabilities under the franchise & excise taxes

- Continues to phase out the Hall Income Tax by reducing the rate from 5% to 4%

- Includes an increase in property tax relief for veterans, the elderly, and individuals with disabilities beginning

- No longer allows the gas and diesel taxes to increase with inflation (i.e. the “indexing” provision)

- No longer includes an increase to rental car fees

- No longer accelerates the phase-out of the Hall Income Tax

Notes About the Fiscal Memo’s Estimates and Our One-Pager

- In the 2016 legislative session, the General Assembly reduced the Hall Income Tax rate from 6% to 5% and required full repeal of the tax by 2022. It also specified that the intent is for the General Assembly to pass additional legislation to phase it out through a 1 percentage point reduction each year until it is eliminated.

- The current version of the IMPROVE Act reduces the current 5% rate to 4% for FY 2017-2018, and expresses the intent to pass additional legislation to further reduce it to 3% for FY 2018-2019.

- The fiscal memo’s estimates only reflect the reduction from 5% to 4%. Given the Legislature’s intent, our one-pager assumes that the General Assembly will continue to reduce the Hall Income Tax by 1 percentage point each year until it is eliminated – reducing it from 4% to 3% for FY 2018-2019 and from 3% to 2% for FY 2019-2020. We assumed that each percentage point reduction is equal to $54 million in revenues, consistent with the fiscal memo’s estimate.

- The estimates for most of the tax reductions do not reflect the impact of price changes. Changes in price affect collections for percentage-based taxes, like sales taxes. For example, if the price of groceries increases, the long-term revenue reductions from the lower tax rate would also increase.